In the US election, there may be a red sweep, and gold and silver continue to rise as they can hedge against its impact

Ole Hansen, head of commodity strategy at Saxo Bank, stated that gold and silver have been rising in the face of unfavorable factors brought about by rising US bond yields and a strengthening US dollar. The two are being used to hedge against a possible "red sweep" in the upcoming US election.

In a new analysis report published on Tuesday, he pointed out that both gold and recent silver have experienced significant breakthroughs, with the main driving factor appearing to be geopolitics.

He wrote, 'In the past week, gold prices have soared to new highs, rising nearly 40% year-on-year.' Last Friday, silver prices also broke through significantly, rising 50% year-on-year.

Hansen said that although the recent uptrend has exceeded expectations, there are several factors that continue to support its upward trend.

He said, "The key driving factors for this bullish phase include concerns about fiscal instability, safe haven demand, geopolitical tensions, de dollarization driving strong central bank demand, and uncertainty surrounding the US presidential election. In addition, interest rate cuts by the Federal Reserve and other central banks are lowering the cost of holding interest free assets such as gold and silver, and this environment has reignited interest in gold ETFs, especially among Western asset management companies that have been net sellers until May 2024

Despite the rise in US bond yields and the strengthening of the US dollar, gold and silver prices continue to climb. He pointed out, "In the past week, the 10-year US Treasury yield has risen by 17 basis points to 4.20%, while the Bloomberg dollar index has risen by 0.6%. At the same time, the timing, speed, and depth of future interest rate cuts have slowed down, and Fed officials have hinted at taking a more cautious approach. However, gold and silver remain resilient, ignoring these typical negative market signals

He wrote, "In addition to ongoing concerns about further deterioration of the situation in the Middle East, our conclusion is that this advantage is increasingly seen as a hedge against a potential 'red sweep' (a political party controlling both the White House and Congress). This situation has raised concerns about excessive government spending, pushing up the debt to GDP ratio, and exacerbating inflation concerns

Hansen said that although expectations of interest rate cuts and relaxed financial conditions are weakening, investors are now turning to precious metals as protection. He also shared four charts that highlighted this' abnormal divergence '.

He pointed out, "From the SOFR futures market, it can be seen that the expectation of interest rate cuts has seen hope for another 50 basis points cut. In the next two meetings, a total of 50 basis points were cut, which has been halved so far

The second unusual sign is the yield of one-year US Treasury bonds.

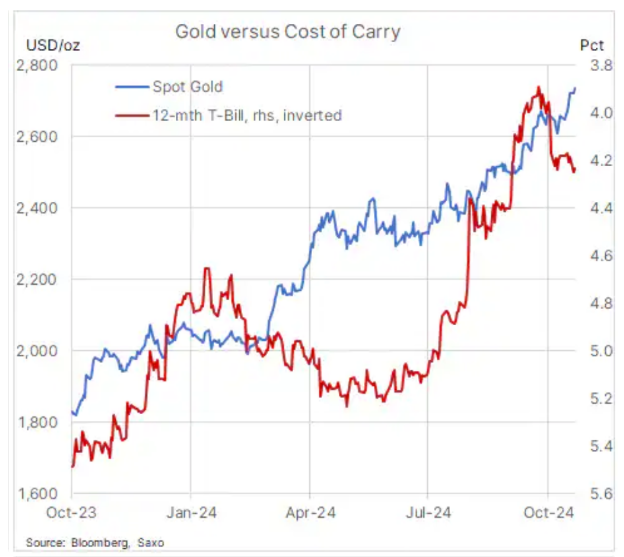

Figure: Gold and holding costs (blue line refers to spot gold, red line refers to 12-month US Treasury yields)

Hansen said, "The attractiveness of gold as an alternative non yield investment often depends on the current opportunity cost, which is another source of income for investors through short-term investments in safe government bonds. Last month, lower expectations of interest rate cuts pushed up the return on 12-month US Treasury bonds

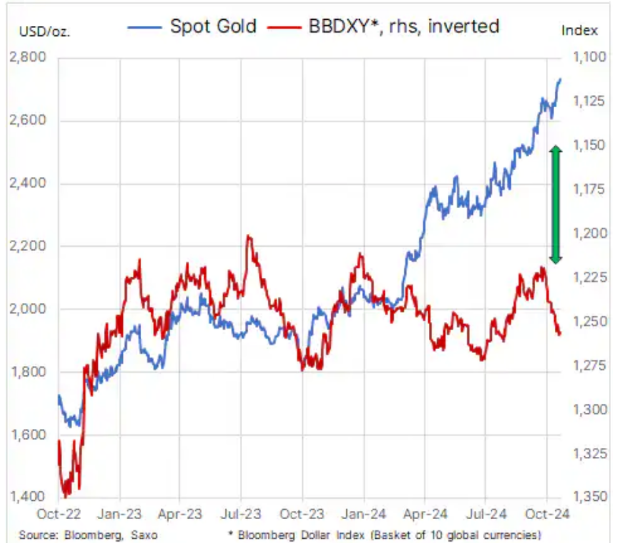

Even if the US dollar rises, the gold price also rises, which is the third key divergence he emphasized.

Image: Spot Gold (Blue Line) and Bloomberg USD Index (Red Line)

He pointed out, "Despite the recent strengthening of the US dollar, gold prices are still rising. The US dollar is supported by Middle Eastern safe haven funds and strong US economic data, driving capital inflows into US risk assets

Finally, he said, "Over the past month, the one-year mismatch between gold and 10-year US Treasury yields has further widened

Figure: Real yields of spot gold (blue line) and 10-year US Treasury bonds (red line)

Hansen stated that US bond yields are showing a "resurgence in strength, as the market is concerned that the November election results may trigger concerns about loose fiscal policy, which could deepen the deficit and reignite inflation.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights