Canadian Dollar Climbs Amid Risk Appetite

- 2025-04-23

UK Manufacturing Orders Improve In April

- 2025-04-23

Swiss Franc Drops Against Majors

- 2025-04-23

Swiss Market Ends Modestly Higher

- 2025-04-23

Bay Street Likely To Open On Cautious Note

- 2025-04-23

Asian Markets Track Wall Street Higher

- 2025-04-23

Russia Holds Key Interest Rate As Expected

- 2025-04-23

Sensex

- 2025-04-23

Trump's attitude towards Powell has taken a 180 degree turn, and US stock index futures have skyrocketed in response!

- 2025-04-23

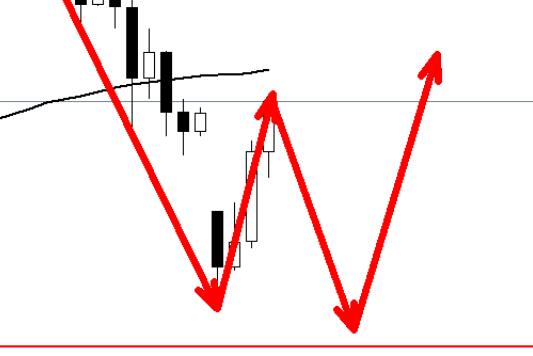

Market risk appetite rebounds, oil prices continue to rebound, and caution should be taken against a second downturn near the pressure level

- 2025-04-23

Gold: Small scenes, don't panic

- 2025-04-23

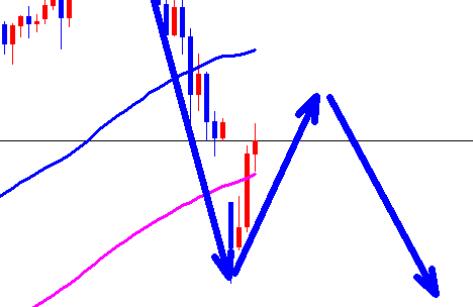

Can bulls still persist despite a significant short-term adjustment in gold?

- 2025-04-23

Gold daily high adjustment, morning rebound continues to be bearish!

- 2025-04-23

Trump's words, gold fluctuates by 200 points

- 2025-04-23