Federal Reserve Chairman Powell's speech is coming, will gold prices soar?

On Tuesday (July 2nd) in the Asian morning trading session, spot gold is currently trading around $2332.16 per ounce. Gold prices rose 0.23% on Monday to close at $2331.60 per ounce, boosted by some investors covering short positions. The US June ISM manufacturing PMI data fell short of market expectations, providing upward momentum for gold prices. The market focus has shifted to the US employment data to be released later this week, which may provide more clues for the Federal Reserve's interest rate cut.

Kim Wyckoff, Senior Market Analyst at Kitco Metals, said, "We see shorter term futures traders taking short positions, while traders in the spot market are buying on dips. The strength of crude oil prices and the weakening of the US dollar also provide support for the market.".

Wyckoff added, "In the remaining time of summer, we may experience sideways fluctuations, or we may experience sideways fluctuations leading to a decline.".

Due to sustained sluggish demand, the US manufacturing industry shrank for the third consecutive month in June, and the input price index fell to a six month low, indicating that inflation may continue to fall.

The focus of this week will be on the speech of Federal Reserve Chairman Powell on Tuesday, followed by the release of the minutes of the Federal Reserve's June monetary policy meeting on Wednesday and the release of US non farm payroll data on Friday.

Last week's data showed that prices in the United States remained stable in May, with moderate growth in consumer spending. If Federal Reserve Chairman Powell delivers a dovish speech, it is expected to provide further upward momentum for gold prices.

At present, the market believes that the probability of the Federal Reserve lowering interest rates in September and another rate cut in December is 64%.

In addition, geopolitical concerns and concerns about the uncertainty of the French election situation also provide some support for gold prices.

Manufacturing in the United States shrank for the third consecutive month in June, easing inflationary pressures

Due to sustained sluggish demand, the US manufacturing industry shrank for the third consecutive month in June, and the input price index fell to a six month low, indicating that inflation may continue to fall.

The Institute for Supply Management (ISM) reported on Monday that the weakness at the end of the second quarter was comprehensive. Timothy Fiore, Chairman of the ISM Manufacturing Business Survey Committee, stated that manufacturers have shown "a reluctance to invest in capital and inventory due to current monetary policy and other conditions.".

The manufacturing industry is under pressure from rising interest rates and weak demand for goods, despite corporate investment being largely sustained.

"We expect the manufacturing industry to remain weak in the coming quarters," said Oliver Allen, senior US economist at Pantheon Macroeconomics. "The decline in corporate bond yields since the end of last year... seems to have provided some support for investment spending, but it is not enough to restore growth in the manufacturing industry. To change this situation, greater relaxation of financial conditions is needed."

The ISM Manufacturing Purchasing Managers' Index (PMI) fell from 48.7 in May to 48.5 in the previous month. A PMI reading above 50 indicates growth in the manufacturing industry, which accounts for 10.3% of the US economy. The PMI is still above the level of 42.5, and ISM states that the level of 42.5 indicates overall economic expansion over a period of time.

Economists surveyed expect the PMI to climb to 49.1. In the past 20 months, the index has shown contraction for 19 months.

Government data released last week showed that the manufacturing industry shrank at an annual rate of 4.3% in the first quarter, with most of the decline coming from durable goods.

Since July last year, the Federal Reserve has maintained its benchmark overnight interest rate range at the current 5.25% -5.50%. Financial markets expect the Federal Reserve to initiate an easing cycle in September, despite decision-makers recently adopting a more hawkish outlook. Since 2022, the Federal Reserve has raised policy interest rates by 525 basis points to curb inflation.

The prospective indicator in the ISM survey, the sub index of new orders, has risen from 45.4 in May to 49.3, still in a shrinking state. Manufacturing production has declined for the first time since February. The production sub index decreased from 50.2 in May to 48.5.

Against the backdrop of weak orders, manufacturing inflation fell sharply in June. The survey shows that the sub index of input prices has dropped from 57.0 in May to 52.1, the lowest since December.

The decrease in commodity prices was the main reason for the flat monthly inflation rate in May. The decrease in input prices in June indicates that the entire economy will continue to maintain a downward trend in inflation.

The sub index of supplier delivery increased from 48.9 in May to 49.8. Below 50 indicates an accelerated delivery speed.

The sub index of manufacturing employment declined after a brief rebound in May. The factory is reducing the number of employees through layoffs, natural attrition, and recruitment freezes.

The overall labor market is gradually cooling down. According to a survey of economists, the government may announce on Friday that non farm employment increased by 190000 in June, compared to 272000 in May. The unemployment rate is expected to remain unchanged at 4.0%.

Another report released by the US Department of Commerce on Monday showed that construction spending in May decreased by 0.1%, while April data was revised upwards from a decrease of 0.1% to an increase of 0.3%. Economists had previously predicted that construction spending would rebound by 0.2% in May. Construction expenditure increased by 6.4% year-on-year in May.

Although mortgage interest rates have fallen from their high levels in May, due to slowing demand, housing supply has significantly improved, which may limit the growth of new buildings.

French anti far right parties seek to establish a united front to block the rule of the National League

On Monday, opposition parties from the far right attempted to establish a united front to block the National League (RN) led by Le Pen from taking office. Previously, the National League achieved a historic victory in the first round of parliamentary elections in France.

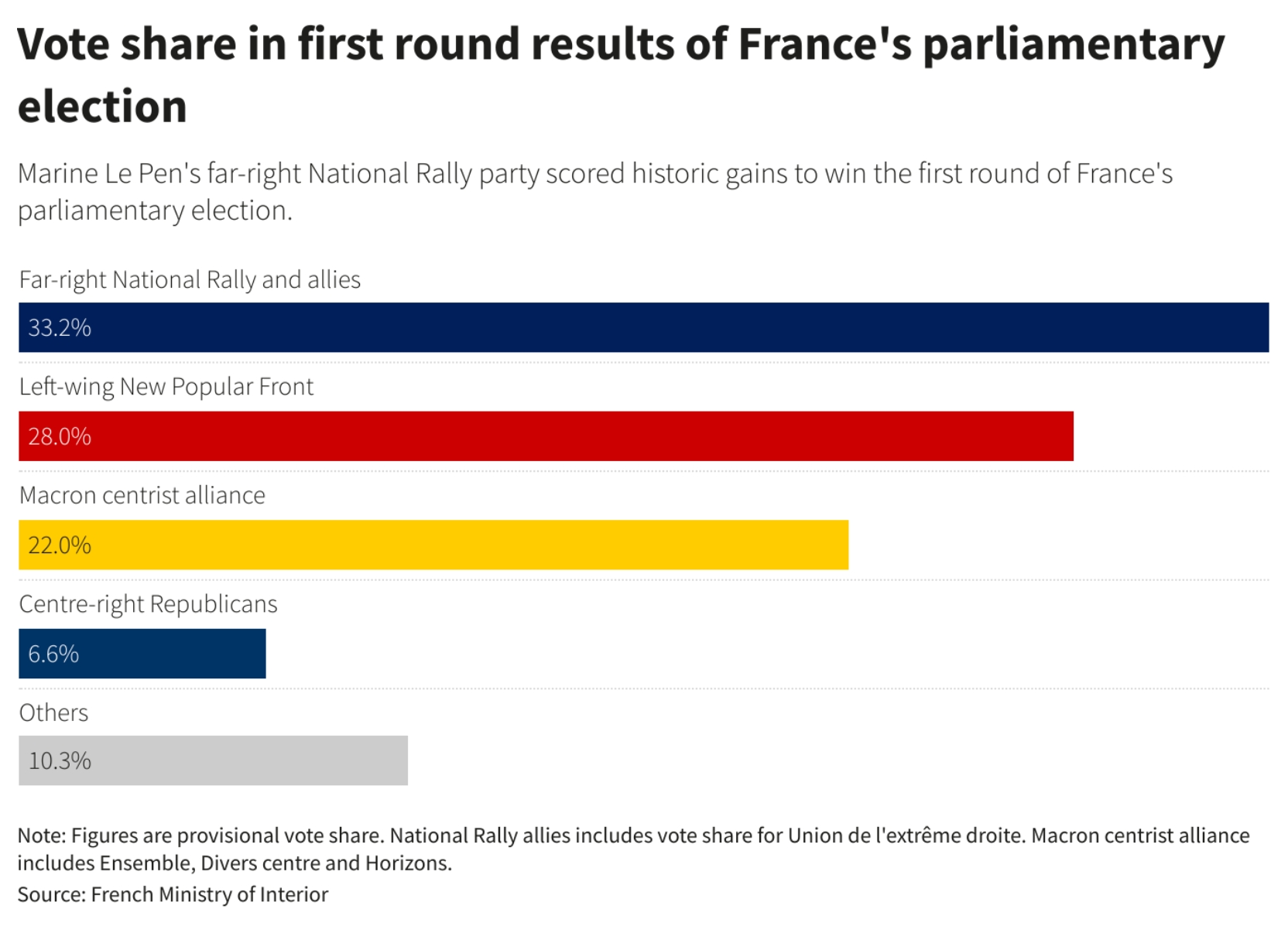

The official results show that the National League and its allies received 33% of the support vote in Sunday's election, followed closely by the left-wing group with 28% of the support, far ahead of President Macron's extensive centrist alliance, which had a support rate of only 22%.

The vote count for the National League was not as high, which relieved the financial markets and led to an increase, but it was still a huge setback for Macron. In last month's European Parliament elections, Macron was defeated by the National League and therefore proposed to hold early elections.

At Henin Beaumont, the northern stronghold of Le Pen, supporters of the National League, Jean Claude Gaillet, said, "I am satisfied because we need to change." However, others are concerned that the rise of the National League and its nationalist agenda will lead to increasing tension in French society.

"I think people are not aware of what is happening, they only consider the cost of living and the immediate situation," Yamina Addou said outside a supermarket in southern Lille. "I think this is very sad."

The ability of the anti immigrant and Eurosceptic National League to form a government will now depend on whether other political parties can successfully unite in hundreds of French constituencies to support their strongest candidate and block Le Pen.

The National League needs to obtain at least 289 parliamentary seats to become a majority. According to polls, Le Pen is expected to secure 250-300 seats in the first round of elections, but this is before the tactical withdrawal next weekend to reshape voter intentions.

The leaders of the Left New People's Front (NPF) and Macron's centrist coalition both stated on Sunday evening that if other candidates are more likely to defeat the National Alliance in Sunday's second round of elections, they will withdraw their candidates in the corresponding regions.

If the left-wing candidate comes from the far left party, the indomitable French Party (LFI) led by Jean Luc Melenchon, it is still unclear whether such an agreement always applies. But according to a source attending a closed door meeting, Macron told ministers on Monday that it is urgent to prevent the National League from obtaining a majority of votes. The person stated that this closed door meeting is to confirm that the agreement can be applied to LFI candidates based on specific circumstances

The source also stated that Macron's slogan when concluding his speech at the Elysee Palace conference was: "Attack!"

Figure: Vote percentage of each party after the first round of voting in the French parliamentary elections

According to Ipsos, a polling agency, after the first round of voting, there are still about 300 out of 577 seats in the French National Assembly that can be contested by three parties. The French newspaper Le Monde reported that approximately 160 candidates ranked third in the seats have withdrawn.

Although the so-called anti far right "Republican Front" has played a widespread role in the past, analysts doubt whether French voters are still prepared to follow the instructions of political leaders for a second round of voting.

On June 30th, in Lajaffahar, Lebanon, Israeli airstrikes caused thick smoke to billow.

On the night of June 30th, the Israeli military issued a statement stating that they had attacked targets belonging to Hezbollah in southern Lebanon in the past few hours, including observation posts and a firing device. The Israeli army also fired artillery into multiple areas in southern Lebanon to eliminate the threat. According to Al Jazeera TV on the 30th, Hezbollah in Lebanon stated that three of its members were killed by the Israeli army on the same day.

On June 29th, Reuters reported that Israeli Foreign Minister Israel Katz stated that Iran's message of a "devastating war" should be destroyed.

According to Xinhua News Agency, the Iranian diplomatic mission to the United Nations warned on the 28th that if Israel launches a "comprehensive military aggression" against Lebanon, it will face a "devastating war". The Israeli military stated on the same day that it does not seek to go to war with Hezbollah in Lebanon, but the Israeli military is prepared for this.

Since June this year, the tense situation on the border between Lebanon and Israel has further escalated. After an Israeli military airstrike killed a senior Hezbollah commander at the beginning of the month, Hezbollah launched hundreds of rockets and drones in retaliation, and Israel subsequently launched even more intense bombings. On the 18th, the Israeli military announced that it had approved plans to launch military operations in Lebanon.

technical analysis

At the daily level, gold prices rebounded after gaining support near the lower track of the Bollinger Bands. Currently, they have rebounded to near the middle track of the Bollinger Bands, and KDJ has formed a golden cross again. In the short term, it tends to be bullish and is expected to test resistance around 2368.74 on the upper track of the Bollinger Bands.

However, currently gold prices are still being suppressed by resistance around the 55 day moving average of 2339.21. If gold prices continue to be suppressed by this resistance and fall below the 5-day moving average of 2323.29, it will weaken the short-term bullish signal.

Pay attention to the breakthrough situation of the Bollinger Line track 2291.65-2368.72 in the central line trend.

Resistance: 2339.21; 2345.58; 2355.01; 2368.62;

Support: 2326.90; 2318.40; 2304.03; 2291.65;

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights