The situation in the Middle East and the Federal Reserve's interest rate cuts are both driving up, and the rise in crude oil prices may continue

On Monday (September 23), international oil prices continued to rise due to the dual impact of the escalating situation in the Middle East and expectations of interest rate cuts by the Federal Reserve. Brent crude oil futures for November rose by $0.22, or 0.3%, to $74.71 per barrel; The November crude oil futures price of WTI in the United States rose by $0.26, or 0.4%, to $71.26 per barrel. On the previous trading day, both types of crude oil futures recorded gains and closed higher for the second consecutive week last week.

From a fundamental perspective, although the weak economic prospects of the two major oil consuming countries, China and the United States, have suppressed further increases in oil prices, the tense geopolitical situation and changes in the Federal Reserve's monetary policy have provided support for the market. The escalation of the conflict between Israel and Hezbollah, as well as the expected economic stimulus effect of a significant interest rate cut by the Federal Reserve, have provided support for oil prices. However, the market still holds a cautious attitude towards the actual impact of the Middle East situation on crude oil supply, leading to a relatively cautious rise in oil prices.

Fundamental analysis: The escalation of the situation in the Middle East provides support for the expectation of a Federal Reserve interest rate cut

Currently, the focus of the market is on the escalating tensions in the Middle East region. According to well-known reports, the Israeli military launched its largest airstrike in nearly a year against Iran backed Hezbollah, covering southern Lebanon, eastern Bekaa Valley, and northern Syria. This move has led to market concerns that the oil supply in the Middle East may be impacted. Yeap Jun Rong, a market strategist at IG, pointed out that "the geopolitical tensions between Israel and Hezbollah in the Middle East have intensified, which may provide good support for oil prices in the broader regional conflict risk

On the other hand, the recent news of significant interest rate cuts in the United States has boosted market expectations for the outlook of oil demand. Priyanka Sachdeva, Senior Market Analyst at Phillip Nova, stated that while expectations of US interest rate cuts have driven up oil prices, weak demand from the Chinese economy has suppressed further increases in oil prices. She pointed out that "fuel demand is still uncertain, and the US interest rate cut has raised concerns in the market that the Federal Reserve may foresee a labor market downturn." Therefore, although the interest rate cut is a short-term positive for oil prices, concerns about long-term weak demand are still constraining gains.

Technical analysis: Short term bullish trend continues to focus on key support and resistance levels

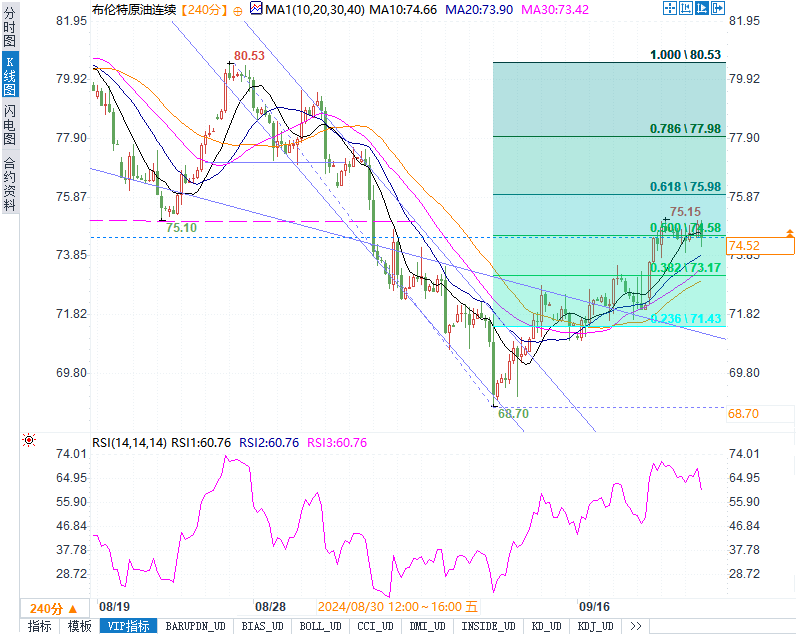

Brent crude oil futures prices showed positive trading dynamics at the opening today, approaching the level of $75.24 per barrel. This price represents the 50% Fibonacci retracement level of the downward trend on the chart, and if it can effectively break through this level, it will open up further upward space to $76.68.

Technically speaking, Brent crude oil is supported by the 50 day moving average (EMA50), which also provides momentum for the expected bullish trend. If the price fails to fall below $73.80 and remains below its daily closing, the upward trend of Brent crude oil will still be valid. The expected trading range for today is between the support level of $73.70 and the resistance level of $76.70, indicating a bullish overall trend in the short term.

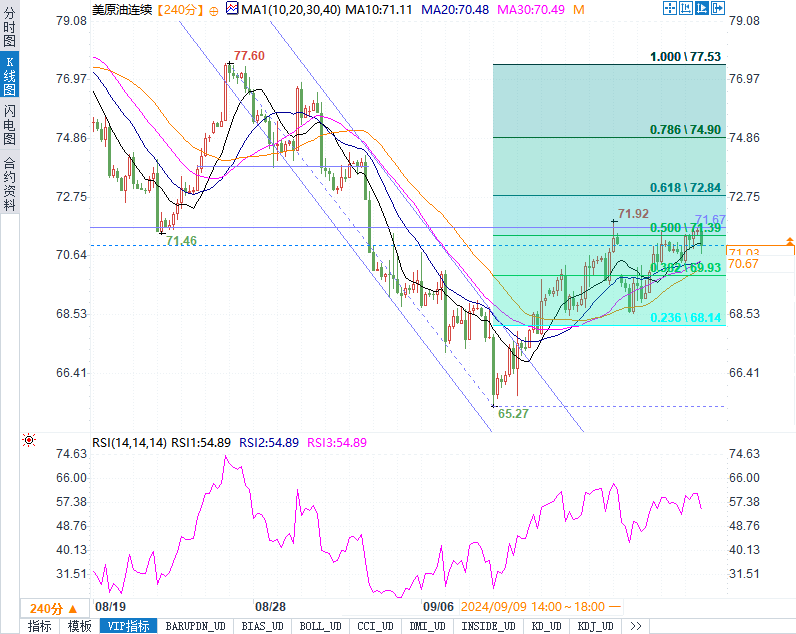

The WTI crude oil futures price successfully closed above $71.95 per barrel last Friday, supporting the continuation of the corrective bullish trend and creating conditions for further exploration to the 61.8% Fibonacci retracement level of $73.48. The price is influenced by the previously completed inverted shoulder shape, opening up space for further increases to $75.36 in the future.

However, it should be noted that if WTI crude oil prices fall below the support level of $71.95, the bullish trend will pause and may push oil prices back to the regional support level of $70.44. The expected trading range for WTI today is between the support level of $71.15 and the resistance level of $74.14, and the overall trend is also bullish.

Short term optimism requires prevention of unexpected event risks

Currently, market sentiment is showing an optimistic trend driven by both geopolitical tensions and expectations of a Federal Reserve interest rate cut. However, investors still need to be vigilant about the impact of further escalation of the situation in the Middle East on the market. Although the current conflict has not had a substantial impact on oil supply, if the situation continues to deteriorate, it may significantly change the supply and demand pattern of the market.

In terms of operational strategy, investors can consider chasing after the Brent crude oil price breaks through $75.24 in the short term, with a target of $76.68. At the same time, it is important to pay attention to the support level of $73.80. If it falls below this level, multiple orders should be stopped and left in a timely manner. For WTI crude oil, it is also possible to follow up with multiple orders when the price breaks through $73.48, with a target range of $74.14 to $75.36.

The Middle East situation and demand outlook dominate the trend of oil prices

Overall, international oil prices will continue to be dominated by the situation in the Middle East and expectations of Federal Reserve policies in the short term. In the coming days, the market needs to closely monitor whether the conflict between Israel and Hezbollah will further escalate, thereby affecting the Middle East oil supply chain. At the same time, the economic data performance of the United States and China will also become a key factor affecting the trend of oil prices.

In the face of the current complex market environment, investors should remain cautious in trading and strictly set stop loss levels to cope with the severe fluctuations that may arise from unexpected events. Meanwhile, it is necessary to closely monitor the future policy direction of the Federal Reserve and its potential impact on the global economy.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights