ECB may unexpectedly cut interest rates by 25 basis points in October

The ECB may push forward with a global monetary easing policy in the coming week, as policymakers almost ruled out the possibility of interest rate cuts only a month ago.

Economists believe that the third 25 basis point rate cut in this cycle may indicate that officials will accelerate more sustained action to alleviate the impact of long-term high borrowing costs in the eurozone on economic growth, which is currently lagging behind.

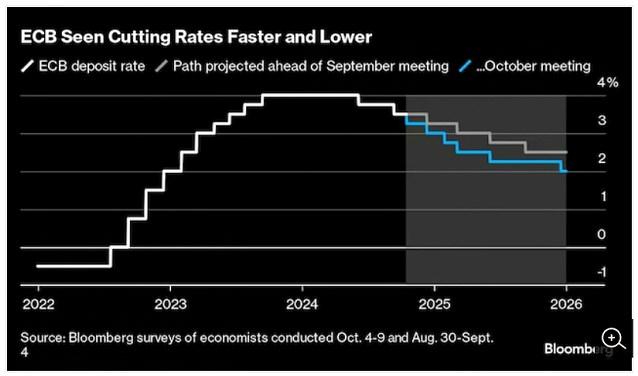

Figure: Expected acceleration and deceleration of interest rate cuts by the European Central Bank (white line represents deposit rates, gray line represents expected path before September meeting, blue line represents October meeting)

A meeting will be held near the capital of Slovenia on Thursday, and at a subsequent press conference, European Central Bank President Lagarde may be asked about the future path of further interest rate cuts and what significant changes have occurred compared to the September meeting.

Due to the shorter than usual interval between decisions, only five weeks, and the lack of much new data, officials seem to have given up their cautious attitude towards the persistent inflationary pressure recently, mainly in response to survey data pointing to the contraction of the private sector economy.

Such reports have impacted financial markets and sparked the widely expected trend of interest rate cuts after policy makers largely supported betting on changes.

This transformation is quite sudden. In the decision made on September 12th, officials almost ruled out a rate cut in October. A few days later, Peter Kazimir, the Governor of the Slovak Central Bank, announced that "we will almost certainly need to wait until December" to take action again, as "almost no new information" will be available by October 17th.

He is currently the only voice openly opposing Thursday's action, but other hawks may join his ranks behind the scenes.

Bloomberg Economics stated, "The European Central Bank will lower borrowing costs by 25 basis points in October and take action again in December. After that, we expect to take action quarterly as policymakers feel they are moving towards neutrality

As for what will happen next, according to a Bloomberg survey, economists now believe that the European Central Bank will accelerate its easing policy, reducing borrowing costs to a level that no longer limits the economy by the end of 2025.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights