Seven major institutions' outlook: European banks are expected to cut interest rates by 25 basis points this week, and the euro cannot escape the fate of decline!

On Thursday, September 12th at 20:15 Beijing time, the ECB will hold an interest rate decision. Just a few days later, on September 18th, the Federal Reserve will hold an interest rate decision. Traders generally expect both central banks to cut interest rates.

The European Central Bank is expected to cut interest rates on Thursday

Holger Schmieding, Chief Economist of Berenberg Bank, said: "The European Central Bank's interest rate cut this Thursday should be largely uncontroversial. Almost all recent ECB spokespersons have confirmed that they want to lower interest rates. Even German Central Bank President Joachim Nagel has stated that he will support a rate cut unless there is evidence that it is unfavorable. Nagel is usually considered one of the hawkish members of the ECB Council.

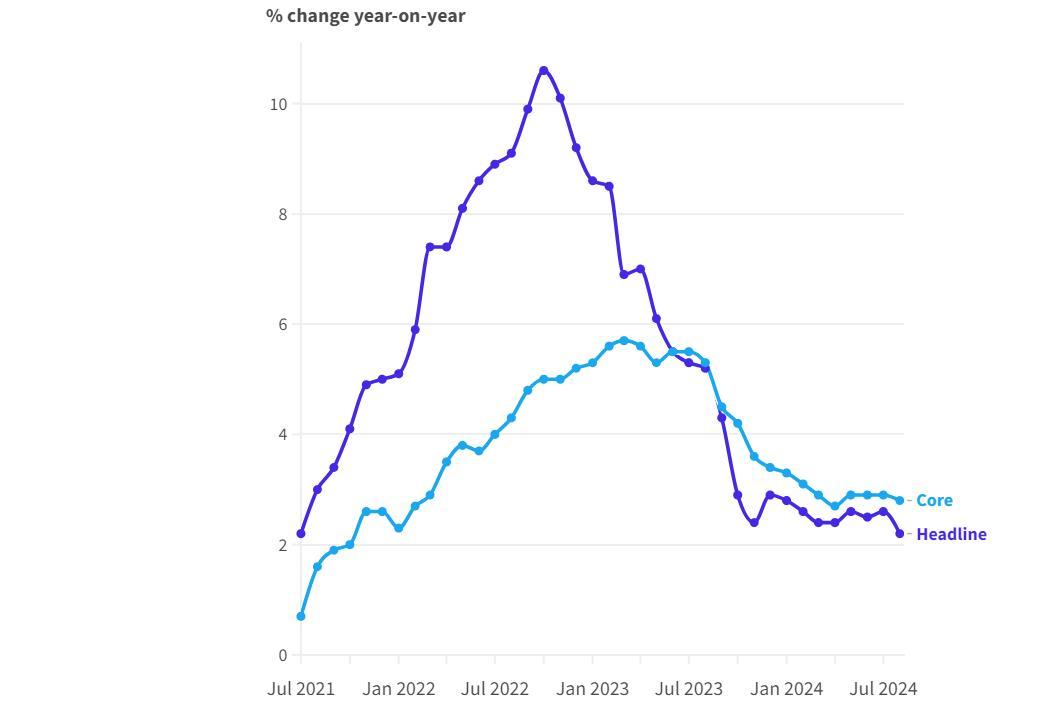

As shown in the figure below, the overall inflation rate in the eurozone fell to its lowest point in three years in August, at 2.2%, while the core inflation rate remained at a relatively high level of 2.8%, with the service industry being the driving factor behind the core inflation rate.

Most analysts expect European Central Bank policymakers to pause interest rate hikes at their meeting in Ljubljana, Slovenia in October. However, due to the inherent risks of maintaining excessively high interest rates, the central bank may also decide to cut interest rates as soon as possible.

At present, the consensus within the Governing Council of the European Central Bank seems to be shifting towards greater optimism, believing that the ECB is on the right track in bringing inflation back to its 2% target.

Some people have openly considered whether accelerating interest rate cuts is appropriate, with the most famous being Philip Lane, Chief Economist of the European Central Bank. He stated at last month's Jackson Hole Economic Seminar at the Federal Reserve Bank of Kansas City that "the return to target is uncertain," but added that the European Central Bank "also" needs to ensure that inflation remains at a level of 2% after returning to target.

He also mentioned that if the European Central Bank maintains excessively high interest rates for a long time, there may be a "long-term" risk of inflation falling below the target.

Summary of institutional viewpoints

Recently, many institutions have provided their own views on the future interest rate policy of the European Central Bank and the potential impact on the euro.

1. Ruixun Bank: There is upward potential for the European Central Bank's interest rate cut bet

Ruixun Bank stated that if the European Central Bank cuts interest rates on Thursday and indicates sufficient progress in inflation to further ease policy, the euro may give up some of its recent gains.

Ipek Ozkardeskaya, an analyst at Ruixun Bank, stated in a report that inflation in the eurozone is slowing down, and given the expectation of a significant interest rate cut by the Federal Reserve, there is room for an increase in the European Central Bank's interest rate cut bet. But she said that unlike the Federal Reserve, the European Central Bank has only one mission, which is to maintain price stability. Therefore, if European officials believe that there is a slight possibility of inflation accelerating in the coming months, the European Central Bank may not be tempted to cut interest rates faster

2. Jeffrey: The interest rate path of the European Central Bank is clearer than that of the Federal Reserve

Mohit Kumar, a global economist at Jefferies, said in a report, "We expect the European Central Bank to gradually cut interest rates by 25 basis points per quarter at its upcoming meetings, depending on the data, and lower rates to below 3%

Kumar said that if economic growth and inflation data meet expectations, it is expected that the European Central Bank's interest rate trough will be around 2.50% -2.75%. The current deposit interest rate of the European Central Bank is 3.75%.

Eric Sturdza Investments predicts that the European Central Bank will be more dovish than the Federal Reserve

Eric Vanraes, fixed income portfolio manager at Eric Sturzza Investments, predicts that the European Central Bank will cut interest rates by 25 basis points on Thursday, and the Federal Reserve will lower by the same amount next week. But it is expected that the stance of the European Central Bank will be slightly more dovish than that of the Federal Reserve.

He said, "However, the European Central Bank is the central bank of 20 countries, not just one. Germany and France need significant interest rate cuts, while Spain only needs moderate policies. Vanraes added that interest rate cuts are just a means. He said, "By gradually phasing out quantitative tightening policies through different approaches, subtle differences can be achieved

4. Bank of America: European Central Bank's interest rate cuts may continue until 2026

Evelyn Herrmann, European economist at Bank of America Global Research, said that due to inflation continuing to be lower than expected, it is expected that the European Central Bank's interest rate cuts may continue until 2026.

Bank of America expects that the European Central Bank will lower deposit rates by 25 basis points on Thursday without changing guidance, followed by another 25 basis points in December and five more cuts in 2025.

5. Strategist: The European Central Bank will strive to make an undisputed policy decision, cutting interest rates by 25 basis points this week

Joel Kruger, market strategist at financial institution LMAX, said that due to the many unresolved issues at the upcoming Federal Reserve meeting next week, the European Central Bank will seek to make an undisputed policy decision to avoid causing too much damage.

Kruger said, "Our basic assumption is that the European Central Bank will cut interest rates by 25 basis points, while possibly only adjusting inflation and growth prospects

LMAX expects the euro to continue to receive good support after the resolution. According to Tradeweb data, the money market has fully digested the expectation of the European Central Bank cutting interest rates by 25 basis points this week.

6. Royal Bank of Canada: If the European Central Bank and the Federal Reserve cut interest rates simultaneously, the euro may slightly decline

Royal Bank of Canada Capital Markets pointed out that a reassessment of US exceptionalism has boosted bets on a Fed rate cut, driving the euro to rise recently, but the euro to dollar exchange rate may fall from around 1.10 to 1.08 in the fourth quarter.

Elsa Lignos, a foreign exchange strategist at Royal Bank of Canada, said in a report that economists' forecasts are not changing as much as the trend of the euro against the dollar suggests, with a 30% chance of a recession in both the United States and the eurozone in the next 12 months.

Lignos said, "The Federal Reserve is expected to start cutting interest rates this month, and we expect the magnitude to be 25 basis points, but the European Central Bank is also likely to continue cutting interest rates by 25 basis points

Morgan Stanley predicts that as the European Central Bank increases its interest rate cuts, the euro will fall by 7%. The euro will fall towards parity with the US dollar within a few months.

EUR/USD daily chart

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights