The results of the Japanese parliamentary elections may be the key to the Bank of Japan's next interest rate hike

Just a few days before the crucial US presidential election and the highly discussed November 7th Federal Reserve meeting, Japan will hold an election. This is a critical moment for Japan, especially the Bank of Japan (BOJ). The Bank of Japan has successfully raised interest rates after nearly 18 years and seems willing to continue tightening its monetary policy stance.

Why early elections?

Due to a series of scandals, former Prime Minister Fumio Kishida was forced to resign in August. Shigeru Ishiba won the internal election of the Liberal Democratic Party (LDP) and, after becoming the new Prime Minister, announced that the general election would be held one year early on October 27th, despite having a majority in the House of Representatives.

Although Japan's debt to GDP ratio has risen to over 250%, Shigeru Ishiba is not very fond of fiscal consolidation. He clearly favors an economic stimulus plan and announced a support plan to help rural areas cope with rising costs. It is interesting that Shigeru Ishiba talked about modifying Japan's current single, non progressive tax system. Compared to his predecessor, he appears more determined to implement reforms, but his strategy will ultimately be determined by election results and economic strength.

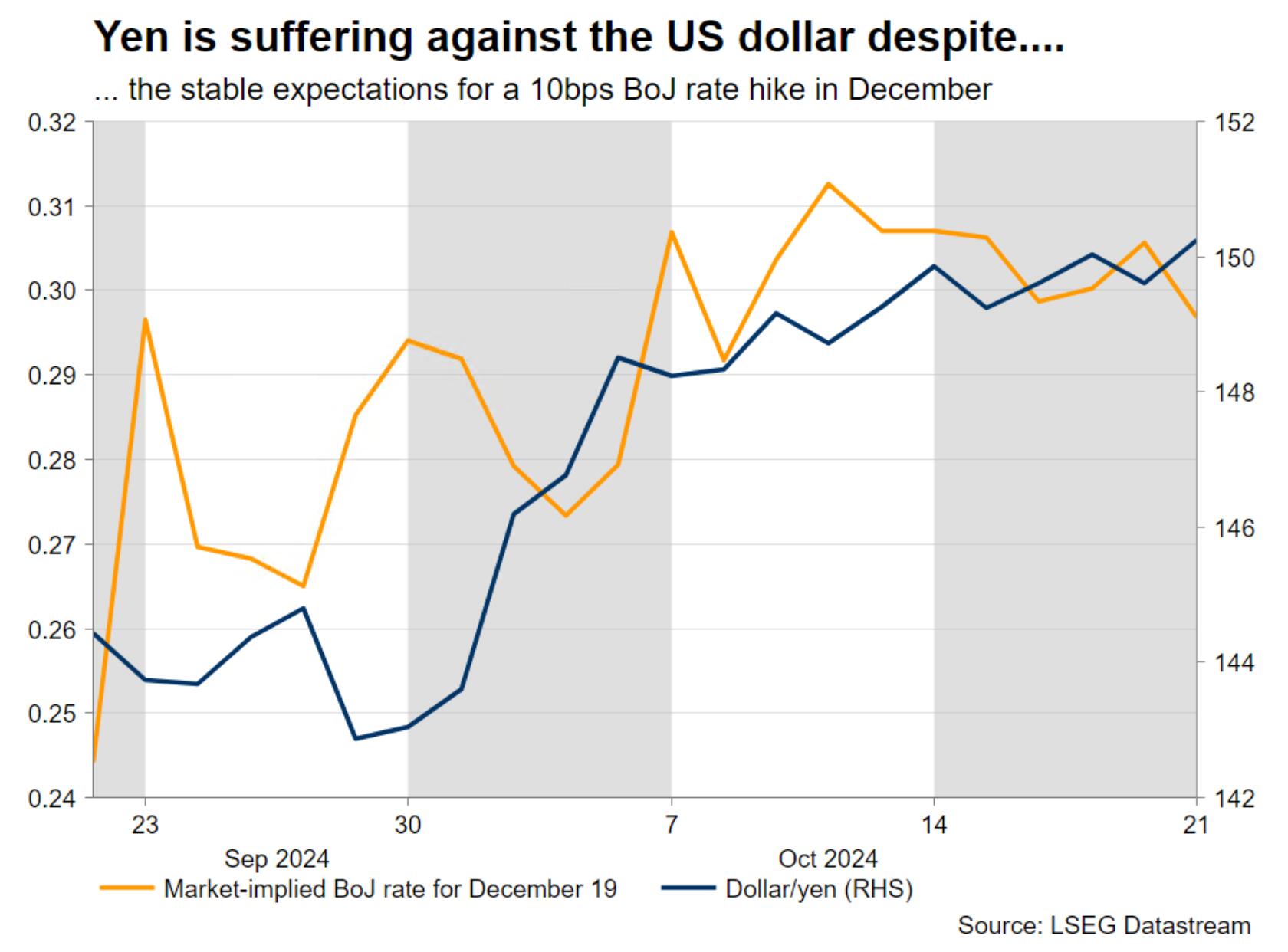

(Market expectation for Bank of Japan to raise interest rates by 10 basis points in December, yellow line: Market expectation for Bank of Japan interest rates in the near future, blue line: USD/JPY trend)

Shigeru Ishiba's views on the Bank of Japan

After the news of Shi Po's victory came out, the Japanese yen rose and the stock market fell, as he was seen as clearly more hawkish than his main competitor, Gao Shi Zaomiao. However, since taking office, during the pre election campaign, Shi Po and the newly appointed Minister of Economy have changed their tone.

Statements such as' We are not in an environment of further interest rate hikes' and 'The Bank of Japan should be cautious in raising interest rates because completely escaping deflation takes time' are major examples of the new leadership of the Liberal Democratic Party re selling its initial stance. The independence of the Bank of Japan is beyond doubt, but history has proven that in Japan, only a combination of fiscal and monetary policies can produce results.

The market still expects a 70% chance of a 10 basis point rate hike on December 19th, but this move clearly depends on the outcome on October 27th, as well as external factors such as the US presidential election, Federal Reserve decisions, and the situation in the Middle East. At least, the hawkish faction of the Bank of Japan may still be able to laugh, as there are reports that Japan's largest union, Rengo, plans to raise wages by more than 5% in next spring's wage negotiations.

According to the latest public opinion survey, we cannot guarantee a majority

After announcing the early elections, most opinion polls showed that the Liberal Democratic Party easily won the 233 seats needed for a majority and formed another government with its secondary partner, the Komeito party. However, recent polls suggest that the Liberal Democratic Party may perform poorly in the October 27th election and fail to gain an absolute majority.

Possible outcomes and impacts of elections

(1) The Liberal Democratic Party easily wins, and the likelihood of the Komeito Party forming a new government is 60%

Although nearly 40% of voters have not yet decided whether to run and the Liberal Democratic Party is plagued by scandals, the opposition party is still divided, so the Japanese public is likely to give the Liberal Democratic Party another chance.

If a strong victory is achieved, Shigeru Ishiba will be able to implement his bold fiscal expansion strategy, which may come at the cost of tightening monetary policy stance. The Bank of Japan will continue to maintain an open attitude towards further interest rate hikes, but the lack of coordination may weaken the current dynamics. The Japanese yen may face the greatest resistance removal due to the poor performance of the US dollar/yen and another rise through the 152 zone.

(2) The results of the Liberal Democratic Party and its allies were not satisfactory, but they still obtained the necessary majority -30%

According to the latest public opinion survey, this situation is becoming increasingly popular. In this situation, the new Prime Minister Ishiba may be forced to seek more coordination with the Bank of Japan. He ultimately succeeded in becoming the Prime Minister and will make every effort to continue in power.

It can be understood that Shigeru Ishiba will still pursue his fiscal expansion plan, despite doubts about the funding source, as tax increases will once again hit consumption. But the possibility of the Bank of Japan raising interest rates in December still exists, and the yen may reverse some of its recent poor performance.

(3) Not obtaining a majority of seats, subsequently seeking new alliance partners or re electing -10%

For the Bank of Japan, this could be the worst-case scenario as political turmoil could force Ueda and others to postpone any interest rate decisions unless the fog clears. Subsequently, negotiations for a grand coalition government will take place, with the possibility of reaching an agreement, especially in the rare case of a minority government in Japan.

In this situation, the Japanese yen will continue to bear pressure, and the USD/JPY exchange rate will continue to rise. If the upcoming US economic data remains strong, the current rally may really accelerate.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights