Non farm outlook: If the unemployment rate remains unchanged at 4.3%, gold prices may reach a new historical high

On Friday, September 6th, spot gold trading in the Asian market was around $2517 per ounce; Yesterday, the gold price surged by over $20. On this trading day, investors will receive the US non farm payroll report, which is expected to trigger a major trend in the gold market. Analyst Eren Sengezer's latest article analyzes the response of gold prices to non farm payroll reports.

Sengezer pointed out that the non farm payroll in the United States is expected to increase by 16 people in August. Compared to an optimistic non farm payroll data, gold's response to disappointing employment data may be stronger.

The poor performance of the "small non farm" data released on Thursday cast a shadow over Friday's non farm data.

On Thursday, the United States released the ADP employment report, also known as the "small non farm payroll," which showed that the seasonally adjusted number of private sector jobs in August increased by 99000, the lowest since January 2021, far below economists' expectations of 144000 and lower than the downward revised 111000 in July.

ADP data further confirms the weakness in the job market, with the market increasing its bet on a 50 basis point rate cut by the Federal Reserve later this month.

At 20:30 Beijing time on Friday, investors will receive the US August non farm payroll report, which provides the latest clues on the Federal Reserve's monetary policy outlook.

According to authoritative media surveys, the seasonally adjusted non farm payroll in the United States is expected to increase by 160000 in August, compared to an increase of 114000 in July. The unemployment rate in the United States is expected to decline from 4.3% to 4.2% in August.

Han Tan, Chief Market Analyst at Exinity Group, said, "If the unemployment rate in August remains the same as 4.3% in July (the highest level since 2021), then as the market increases its bets on a significant interest rate cut, gold prices will return to historical highs

According to CME's "Federal Reserve Watch" tool, traders currently expect a 59% chance of a 25 basis point rate cut by the Federal Reserve this month and a 41% chance of a 50 basis point rate cut.

In addition to overall changes in non farm employment and unemployment rates, investors need to focus on average hourly wage data, which can provide important signals on inflation.

According to authoritative media surveys, the average monthly hourly wage rate in the United States is expected to increase by 0.3% in August, higher than last month's 0.2% increase.

The average hourly wage growth rate in the United States in August is expected to increase from 3.6% in the previous month to 3.7% year-on-year.

Investors will also pay attention to labor force participation rate data. According to media surveys, the labor force participation rate in the United States is expected to remain unchanged at 62.7% in August.

Nick Timiraos, a journalist from The Wall Street Journal known as the "mouthpiece" of the Federal Reserve, recently published an article stating that the US August employment report scheduled for release on Friday will play a greater role than usual in determining the magnitude of the Fed's interest rate cuts this month.

Timiraos wrote that at the Federal Reserve's September meeting, the focus of the debate was on whether to start cutting interest rates by 25 or 50 basis points to prevent unwanted weakness in the job market. The August recruitment and employment report will be the key to determining this decision.

Timiraos pointed out that a decent employment report may prompt officials to start a possible series of interest rate cuts by 25 basis points. If recruitment is weak or the unemployment rate rises, as in July, a larger interest rate cut will be imminent.

The following is the main content of Eren Sengezer's article:

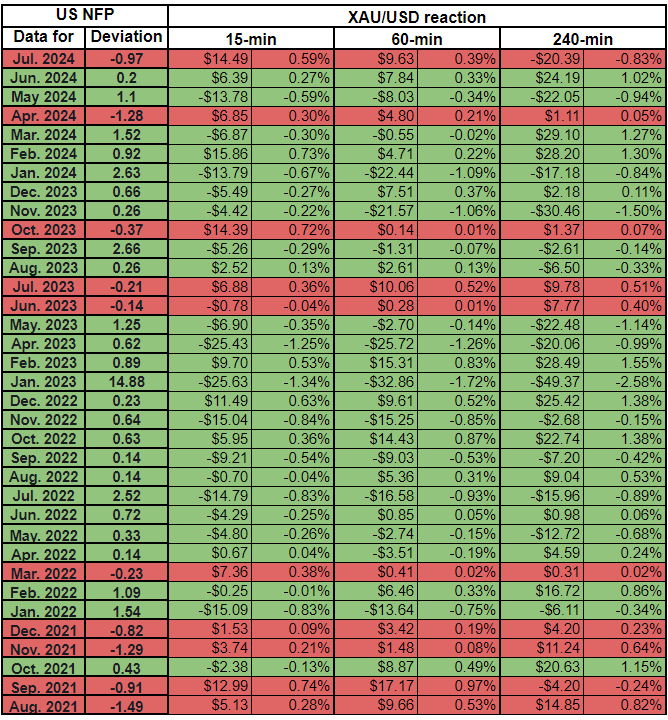

How much impact does the US employment report have on gold prices historically? In this article, we present the results of a study in which we analyzed the response of gold prices to the previous 35 non farm payroll data. (Note: We have omitted the non farm payroll data for March 2023, which was released on the first Friday of April and fluctuated less due to Easter.)

We presented our survey results on the occasion of the release of the July employment report by the US Bureau of Labor Statistics on Friday, September 6th. It is expected that non farm employment will increase by 160000 in August, following a disappointing increase of 114000 in July.

Analysis method

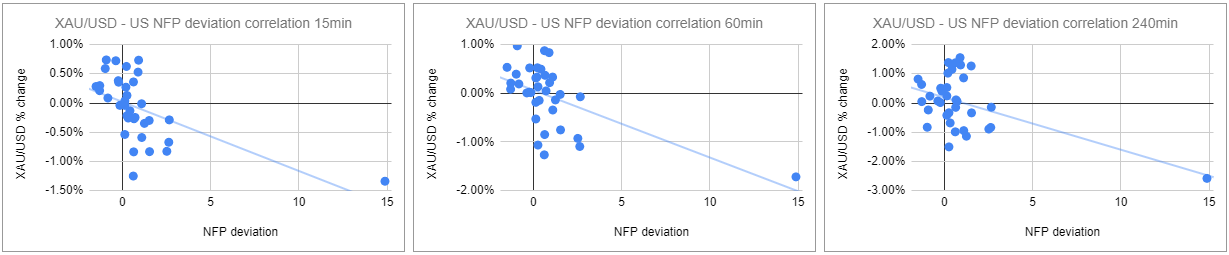

We plotted the gold price response within 15 minutes, 1 hour, and 4 hours after the release of non farm payroll data. Then, we compare the reaction of gold prices with the deviation between actual non farm results and expected results.

We use an economic calendar to calculate bias data because it assigns a bias point to each macroeconomic data release to show how much difference there is between actual data and market consensus. For example, the non farm employment data for August 2021 was far below the market expectation of 750000, with a deviation of -1.49. On the other hand, the non farm employment data for September 2023 was 246000, higher than the market expectation of 170000, which is a positive surprise with a deviation of 2.66. The better than expected non farm payroll data in the United States is seen as favorable for the US dollar, and vice versa.

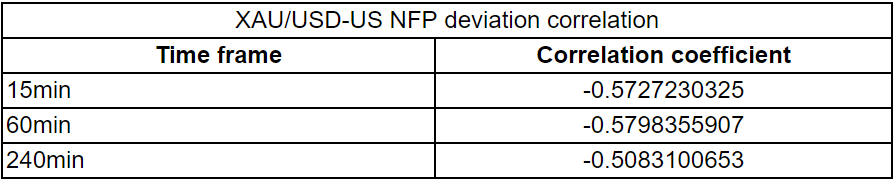

Finally, we calculate the correlation coefficient (r) to identify which time period has the strongest correlation between gold and non farm unexpected situations. When the r value tends to -1, it indicates a significant negative correlation, and when the r value tends to 1, it indicates a significant positive correlation. Due to the fact that gold is priced in US dollars, an optimistic non farm report should lead to a decline in gold prices and point towards negative correlation.

Analysis results

Out of the previous 35 releases of non farm payroll data, 10 fell short of expectations and 25 exceeded expectations. On average, in terms of disappointing data, the deviation is -0.77, while the strong data is 1.4. After 15 minutes of data release, if the non farm employment data falls below market consensus, the average gold price will rise by $7.26. On the other hand, if the data is better than expected, the average price of gold will drop by $4.86. This discovery suggests that investors may have a stronger direct response to weaker than expected non farm payroll data.

The correlation coefficients we calculated for the different time frames mentioned above did not approach the level considered significant -1. The strongest negative correlation occurs 15 minutes and 1 hour after publication, with an r-value of around -0.57. After 4 hours of publication, the r-value increases to -0.5.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights