After hitting a new historical high, gold experienced a significant pullback, and the increase in US crude oil inventories exceeded expectations, leading to a decline in oil prices

The following is Thursday (October 24th) financial breakfast, including important fundamental news, precious metals/crude oil/foreign exchange/commodity/stock/bond markets, international news, domestic news, institutional views, today's important financial data, and major financial events. After hitting a new historical high on Wednesday, gold experienced a significant pullback as the Israeli military claimed to have killed the successor leader of Hezbollah. Hezbollah launched its first attack on Israel using new drones and precision missiles. It is reported that Russia will assist Iran without damaging its relationship with Israel, as tensions in the Middle East persist. Goldman Sachs said that if Trump is elected as the President of the United States and the Republican Party becomes the majority party in both houses of Congress, it could become a "nightmare" for the euro.

Overview of Major Global Market Trends

1. Precious metals

On Wednesday, spot gold experienced a pullback, briefly falling below the $2710 mark and ultimately closing down 1.21% at $2715.43 per ounce. Spot silver closed down 3.31% at $33.69 per ounce. Analysts point out that this price drop may indicate that investors have made some profit taking at high levels.

However, there are still analysts who are bullish on silver. Analyst Christian Borjon Valencia said that the first resistance level for silver is at $35, and there is a possibility that it may rise towards a historical high.

2. Crude oil

International crude oil prices fell on Wednesday as the increase in US crude oil inventories still exceeded expectations. WTI crude oil ultimately closed down 0.52% at $70.89 per barrel; Brent crude oil closed down 0.41% at $74.90 per barrel.

3. Foreign exchange

Due to economic data leading to a decrease in expectations for the magnitude and speed of the Federal Reserve's interest rate cuts, the US dollar index continued its upward trend on Wednesday, ultimately closing up 0.33% at 104.41.

On Wednesday, the euro continued to decline against the US dollar, dropping to a low of 1.0760 at one point before closing down 0.13% at 1.0781.

Goldman Sachs predicts that if Trump is elected as the President of the United States next month and the Republican Party becomes the majority party in both houses of Congress, it may become a "nightmare" for the euro, as he may impose high tariffs and implement large-scale tax cuts in the United States after taking office. Currently, Goldman Sachs' benchmark forecast is that by the end of this year, the euro against the US dollar will rebound on its current basis, but this depends on the election results on November 5th, and the possibility of depreciation by the end of the year cannot be ruled out.

On Wednesday, the USD/CAD rose to 1.3862 at one point, and finally closed up 0.14% at 1.3835. The Bank of Canada announced a 50 basis point reduction in its benchmark interest rate, from 4.25% to 3.75%, which is in line with market expectations and marks the fourth consecutive time the central bank has implemented a rate cut.

Stephen Brown, a macro analyst at Capital Economics, stated on October 23 that given the current weak economic situation, the Bank of Canada is likely to continue cutting interest rates by 50 basis points at its December policy meeting.

4. Products

On Wednesday, LME copper closed down 1.21% at $9503 per ton; LME aluminum closed up 0.74% at $2656.50 per ton; LME zinc closed up 0.11% at $3146 per ton.

5. Stock market

On Wednesday, the Shanghai Composite Index rose 0.52%, the Shenzhen Component Index rose 0.16%, and the ChiNext Index fell 0.53%. The concept of national defense and military industry has surged, the concept of wind power is active, and the concept of photovoltaics is fluctuating and rising.

On Wednesday, major European stock indexes closed down across the board, with the German DAX30 index falling 0.23%; The FTSE 100 index in the UK closed down 0.58%; The European Stoxx 50 index closed down 0.34%.

On Wednesday, the US stock market closed down 0.96%, the S&P 500 index fell 0.92%, and the Nasdaq fell 1.6%.

6. Bond market

On Wednesday, US Treasury yields surged, with the benchmark 10-year Treasury yield closing at 4.2430%; The two-year US Treasury yield, which is more sensitive to monetary policy, closed at 4.09

international news

① The latest economic report (Brown Book) released by the Federal Reserve System of the United States points out that economic activity in most parts of the country has remained stable since early September, but a few areas have experienced some degree of economic growth

② Market news: Russia will help Iran without damaging its relationship with Israel

③ Russian President Putin and President Erdogan of Türkiye met to discuss energy cooperation and regional security

④ Latest poll: Democratic Vice President Harris leads Trump by a narrow margin

⑤ Hezbollah in Lebanon: First use of new drones and precision missiles to attack Israel

⑥ ECB President Lagarde: The European Central Bank does not rule out the possibility of taking larger interest rate cuts

⑦ Saudi Aramco: In the coming decades, the southern hemisphere will drive demand for crude oil

⑧ Kellie Wood, Deputy Head of Fixed Income at Schroeder Sydney, pointed out that the Reserve Bank of Australia's slow pace of raising interest rates after the outbreak of the pandemic and improper timing may also result in errors in the current timing of interest rate cuts

⑨ The South Korean Minister of Finance pointed out that the country is currently unable to maintain the stability of its currency by raising interest rates

⑩ Insiders have revealed that decision-makers at the European Central Bank have begun exploring whether it is necessary to lower interest rates below neutral levels during the current loose monetary policy cycle.

Domestic news

① Good news from China's aerospace industry: Remote Sensing 43-03 satellite successfully entered orbit

② Shanghai Financial Regulatory Bureau: Promoting Innovation in the Shipping Insurance Industry and Promoting the Development of the Real Economy

③ The Futures Supervision Department of the China Securities Regulatory Commission: Promoting the use of futures markets by industries to avoid risks and helping to demonstrate the functions of shipping index futures

④ The Ministry of Industry and Information Technology stated that it will take multiple measures to expand automobile consumption and optimize policies for automobile production access management. Cultivate and strengthen new industries and tracks such as low altitude economy, commercial aerospace, and biomanufacturing.

Summary of institutional viewpoints

① Goldman Sachs expects oil prices to remain around $76 per barrel by 2025, with ample market supply

② Commonwealth Bank of Australia: The possibility of the Reserve Bank of Australia cutting interest rates within the year still exists

③ IMF warns that the global fight against inflation is' almost won ', but many risks are rising, such as intensified financial volatility, Middle East conflicts, and potential spikes in commodity prices

④ Ping An Securities Analysis: The pace of consolidation in the securities industry is accelerating, and attention is being paid to the opportunities brought by mergers and acquisitions

⑤ Blackstone CEO Susmin: US election results do not affect economic recession risk

⑥ Royal Bank of Canada: The largest natural gas supply 'wave' to date will reshape global markets

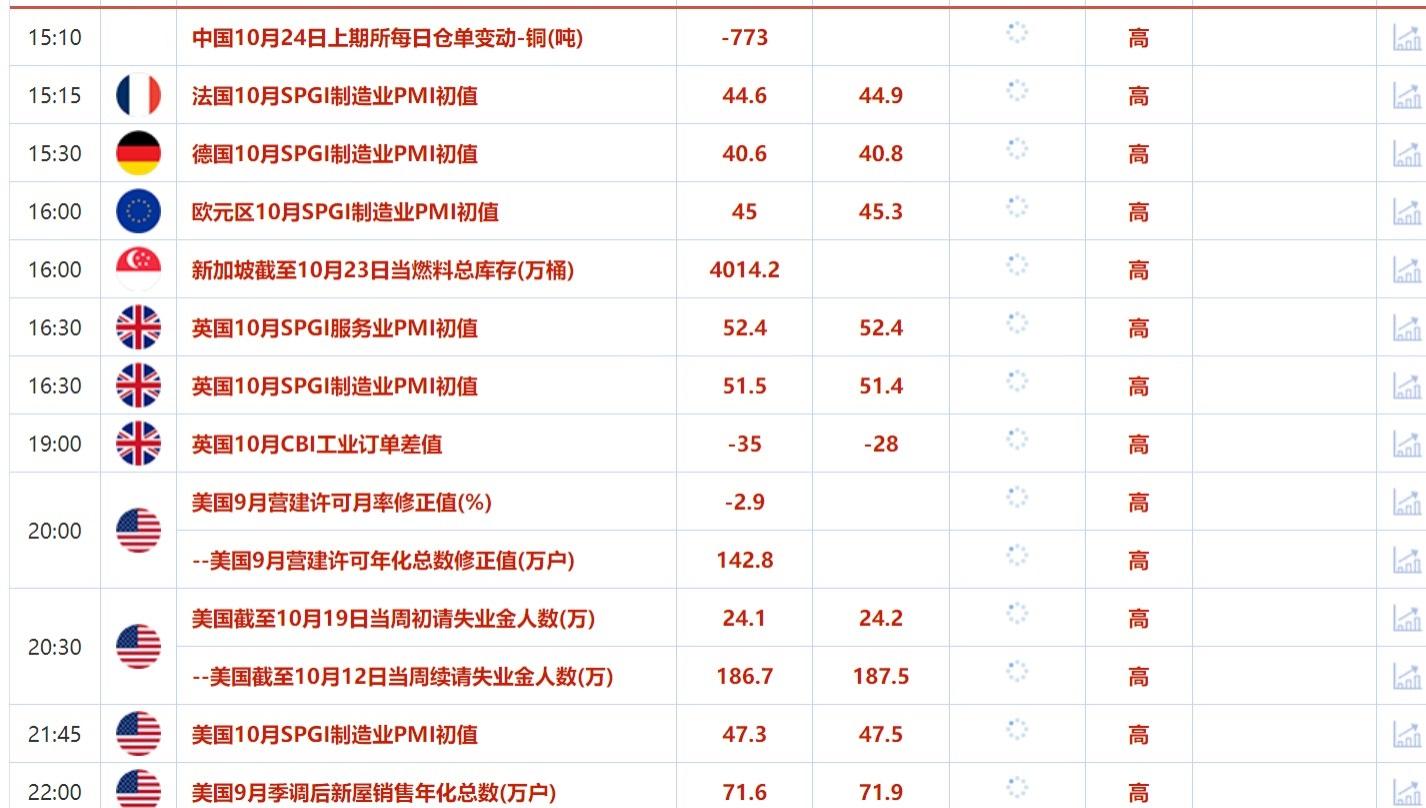

Today's key data and major events

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights