How will the non farm payroll in August affect the magnitude of the Federal Reserve's interest rate cut?

On Friday, September 6th at 20:30, the United States will release its August non farm payroll report, which is also the focus of market attention this week.

Traders and economists predict that the non farm payroll report will show 164000 new jobs added in the United States in August, with an average monthly increase of 0.3% (or an annual increase of 3.6%) in hourly wages. The U3 unemployment rate for August will drop to 4.2%.

Matt Weller, Global Research Director at Jiasheng Group, predicts that despite significant uncertainty in the current global context, non farm payroll growth in August may be between 130000 and 200000.

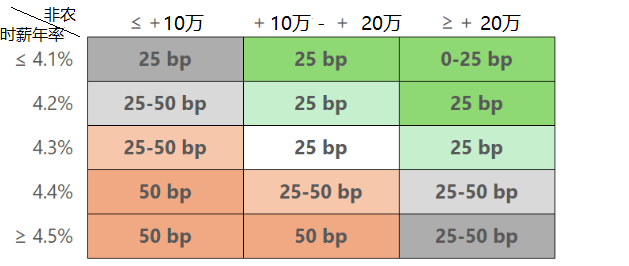

Weller cited StoneX Group's forecast, pointing out the impact of August non farm payroll growth and average annual wage rate on the Fed's September rate cut, as follows:

Weller stated that from a technical analysis perspective, although there was a rebound last week, the US dollar is still in a clear downward trend. The short-term response of the US dollar may be affected by the magnitude of the Federal Reserve's interest rate cuts. If the Federal Reserve only cuts interest rates by 25 basis points, the US dollar will rise; If the Federal Reserve cuts interest rates by 50 basis points, the US dollar is bullish.

But ultimately, considering the dominant downward trend and the possibility of the Federal Reserve continuing to cut interest rates in the coming year, it may continue to put pressure on the US dollar in the autumn.

Daily chart of the US dollar index

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights