Behind the pullback in gold prices, two major 'bearish' factors are the main drivers

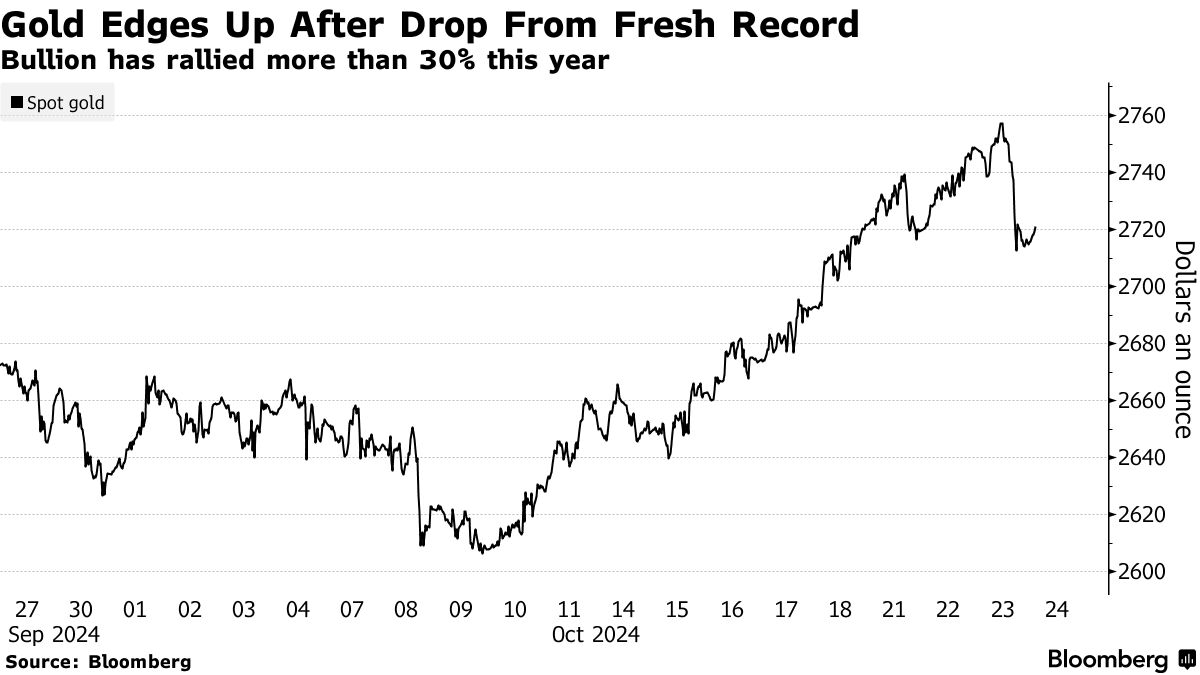

On Thursday morning (October 24th) in the Asian market, gold remained weak at $2721, with a violent pullback from Wednesday's European session high of $2758. Analysts pointed out that the rise in the yield of US treasury bond bonds put pressure on the gold price, and investors were selling at a near historical high, and gold was technically overbought, leading to the largest one-day decline in gold prices since 11 weeks and a slight rebound.

Gold prices fell from historical highs on Wednesday, closing down 1.2% and currently trading at nearly $2720 per ounce.

Technical indicators suggest that the recent uptrend may be too strong, with the 14 day relative strength index indicating that gold is overbought, leading to a pullback in gold prices.

As the market bet that the Federal Reserve would adopt prudent monetary easing policy, the US bond market continued its decline and the market was further bearish.

The rise in US bond yields and borrowing costs often puts pressure on gold as it does not pay interest.

(Source: Bloomberg)

Earlier on Wednesday, gold prices hit a new high of $2758.49 per ounce, as the US presidential election was evenly contested and geopolitical risks in the Middle East stimulated safe haven demand.

The market is also concerned that there may be competition in the November US presidential election, and it may take some time to determine the winner.

Bloomberg reported that the US presidential election in November is entering its final weeks, with intense campaigning between former President Donald Trump and Vice President Kamala Harris.

A Bloomberg News/Corning Consult poll shows that in seven swing states, the support rates of the two candidates are statistically evenly matched.

In all seven states, the two candidates are evenly matched, with both candidates having a support rate of 49% among potential voters. The overall statistical error margin of this public opinion survey is 1 percentage point.

The slight advantage of these battleground states highlights how the final advertisements, rallies, and door-to-door campaigns will determine who can take over the White House.

Investors are also concerned that the conflict between Israel and Iran may escalate into a broader war.

Despite the short-term pullback, the price of gold has risen by over 30% this year, hitting new highs repeatedly.

As the Federal Reserve shifts towards interest rate cuts, the rise in gold prices has intensified over the past few months.

Fund managers have also contributed to the rise in gold prices, with hedge funds increasing their net long positions in gold in recent trading days and investors increasing their holdings in exchange traded funds (ETFs).

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights