The new Japanese Prime Minister bluntly stated that the current environment is not suitable for further interest rate hikes, and the USD/JPY has risen to a high in over a month

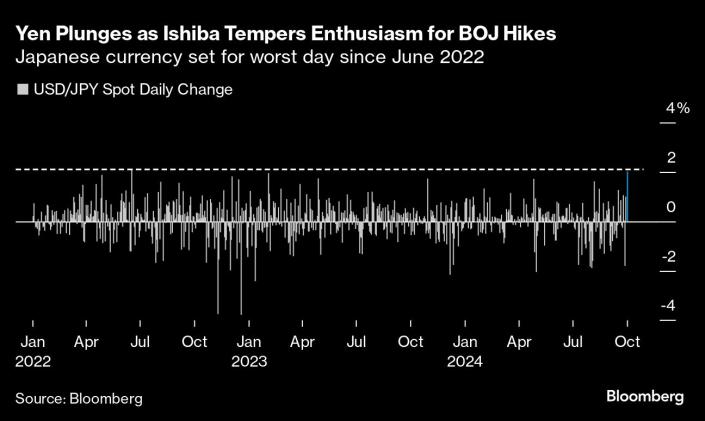

On Wednesday (October 2nd), Japan's newly appointed Prime Minister Shigeru Ishiba recently stated that the Japanese economy is not yet ready to face another interest rate hike from the central bank. As soon as this statement was made, the foreign exchange market immediately shook, and the Japanese yen fell sharply by about 2%. On Thursday (October 3), the Asian yen continued its downward trend, with the USD/JPY hitting a high of 147.4, a new high since August 20, a decline of about 0.5%.

At the same time, Bank of Japan Governor Kazuo Ueda also made a similar cautious statement. This series of statements has led the market to believe that the Bank of Japan will not raise interest rates in the short term, causing the yen to record its largest daily decline in two years, surpassing the decline during the volatile market in early August.

Coinciding with the decline of the yen was the sell-off of US treasury bond bonds. As the US employment data was better than expected, the yield of benchmark 10-year treasury bond bonds rose by about 5 basis points to 3.78%.

Federal Reserve Chairman Jerome Powell reiterated in his speech on Monday that the fundamentals of the US economy remain solid, further lowering market expectations for a significant rate cut by the Fed.

Powell's speech showed that the Federal Reserve's stance on raising interest rates this year is more firm than market expectations, while the Bank of Japan has stated that it is not considering raising interest rates for the time being, which has dealt a double blow to the yen, "said Leah Traub, portfolio manager and head of the currency team at Lord Abbett. A few weeks ago, the market was overly pessimistic about the US dollar, and now we have to readjust our positions

Although the bullish sentiment towards the yen has weakened since early September, yen options traders remain optimistic about the future trends for the week, month, and quarter.

Meanwhile, although hedge funds continue to short the Japanese yen, they have reduced some of their bearish bets in recent weeks. On Wednesday, the Japanese yen plummeted by over 2%, and in the previous two days, the yen had also fallen by a cumulative 1%. Powell's hawkish remarks have boosted the overall rise of the US dollar against the currencies of the Group of 10 countries.

Jane Foley, head of foreign exchange strategy at Rabobank, said that the volatility of the yen this week reflects the extremely tense state of the market, which also highlights the uncertainty of the market's policies towards the Bank of Japan and the potential impact of the Prime Minister's remarks. Given the sensitivity of the market, I expect the Prime Minister to reduce his comments on the policies of the Bank of Japan in the future to avoid further market volatility.

In early August, as the Bank of Japan began raising interest rates, traders were forced to painfully withdraw their bets on arbitrage trading by borrowing low interest yen. At that time, the Japanese yen rose sharply in the wave of arbitrage trading selling due to its interest rate being lower than G10 currencies, and its volatility soared.

However, now the outlook for the yen is gradually dimming as the Bank of Japan may postpone interest rate hikes to support the new government's policies.

If the Bank of Japan raises its policy interest rate again like it did on August 5th, the market will be greatly impacted, and the impact on the Ishibashi government will be very significant. Therefore, it is expected that the Bank of Japan will not raise interest rates again this year, and the trend of yen depreciation may continue until the end of the year, "said Yokota Yuji, a foreign exchange trader at Mitsubishi UFJ Trust Bank in New York

Bloomberg strategist Sebastian Boyd believes that "Shigeru Ishiba's dovish stance, combined with fundamental and technical factors, suggests that the yen may further depreciate significantly。

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights