What does "one hand" mean in foreign exchange trading terminology?

As a beginner in foreign exchange trading, it is essential to systematically learn the basic knowledge related to foreign exchange trading. Today, in the Introduction to Foreign Exchange Encyclopedia, we will learn about the concepts of foreign exchange fundamentals: standard hands and contracts.

Standard hand

We have learned that "point" is the basic unit of exchange rate fluctuations in foreign exchange trading, so what is the unit of measurement for "hand" in foreign exchange trading terminology?

Lot: It is the unit of trading quantity in foreign exchange trading, and the number of trading lots is also an important link in fund management and position control.

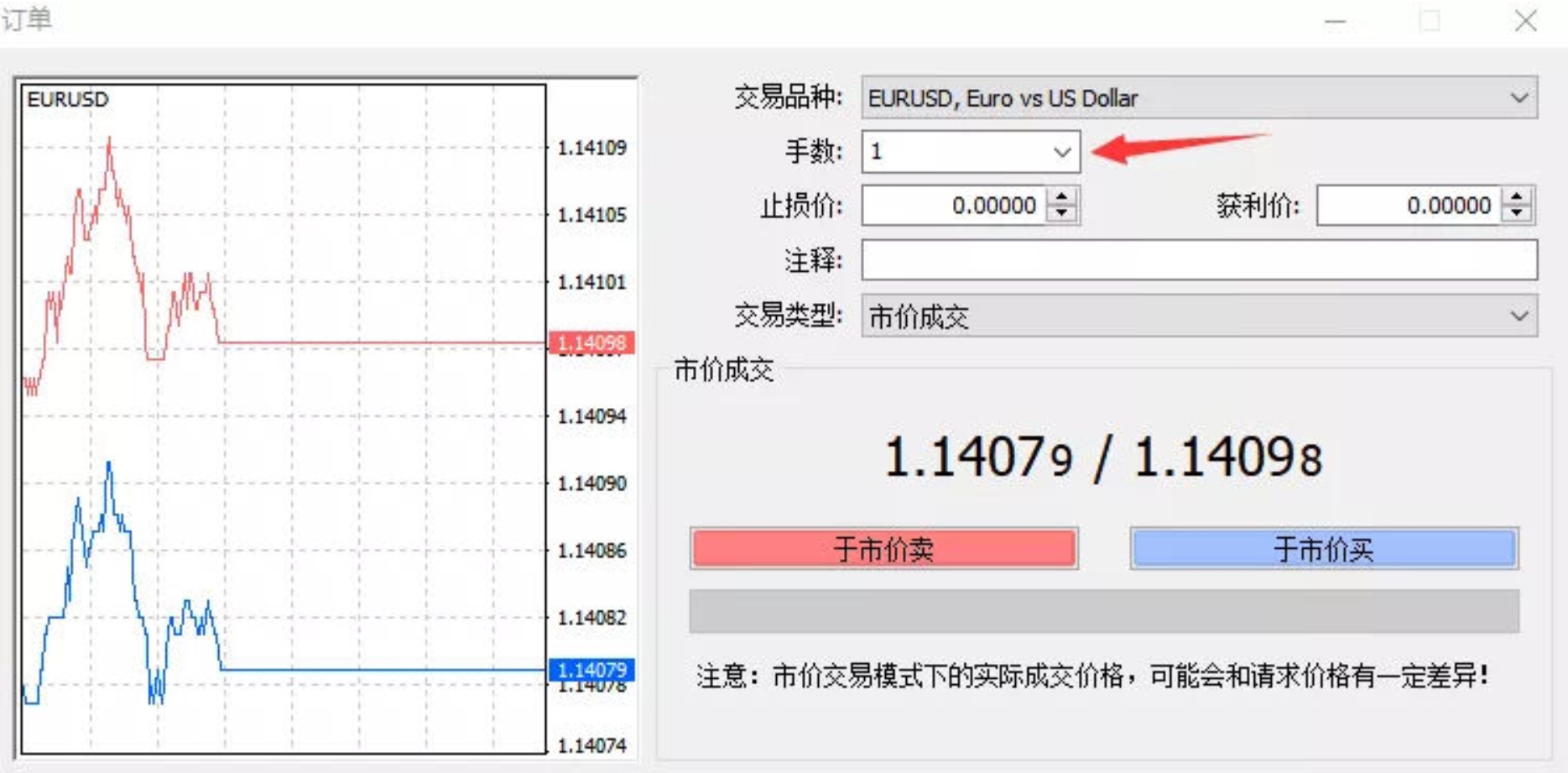

Commonly known as a position, for example, on the MT4 foreign exchange platform, if you long in Europe and America, you place one hand (equivalent to one standard hand), as shown below:

A (standard) hand equals 100000 base currencies, and (1 standard hand) can be divided into different types of hands based on different trading volumes, such as standard hands, mini hands, etc

One (mini) hand=10000 base currency, (0.1 standard hand)

One (micro) hand=1000 base currency, (0.01 standard hand)

……

For example:

The current exchange rate quote for GBPUSD is 1.30568. If you buy one hand (one standard hand) of GBPUSD, you hold 100000 pounds. Regardless of exchange rate fluctuations, the GBPUSD you buy will increase or decrease on the basis of 100000 pounds.

PS: The meaning of currency pairs: the left side is the base currency (benchmark currency), and the right side is the quotation currency (settlement currency).

GBP (base currency) to USD (quoted currency), i.e. GBP (base currency)/USD (quoted currency)

The minimum unit for foreign exchange trading can reach 0.01 standard hands (i.e. micro hands). For beginners in foreign exchange trading, 0.01 hands is a reasonable starting point for practicing positions. This can enable them to participate in the global foreign exchange market through real trading accounts in the early stages of learning foreign exchange trading technology, while also reducing the "tuition fees" for newcomers entering the foreign exchange market and accumulating valuable practical experience.

contract

Foreign exchange margin trading, also known as contract (spot) foreign exchange trading.

So in the foreign exchange market, one hand means trading 100000 units of base currency, or it can be said that one hand represents buying and selling 100000 units of base currency (the currency unit of contract value), but using quoted currency for settlement (i.e. calculating the point value of fluctuation gains and losses).

For example:

The contract value of one standard hand EURUSD (Euro to USD) is 100000 euros (currency unit)

The contract value of one standard hand GBPUSD (GBP to USD) is 100000 pounds (currency unit)

The contract value of AUDUSD (AUD to USD) for one standard hand is AUD 100000 (currency unit)

The contract value of NZDUSD (New Zealand dollars to US dollars) is 100000 New Zealand dollars (currency units)

The contract value of one standard hand USDJPY (US dollar to Japanese yen) is 100000 US dollars (currency unit)

The contract value of one standard hand USDCAD (USD to CAD) is $100000 (currency unit)

The contract value of one standard hand USDCHF (US dollar to Swiss franc) is 100000 US dollars (currency unit)

By studying the important concepts of standard hands and contracts in foreign exchange fundamentals, we can better understand the relevant knowledge from the principles and logic of foreign exchange trading, laying a solid foundation for further learning of leverage and margin in foreign exchange trading.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights