The Vice Chairman of the Reserve Bank of Australia stated that the Reserve Bank of Australia will maintain the cash rate unchanged

Australian Federal Reserve Vice Chairman Andrew Hauser has stated that interest rates in Australia may remain unchanged in the near future as inflation is "more sticky" than in the United States, highlighting global divisions as the Fed prepares to ease policy.

When referring to Federal Reserve Chairman Powell, he said, "We are not as confident as he is in the United States that Australia's inflation has returned to a sustainable path towards target levels. Therefore, we have to temporarily keep interest rates unchanged

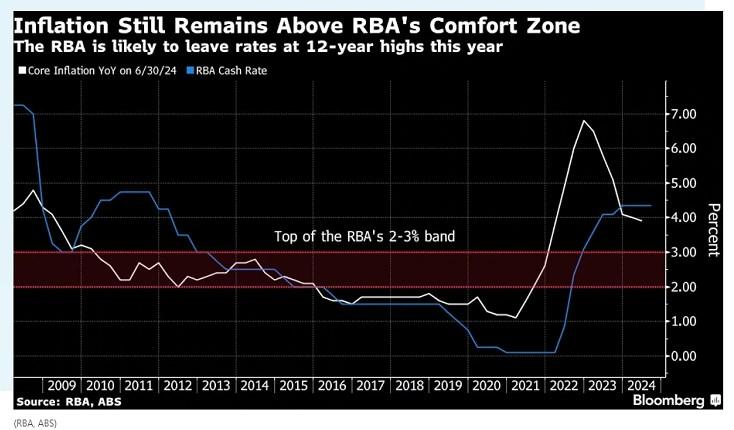

Image: Inflation remains above the comfort zone of the Reserve Bank of Australia (the Reserve Bank of Australia may maintain interest rates at a 12 year high this year) (blue line represents cash rates, white line represents year-on-year core inflation)

But he added, "We will remain vigilant about changes in interest rates and the possibility of interest rate cuts

About a week ago, Powell stated at the annual meeting in Jackson Hole, Wyoming that the time has come for the Federal Reserve to lower its key policy rate. Hauser represented the Reserve Bank of Australia at the seminar.

In the tightening cycle of 2022-23, Australia raised interest rates less than other countries in an attempt to maintain job growth. The Reserve Bank of Australia has raised its cash rate to a 12 year high of 4.35%, which is about 1 percentage point lower than the United States.

When talking about local interest rates, Hauser said, "Therefore, you may not expect inflation to fall so much or so quickly until we see it return to target levels more sustainably." The Reserve Bank of Australia's decision to raise interest rates is less favorable than other central banks and has been closely monitored because Australian consumer prices take longer to return to target levels.

Some inflation indicators released by Australia last week showed that although price pressure is easing, the pace is not enough to give the central bank reason to cut interest rates early.

Hauser stated that Powell's signal that US interest rates will soon begin to decline will not change the local policy outlook, but the Reserve Bank of Australia will consider factors such as global price slowdown and other central bank rate cuts in future decisions.

Hauser said, "We hope to follow suit at the appropriate time, but we must take into account Australia's inflation outlook, which is currently too high." "This is our focus

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights