Trump's inauguration may push investors towards gold, as gold and silver will benefit from a trade war

Heraeus precious metal analysts say that the prospect of Trump's victory in November may drive global investors to turn to gold, and both gold and silver prices will benefit from tariffs and trade disputes.

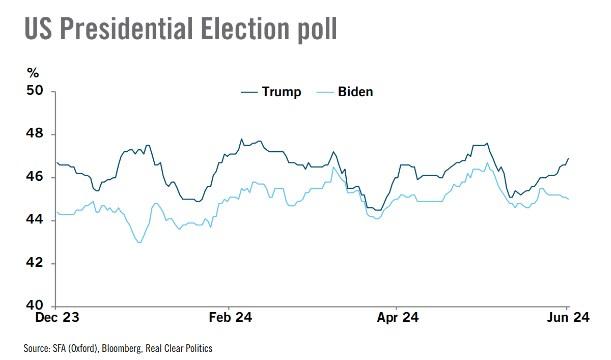

Heraeus stated in his latest report on precious metals that the economic policies of the second Trump administration may push global investors towards gold. Analysts wrote, "The upcoming November 5th presidential election will lead the United States on two completely different paths, depending on the outcome." "Even more unpredictable, former president and current Republican candidate Trump may introduce some economic policies that could lead to significant market shocks, geopolitical risks, and rising inflation. Trump currently maintains a 46.9% advantage over Biden in polls compared to 45.0%."

Image: US presidential election opinion poll (deep blue for Trump, light blue for Biden)

Heraeus pointed out that if a trade war breaks out again, it may exacerbate tensions between the United States and Asian powers, and may harm the US and global economy.

They said, "Although the Biden administration has retained many tariffs imposed by Trump on Asian countries and only raised tariffs on a small portion of the country's clean technology imports, the second Trump administration may escalate the trade war as never before." Trump proposed two important trade policy agendas: a comprehensive tariff of 10% on all imported goods from all countries, and a tariff of 60% or higher on all imported goods from Asian countries. Although the legal feasibility of these measures remains questionable, Trump's first administration demonstrated that by citing loopholes in old regulations (the 1974 Trade Act), there is a possibility of launching a trade war against Asian countries. ". A paper by the Peterson Institute found that these proposed tariffs could lead to an economic loss of 1.8% of the US GDP and significantly increase inflation. This assessment did not take into account the retaliatory tariffs that Asian powers and other countries are almost certain to impose

Analysts point out that the trade war from 2018 to 2020 coincided with an increase in gold prices. They said, "During this period, gold prices skyrocketed due to prolonged negotiations, tariffs, and geopolitical escalation, prompting investors to seek gold as a safe haven asset, despite the interest rate hike environment before mid-2019." "The appreciation of gold is closely related to tariff hikes, which are a meaningful indicator of the tense relationship between the two countries." Global ETF holdings increased from 71 million ounces at the end of 2017 to 86 million ounces at the end of 2019, while US ETF holdings increased from 37 million ounces to 44 million ounces. ".

Heraeus is concerned that Trump's public criticism of Fed Chairman Powell's interest rate hike policy during his first term may undermine the Fed's independence.

They said, "The unofficial proposals of the Trump campaign team include taking measures to weaken the independence of the Federal Reserve and potentially prematurely dismiss Powell." "Trump may replace Powell with a dovish candidate after his term ends in 2026. In addition, Trump may appoint several members of the Federal Open Market Committee (FOMC) who support loose monetary policy."

They pointed out, "A more dovish FOMC will accelerate interest rate cuts, relax inflation controls, weaken the US dollar, and increase investor demand for gold. Any move that puts administrative power above the Federal Reserve could shake market confidence in US monetary policy and further push up gold prices."

As for the precious metal market in Asia, analysts point out that India's demand for gold remains strong. They said, "India's gold imports remained strong in May, reaching around 44.5 tons, indicating a higher than average level of gold purchases." "Although the import volume in May was slightly lower than last year's 58.5 tons (which was a particularly high year for gold consumption in India), high gold imports near the middle of the year usually translate into strong jewelry production for the third quarter holiday."

Analysts pointed out that India's jewelry demand in the first quarter of 2024 was 95.5 tons, with an annual growth rate of 4%. They wrote, "This is only half of the 184.2 ton consumption of major Asian countries during the same period (a year-on-year decrease of 6%)." "India's jewelry consumption accounts for 20% of the world's total, making it the second largest gold consumption market. The resilience demand from the beginning of the year partially offset the decline in jewelry demand from major Asian countries."

They also pointed out that the Bank of India had a net inflow of 24.1 tons of gold in 2024, which exceeded last year's total. They said, "The Bank of India is the third largest gold buyer among its peers this year."

Spot Gold Daily Chart

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights