Golden Week Review:Non agricultural strikes, most retail investors are bullish on the future market

Spot gold remained volatile and consolidated last week, opening at $2321.88 per ounce, reaching a high of $2339.79 per ounce and a low of $2293.69 per ounce, ultimately closing at $2326.72 per ounce. The trend of the US dollar continues to dominate the recent trend of gold, falling below the support level of 2300 at the beginning of the week under the heavy pressure of the strong US dollar. Subsequently, with the support of strengthened interest rate cuts expected by US economic data, gold prices attempted to rebound, ultimately reaching $2326, with a slight increase of 0.22% last week.

According to a new report by Georgette Boele, senior economist at ABN Amro, gold prices have lost momentum due to driver differentiation and the breakdown of traditional relationships, so investors should remain cautious about this yellow metal.

However, Michele Schneider, Chief Strategist at MarketGauge.com, said, "Gold is in a wait-and-see state, but risks tend to rise. Inflation will not disappear, geopolitical tensions will not ease, and government deficits will continue to increase. This provides solid support for gold."

Review of Weekly News

The first debate in the US presidential election ends, and Trump bluntly declared a huge victory

Trump held his own rally in Virginia a few hours after the debate, calling it a "huge victory". "Joe Biden's problem is not his age," said the 78 year old Trump. "It's his abilities. His abilities are extremely poor."

The former president stated that he does not believe Biden will withdraw from the campaign, stating that Biden "performed better than other Democrats in polls," including California Governor Gavin Newsom and Vice President Camara Harris.

Although the issue of Biden's age is not new, his unstable performance on the debate stage - including language gaps, hoarse voices, and some difficult answers - has caused panic among some Democrats, who have raised new questions.

Former Speaker of the House Nancy Pelosi said, "From a performance perspective, this is not very good.". Other Democrats, such as Biden's former communications director Kate Bedingfield, called this a "very disappointing performance in the debate.".

A donor planning to participate in Biden's fundraising event in Hampton on Saturday said, "This is a disaster, it's even worse than I imagined. Everyone I know thinks Biden should quit."

Another long-time Democratic campaign advisor told CNBC less than 20 minutes after the debate, "The game is over."

"The only thing that could cause a bigger disaster was his fall from the stage. The big donor said... he must step down," said a Democratic staff member. "If Biden continues to stay in office, we will have to watch him stand on the tightrope in the air before November."

Last Friday, the editorial board of The New York Times called on Biden to withdraw from the campaign. It states that Democrats should "acknowledge that Biden cannot continue running and create a program to choose a more capable person to replace him.".

Last Thursday night, senior Democratic lawmakers, donors, and insiders felt uneasy because the President often stumbled during debates, answered incoherently, and sometimes seemed to lose his train of thought.

CNN reported that 48 million television viewers watched the debate, and another 30 million streaming viewers watched the debate. This debate is considered a crucial opportunity for Biden to turn around his faltering re-election campaign, which has been dragged down by concerns about his age and cost of living. In most national and swing state polls, he lags behind Trump.

There is no doubt that the Federal Reserve will cut interest rates in September! Core PCE hit a new low in nearly three years

An important economic indicator released by the Federal Reserve last Friday showed that inflation in May slowed to its lowest annual rate in over three years, providing good news for Federal Reserve officials seeking to start cutting interest rates in the coming months.

According to a report from the US Department of Commerce, after seasonal adjustments, the core personal consumption expenditure price index only increased by 0.1% in April, up 2.6% from the same period last year and down 0.2 percentage points from April.

Both of these numbers match Dow Jones's estimate. The annual rate in May reached its lowest level since March 2021, marking the first time in this economic cycle that inflation has exceeded the Federal Reserve's target of 2%.

The overall inflation rate, including food and energy, remained stable for the month and increased by 2.6% year-on-year. These numbers also meet expectations.

According to the CME FedWatch tool, traders currently expect a probability of approximately 68% for the Federal Reserve to cut interest rates in September, higher than the 64% before the release of inflation data.

Seema Shah, Chief Global Strategist at Principal Asset Management, said, "Today's PCE data was not surprising, which is a relief and the Federal Reserve will welcome it. However, the policy path is still uncertain. Further slowdown in inflation, coupled with more evidence of a weak labor market, will be a necessary condition for the first rate cut in September."

The Federal Reserve aims at an inflation rate of 2%, and will start to raise interest rates in March 2022. The previous year, the Federal Reserve had always regarded price inflation as the temporary impact of the COVID-19 epidemic, which may gradually fade. The last time the Federal Reserve raised interest rates was in July 2023, when it raised its benchmark overnight borrowing level to a range of 5.25% to 5.50%, the highest level in 23 years.

Recent economic data shows that the US economy has withstood the test of the Federal Reserve's aggressive monetary tightening policy. The Federal Reserve Bank of Atlanta stated that the annualized growth rate of GDP in the first quarter was 1.4%, and it is expected to grow by 2.7% in the second quarter.

Recently, there have been some minor cracks in the labor market, with the number of people continuously applying for unemployment benefits reaching the highest level since November 2021. However, the unemployment rate remains at 4%, which is considered a relatively low level based on historical averages, although the unemployment rate is also slowly rising.

Outlook for this week

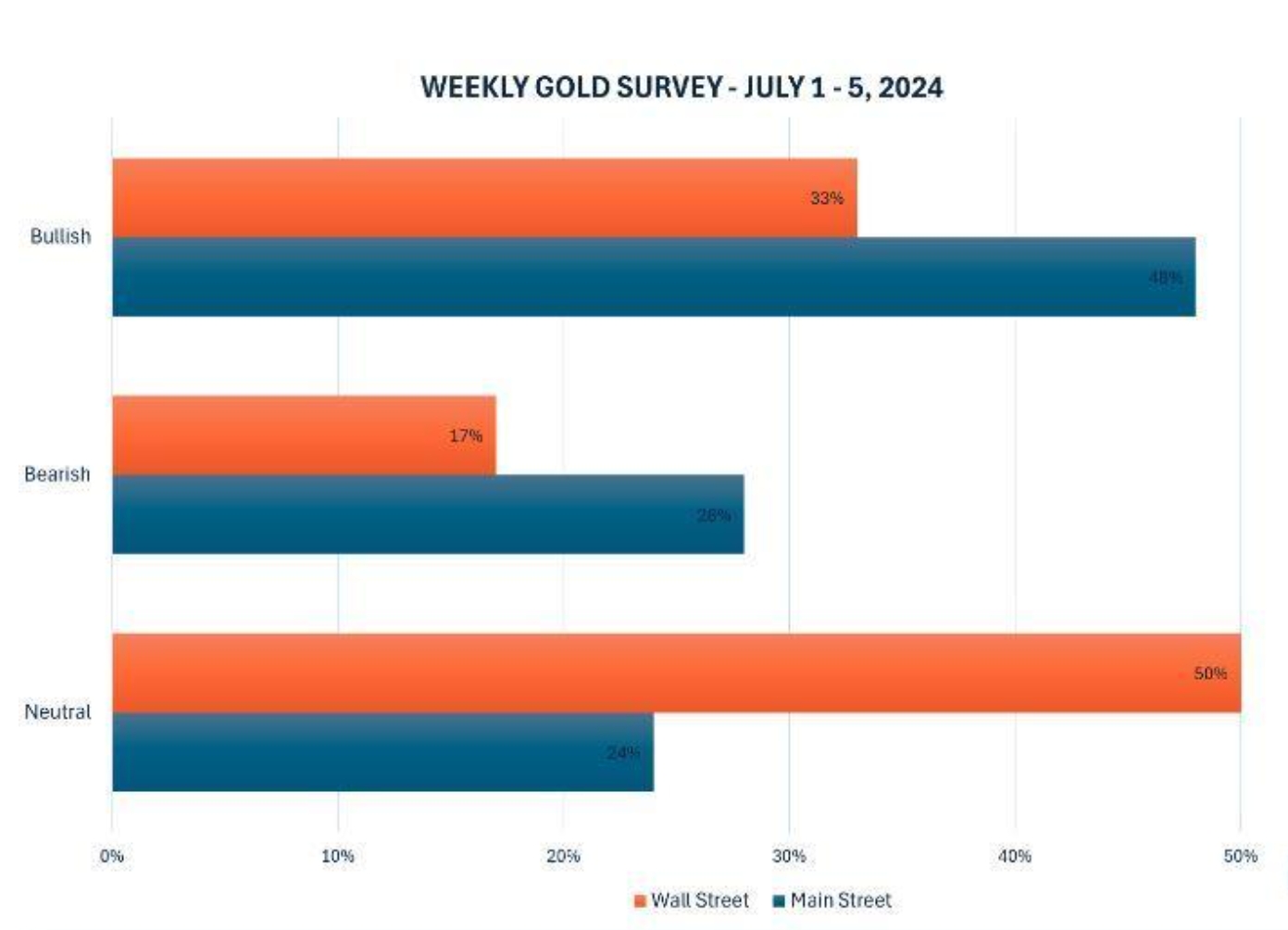

The latest Kitco News Golden Week survey shows that most industry experts plan to wait and see in the coming week, while retail investors have differing opinions on the short-term prospects of gold.

Last week, 12 Wall Street analysts participated in the Kitco News gold survey, and the consensus next week is that caution is the greatest courage. Four experts said they expect gold prices to rise in the next week, accounting for 33%, while two analysts or 17% predict prices to fall. The remaining six experts, who make up exactly 50% of the total, are unwilling to believe in the direction of gold in the coming week.

At the same time, Kitco received 178 votes in online voting, and retail investors have differing opinions on the short-term outlook for gold in the coming week, similar to last week's views on Wall Street. 86 retail traders, accounting for 48%, are expected to see an increase in gold prices in the next week. Another 50 people, accounting for 28%, are expected to see a decline in gold prices, while the remaining 42 respondents, accounting for 24%, believe that prices will continue to consolidate horizontally in the coming week.

Independence Day in the United States will make this week's economic data unusual, and important releases will be compressed on both sides of the holiday. On Monday, the market will receive the ISM Manufacturing Purchasing Managers Index, followed by the initial Eurozone CPI and JOLTS job vacancy data released on Tuesday. European Central Bank President Christian Lagarde and Federal Reserve Chairman Jerome Powell will also deliver speeches at a central bank meeting in Portugal.

On the following Wednesday, the market will pay attention to the ADP employment report, weekly unemployment benefits data, ISM Service Purchasing Managers Index, and the minutes of the June FOMC meeting.

After the holiday on July 4th, American traders will wake up on Friday morning to welcome the June non farm payroll report.

Darin Newsom, senior market analyst at Barchart.com, remains optimistic about next week's gold price.

He said, "I will continue to be bullish because the August contract still seems to have room to continue its short-term upward trend." He said, "Last Friday morning, the August contract broke through its previous four-day high of $2349.70/ounce, and the next short-term upward target is $2370.40/ounce. We need to remember that the medium-term trend of the contract is still downward, forming a triple bottom of $2304.20/ounce (week of June 3), $2304.50/ounce (week of June 10), and $2304.70/ounce (week of this week)."

"As the saying goes, maybe it's just because I remember when I'm old, 'the triple bottom was broken'," Newsom warned.

Everett Millman, Chief Market Analyst at Gainesville Coins, said he expects gold to continue to be constrained by recent holding patterns until certain events shake broader markets.

"Nowadays, many people view gold as the reverse of a risky asset in the stock market, although this is not a perfect one-on-one relationship," he said. "I think this is the biggest driving factor now, especially when people are confused about the performance of the stock market, especially when we are only seeing the very top of the stock market at the beginning, just the kind of trend at the beginning, of course, it is the negative direction of the big beginning trend." "This is not a perfect foundation, but we are still not far from historical highs until the stock market experiences a significant decline or correction. I think gold will continue to hang."

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights