Pound bulls breathe a sigh of relief! Investment bank says UK economy picks up, won't cut interest rates quickly

On Thursday, September 19th at 19:00 Beijing time, the Bank of England will hold an interest rate decision. The Dutch central bank stated that due to the steady recovery of the UK economy, the Bank of England will not cut interest rates as quickly as the market expects.

Knut A. Magnussen, senior economist at the Dutch central bank, said that the UK economy "seems to be in a steady upward phase. We believe that the Bank of England has almost no pressure to cut interest rates".

He said that the Bank of England will cut interest rates again in November and at "every other" meetings, which means that the rate cuts will take a slow approach.

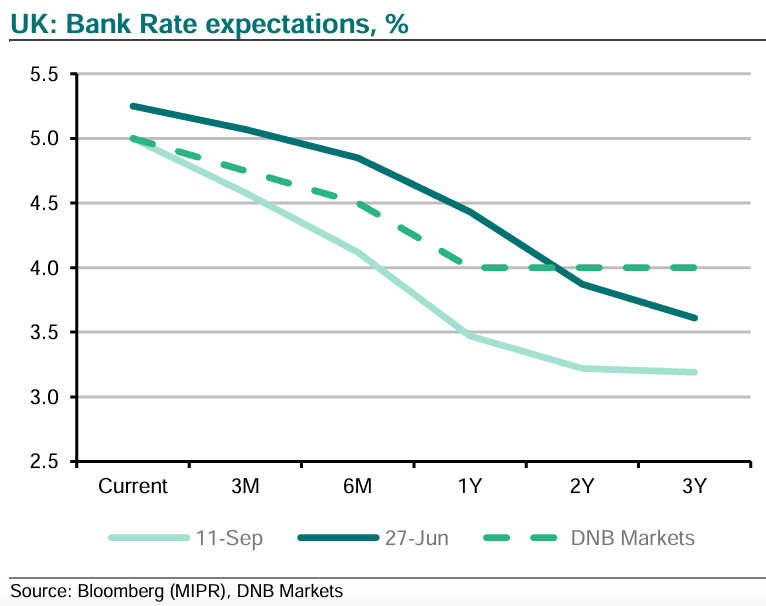

The Bank of England's interest rate expectations are shown in the following chart

Goldman Sachs economists also released their views, believing that the Bank of England will soon open the floodgates and launch a series of interest rate cuts in November.

Goldman Sachs believes that the market has underestimated the upcoming rate cut, which means that loan rates in the UK will decrease and may put pressure on the pound and mortgage rates.

The divergence of views between the Dutch central bank and Goldman Sachs lies in their different expectations for service sector inflation and wages, which are closely monitored by the Bank of England. Goldman Sachs believes they will rapidly cool down, while the Dutch central bank believes they will not.

The Dutch central bank believes that wage and service inflation in the UK will continue to decline, but the magnitude of the decline will be slow, and it is urging the Bank of England to remain vigilant.

Money market pricing shows that investors are hoping for bank interest rates to drop all the way to around 3.25%. This is 75 basis points lower than the terminal interest rate expected by the Dutch central bank.

Magnussen said, "We believe that a strong labor market and increased economic activity will limit the extent of interest rate cuts. Lower (service sector) inflation and wage growth will provide room for interest rate cuts, which seems reasonable, but as long as the UK economy avoids recession, we believe interest rates will only fall to around 4%

If the forecast of the Dutch central bank is correct, the pound and mortgage rates are expected to be supported by the UK interest rate differential for a longer period of time.

In fact, after the Dutch central bank, there are other institutions offering their own views on the Bank of England's decision and the outlook for the pound.

Dutch International Group analyst Francesco Pesole said that the pound may strengthen as the Bank of England is unlikely to cut interest rates this week.

Pesole said that the UK economic data has hindered market expectations of a significant interest rate cut by the Bank of England, similar to the Federal Reserve, which means that the pound may continue to rise against the US dollar. At the same time, the divergence in economic growth prospects between the eurozone and the UK is favorable for the pound against the euro. Although the pound is starting to appear relatively expensive, the euro against the pound may not continue to rebound to 0.85 unless the Bank of England strongly suggests further interest rate cuts.

Daily chart of GBP/USD

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights