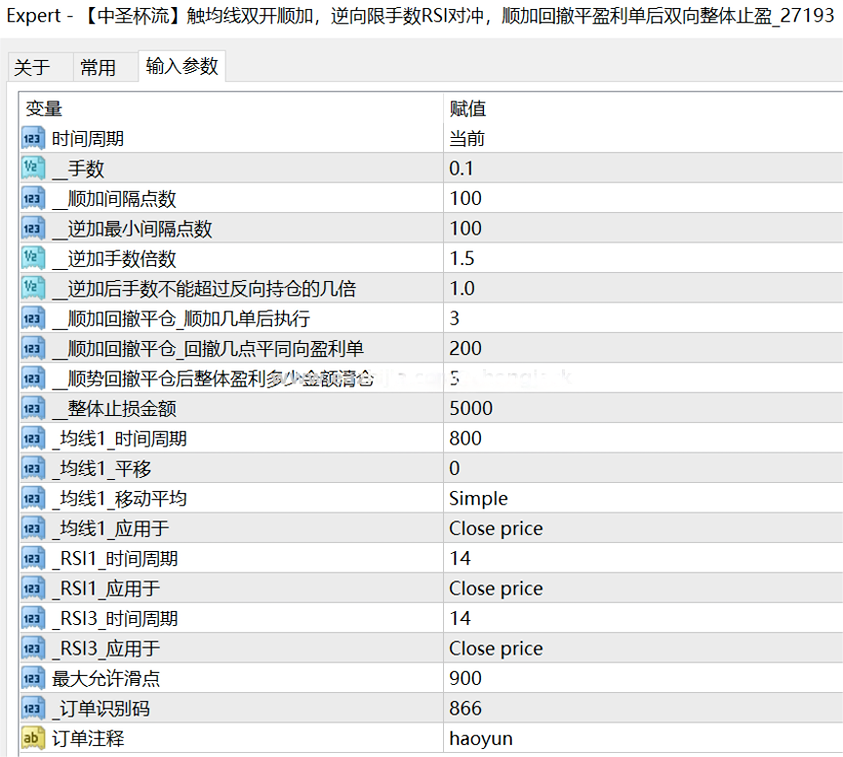

Double opening of moving averages, reverse limit of RSI hedging, and overall profit taking in both directions after retracement of profitable orders

1. In the case of short positions, the K-line price touches the 800 period moving average, and positions are opened in both directions without setting stop loss and take profit.

2. Independently add positions in one direction every 100 points.

3. In the direction with fewer positions, when RSI turns during trading, increase your position by 1.5 times against the trend. Only one candlestick is added once, and the number of positions added cannot exceed the number of positions held in the opposite direction. Otherwise, no additional positions will be added.

4. After adding positions in one direction and reaching 3 orders, withdraw all profitable orders in this direction by 200 points and stop reverse adding positions in this direction.

5. After executing a forward and reverse position in either direction, a total profit of $5 was generated from clearing long and short positions.

6. Set a risk control for clearing the overall floating loss of $5000.