The US dollar index rises and falls, while the EUR/USD oscillates and is waiting to break

Macroscopic perspective

At the international level, the situation in the Middle East has attracted attention. US President Biden announced that through US and French mediation, the ceasefire agreement between Israel and Hezbollah in Lebanon will come into effect on Wednesday. Previously, it was approved by the security cabinet, but reactions from all parties were mixed. Moreover, this ceasefire has not yet pushed for the relevant agreement between Israel and Hamas in Gaza. The domestic economic situation in the United States is complex, and officials have different opinions on the direction of the Federal Reserve's monetary policy. Recent meeting minutes show that most believe that policy restrictions should be gradually reduced. After the meeting minutes were released, the financial market reacted significantly. At the same time, there have been changes in the US consumer market and real estate market, with consumer confidence rising to a 16 month high in November, with different groups showing varying performances; New home sales plummeted in October, influenced by various factors, which may inhibit the construction of new homes. There are many risk events on this trading day, and the New Zealand Federal Reserve's interest rate decision during the Asian session is expected. Multiple economic data from the United States are yet to be released during the New York session, and due to the early release of data on changes in the number of initial jobless claims during Thanksgiving, investors need to continue to pay attention to the geopolitical situation and Trump related developments.

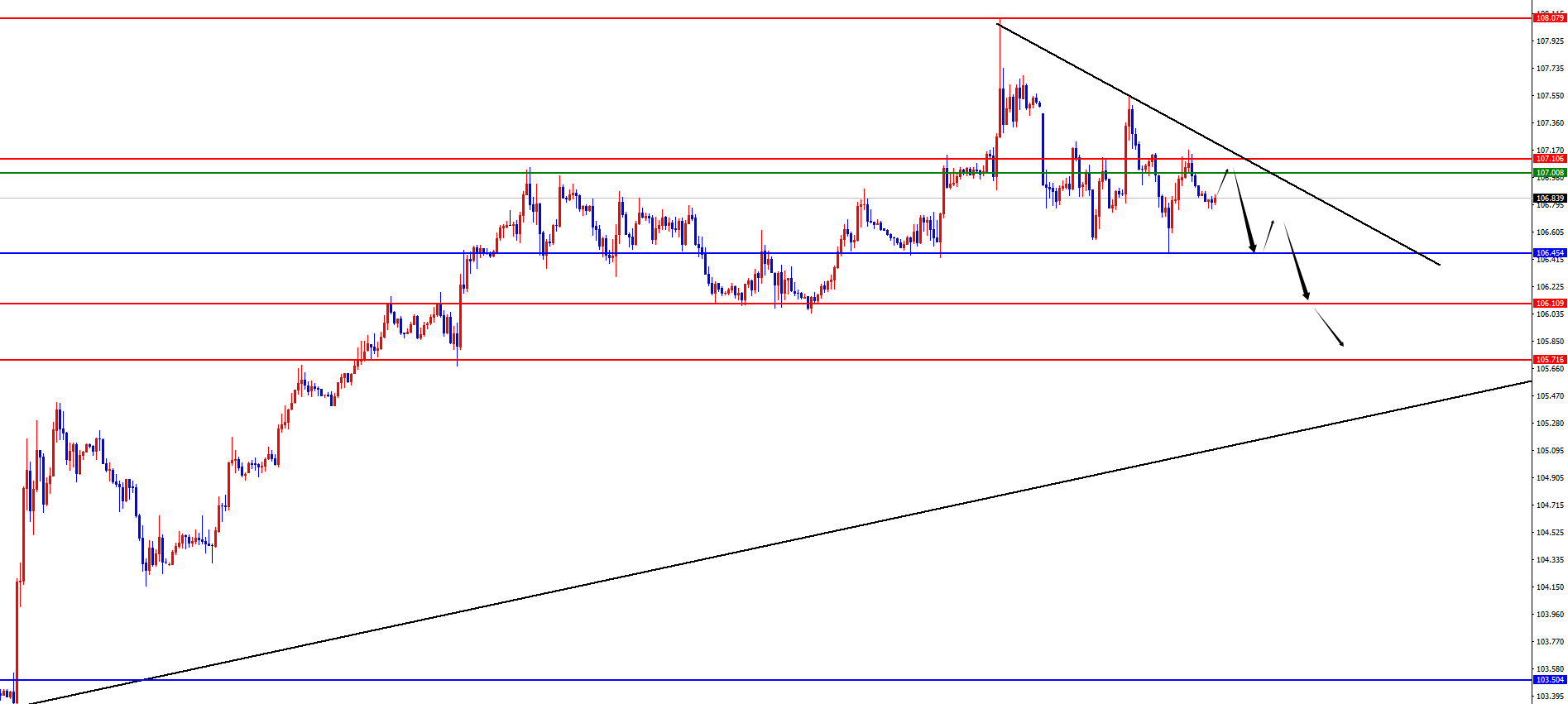

The US Dollar Index

In terms of the US dollar index, the overall price of the US dollar index showed a trend of rising and falling on Tuesday. The highest price of the day rose to 107.536, the lowest was 106.466, and closed at 106.855. Looking back at the performance of the US dollar index on Tuesday, after the morning opening, the price first gained short-term support and quickly rose, but did not continue after the short-term rise. Instead, it came under pressure again and fell, breaking through the low point of the morning session. Although it rebounded upwards during the US session, it still did not break through the high point of the European session. At the same time, it finally closed with a bearish candlestick and left a long upward lead above. At present, the daily resistance is supported in the 106.45 area, which is a key watershed for the trend of the US Japan band. We will pay attention to the further downward performance in the future. For the four hours, we will temporarily focus on the resistance in the 107.10-20 range, and pay attention to the pressure once the price is in place.

The US Composite Index is empty in the 107.10-20 range, with a defense of $5 and a target of 106.45-106.10

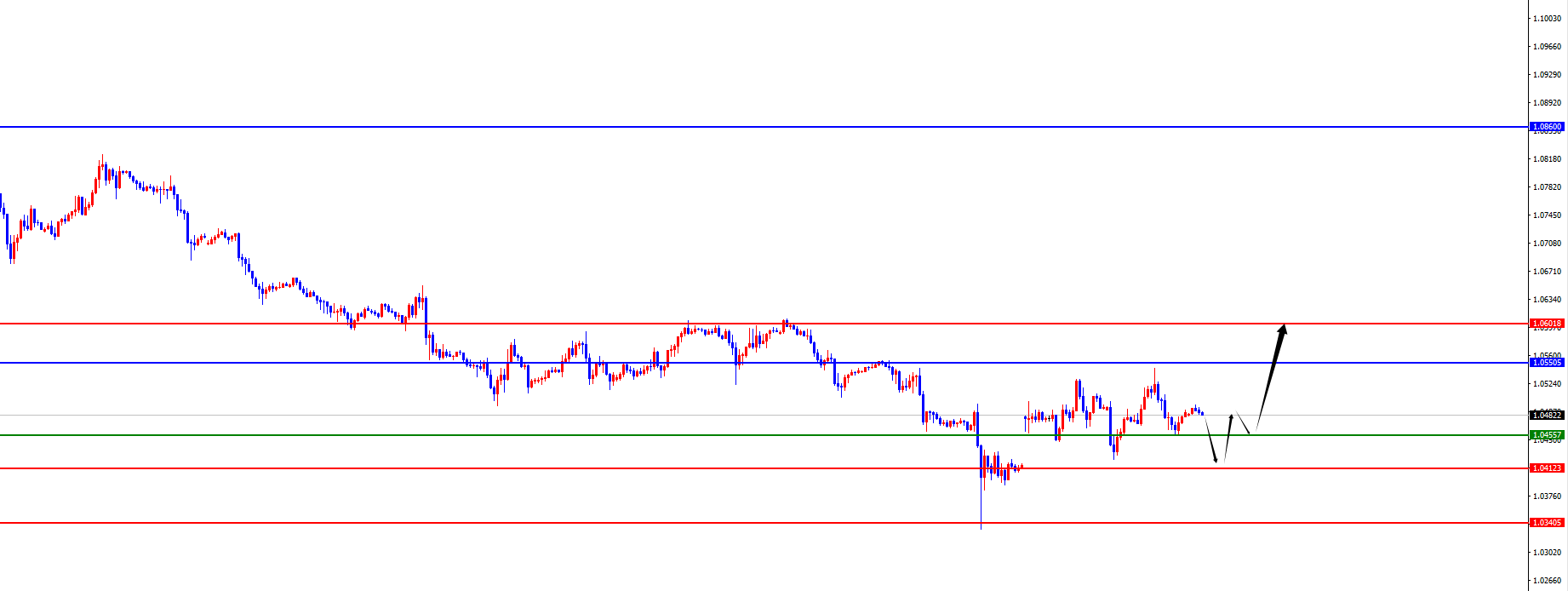

In terms of EUR/USD, the overall price of EUR/USD showed a volatile state on Tuesday. The lowest price of the day fell to 1.0424, the highest rose to 1.0544, and closed at 1.0481. Looking back at the performance of the European and American markets on Tuesday, prices quickly came under pressure in the short term during the morning session, and then stopped rising. However, during the US session, prices did not continue to rise but instead came under pressure again. Currently, it is necessary to pay attention to the gains and losses of the daily 1.0550 long short watershed position in Europe and America. If prices continue to break, they are expected to continue. Conservatives can wait for the price to break before following, while radicals can support the upward trend at the low point of this week. Once the price breaks above 1.0550, it is expected to start a wave like upward trend. Everyone should pay close attention to it in the future.

EUR/USD 1.0410-20 is mostly in the range, with a defense of 40 points and a target of 1.0480-1.0550 (pay attention to the daily 1.0550 long short score ridge and subsequent breakthrough performance)

Today's focus on financial data and events: Wednesday, November 27, 2024

① 08:30 Australian October Weighted CPI Annual Rate

② At 09:00, the Reserve Bank of New Zealand announced its interest rate decision and policy statement

③ 10:00 New Zealand Federal Reserve Chairman Orr holds a press conference

④ 17:00 Swiss November ZEW Investor Confidence Index

⑤ 17:30 German Gfk Consumer Confidence Index for December

⑥ 21:30 Initial jobless claims for the week ending November 23 in the United States

⑦ 21:30 Third quarter real GDP annualized quarterly rate correction in the United States

⑧ 21:30 Monthly rate of durable goods orders in October in the United States

⑨ 22:45 Chicago PMI for November in the United States

⑩ 23:00 Annual Core PCE Price Index for October in the United States

⑪ 23:00 Monthly Personal Expenditure Rate for October in the United States

⑫ 23:00 Monthly rate of signed home sales index for October in the United States

⑬ 23:00 US October Core PCE Price Index Monthly Rate

⑭ 23:30 US to November 22 week EIA crude oil inventory

⑮ 23:30 US to November 22 week EIA Cushing crude oil inventory

⑯ 23:30 US EIA Strategic Petroleum Reserve Inventory for the Week of November 22

⑰ The next day at 01:00, EIA natural gas inventory for the week of November 22nd in the United States

⑱ The next day at 02:00, the total number of oil wells drilled in the United States for the week ending November 29th

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights