On Monday morning (November 4th) in the Asian market, spot gold fluctuated narrowly, staying above the 2730 level and currently trading around $2739.28 per ounce. Gold prices fell 0.3% last Friday to close near $2735, pressured by the strengthening of the US dollar and the higher yield of treasury bond bonds, and some long profits were taken after the gold price hit a record high of $2789.95. However, the weak employment growth data of the world's largest economy prompted analysts to increase their bets on the Federal Reserve's interest rate cut, thus limiting some of the decline.

Last Friday, the US dollar index was 0.41%, but at the beginning of Monday trading, the US dollar index gave up most of its gains and is currently down 0.38%, trading around 103.93, providing support for gold prices.

Affected by hurricanes and strikes by aerospace factory workers, non farm employment increased by 12000 jobs last month, the smallest increase since December 2020.

The labor market is cooling down, with a downward revision of 112000 job growth in August and September. Although the unemployment rate remained stable at 4.1% in October, this was due to more people leaving the labor market. Economists predict that Federal Reserve officials will ignore this report and cut interest rates again during this week's meeting.

In late September, Hurricane Helen ravaged the southeastern United States, and a week later, Hurricane Milton hit Florida.

The response rate of the October institutional survey dropped to 47.4%, the lowest since January 1991, far below the average response rate of 69.2% for the same period in the past five years.

A household survey used to calculate the unemployment rate found that 512000 people reported being unable to work in October, setting a record high for the month. About 1.4 million people who usually work full-time said that due to weather conditions, they can only work part-time. This is also a historic high in October, compared to only 129000 people in the same period last year.

Almost all of the new job opportunities added in October came from healthcare and government departments. The healthcare industry saw an increase of 52000 job opportunities. Driven by recruitment by state and local governments, government employment opportunities increased by 40000.

The manufacturing industry saw a decrease of 46000 jobs, which also reflects a reduction of 6000 jobs in the automotive industry, possibly due to layoffs at Chrysler's parent company Stellantis.

The proportion of industries reporting job growth decreased from 59.8% in September to 55.6%.

After a 0.3% increase in September, the average hourly wage rose by 0.4% in October. The increase in average hourly wage may be due to the withdrawal of hourly wage workers from salary calculation.

Salary increased by 4.0% year-on-year in October and 3.9% in September. Strong wage growth provides support for consumer spending and the overall economy.

Bob Haberkorn, Senior Market Strategist at RJO Futures, said that with the upcoming US election and rumors of Iran retaliating against Israel, there are too many risks on the table, and a poor employment report should lead to a rate cut by the Federal Reserve.

Economists believe that the likelihood of the Federal Reserve cutting interest rates by 25 basis points this week is 98.9%, compared to 91% before the release of employment data.

Sam Williamson, a senior economist at First American, said, "The labor market continues to gradually cool down, providing evidence for the Federal Reserve to further cut interest rates at next week's and December meetings

Although the US dollar index rose 0.4% last Friday, the US dollar gave up its gains at the beginning of the Asian session on Monday, as investors prepared for a potentially crucial week for the global economy; This week, the United States will hold presidential elections, and the Federal Reserve may cut interest rates again, which will have a significant impact on bond yields.

The support rates of Democratic candidate Harris and Republican candidate Trump in the polls are evenly matched, and the outcome may not be announced until a few days after the voting ends.

Analysts believe that Trump's policies on immigration, tax cuts, and tariffs will put upward pressure on inflation, bond yields, and the US dollar, while Harris is seen as a candidate with policy coherence.

Traders suggest that the initial decline of the US dollar may be related to a highly regarded poll. The poll showed Harris unexpectedly leading Iowa by 3 percentage points in support, largely due to her popularity among female voters.

People generally believe that Trump's victory will benefit the US dollar, although many believe that this result has already been digested, "said Chris Weston, an analyst at brokerage Pepperstone. Trump's presidency and complete control of Congress may have the greatest impact, as people will expect a significant sell-off of US bonds, leading to a surge in the US dollar

He stated that Harris' victory and separate control of Congress by both parties are expected to lead to a rapid reversal of the 'Trump deal'. The US dollar, gold, and US stocks are expected to decline

The uncertainty of the US election results is one of the reasons why the market believes that the Federal Reserve will choose a regular 25 basis point rate cut on Thursday instead of another 50 basis point cut.

We expect to cut interest rates four times in a row in the first half of 2024, with a final rate of 3.25% -3.5%, but there is more uncertainty about the pace and final rate next year, "said Jan Hatzius, an economist at Goldman Sachs. Our baseline forecast and probability weighted forecast are now more dovish than market pricing

Super Week is coming

This week's US data includes factory orders, trade, ISM Non Manufacturing Purchasing Managers' Index and S&P Global Purchasing Managers' Index (PMI) final values, weekly unemployment claims, initial University of Michigan Consumer Confidence Index for November, and inflation expectations.

In China, the meeting of the Standing Committee of the National People's Congress from November 4 to 8 will be a key event, and the market is waiting for the details of the fiscal stimulus plan to be announced at the end of the meeting. Key data includes Caixin's October Service PMI, Thursday's trade data, and Saturday's inflation data.

The UK budget slightly suppressed the expectation of the Bank of England cutting interest rates by 25 basis points to 4.75% on Thursday. The Bank of England's monetary policy report and summary will drive market expectations. There are no important data releases from the UK this week.

The market generally expects the Reserve Bank of Australia to maintain its benchmark interest rate at 4.35% for the eighth consecutive meeting on Tuesday. All 30 economists surveyed expect interest rates to remain unchanged, as strong economic activity and sustained core inflation rates suggest a cautious approach. However, the Reserve Bank of Australia may slightly soften hawkish rhetoric, and most economists expect the Reserve Bank of Australia to cut interest rates for the first time in February 2025.

There is a large amount of data in the Eurozone, starting with factory orders from the EU and Germany, followed by the final PMI values for October, Eurozone retail sales, and German industrial production.

Japan is on holiday on Monday, and only the final PMI values and the minutes of the Bank of Japan's September meeting will be released this week. The latter will be worth noting, but its importance will be replaced by the policy decision of the Bank of Japan on October 31st.

Canada will release the minutes of the Bank of Canada's policy meeting on October 23, which will lower interest rates by 50 basis points to 3.75%. The Ivey PMI and employment data for October are the main data for this week.

New Zealand will release its third quarter employment data and central bank financial stability report.

More than 77 million Americans have voted in the countdown to the US general election

On Sunday, Democrat Harris delivered her final campaign speech at a historic black church in the battleground state of Michigan, while her Republican opponent Trump talked about violence at a rally in Pennsylvania.

Public opinion polls show that the competition between the two is fierce, with Vice President Harris, 60, gaining strong support among female voters, while former President Trump, 78, is strongly supported among Hispanic voters, especially male voters.

A Reuters/Ipsos poll shows that voters have an overall negative opinion of both candidates, but so far this has not affected their voting. According to data from the University of Florida's Election Lab, more than 77 million Americans had voted before Tuesday's election day, nearly half of the 160 million votes cast in 2020. The voter turnout in the 2020 US election was the highest in over a century.

The control of the US Congress will also be contested on Tuesday, with the outside world expecting the Republican Party to seize a majority in the Senate, while the Democratic Party is seen as having a 50% chance of reversing the Republican Party's slim majority in the House of Representatives.

In just two days, we will have the ability to determine the fate of future generations of our country, "Harris told parishioners at the Greater Emmanuel Institutional Church of God in Christ in Detroit. We must take action. Simply praying is not enough, just talking is not enough

At the first of the three rallies held on Sunday, Trump often gave up his teleprompter and made impromptu speeches, condemning polls for promoting Harris' activities. He referred to the Democratic Party as the 'demonic party', mocked Democratic President Biden, and complained about the price of Apple.

On Sunday, Trump complained to supporters during his speech that there were gaps in the bulletproof glass around him and muttered to himself that the assassin had to shoot through the news media to reach him.

To assassinate me, someone must shoot through fake news, and I don't mind that. "He has long criticized the media and attempted to incite public dissatisfaction with the media.

Trump had falsely claimed that his 2020 election defeat was due to fraud, which led to his supporters storming the US Congress on January 6, 2021. Towards the end of his speech in Pennsylvania, Trump muttered to himself that he would rather not have surrendered his power.

Whether former Republican President Trump or Democratic Vice President Harris wins the election, the fiscal trajectory of the United States is expected to deteriorate.

Regardless of which candidate is elected, deficit spending will increase, "said Tom di Galoma, head of fixed income trading at Curvature Securities.

Polls show fierce competition, but market betting websites believe that Trump has a higher chance of winning the US presidential election.

Israel bombs Gaza and Lebanon, ceasefire hopes fade away

The prospect of a ceasefire between Israel and its enemies Hamas and Hezbollah was shelved last Friday. According to Gaza medical personnel, Israeli airstrikes have caused at least 68 deaths in the Gaza Strip, and Israel has also bombed the southern suburbs of Beirut.

The Israeli military claims that they killed senior Hamas official Izz al Din Kassab in an airstrike in the southern Gaza town of Khan Younis, and that he was one of the last surviving senior members of Hamas responsible for coordinating with other organizations in Gaza.

The US envoy has been working hard to achieve a ceasefire between the two sides before the US presidential election on Tuesday.

But according to Hamas Al Aqsa TV station's report last Friday, Hamas does not support a temporary ceasefire. The ceasefire proposal failed to meet Hamas' condition that any agreement must end the year long Gaza war and include the withdrawal of Israeli troops from this devastated Palestinian enclave.

Earlier, Israeli Prime Minister Netanyahu stated that his top priority is to ensure security "regardless of any pressure or restrictions".

Netanyahu's office said he conveyed this message to US envoys Amos Hochstein and Brett McGurk in Israel on Thursday. Meanwhile, Israel continued its military attacks on Hamas in Gaza and Hezbollah in Lebanon last Friday.

Gaza healthcare workers say that approximately 68 people have died and dozens have been injured in Israel's attacks on Deir Al Balah city, Nusselat refugee camp, Al Zawayda town, and southern Gaza.

According to media reports, Israel carried out at least 10 bombings on the southern suburbs of Beirut last Friday morning. This is the first bombing of the area in nearly a week - it was once a densely populated area and a stronghold of Hezbollah.

The hostile actions have undermined hopes of reaching a ceasefire agreement before Tuesday's US presidential election.

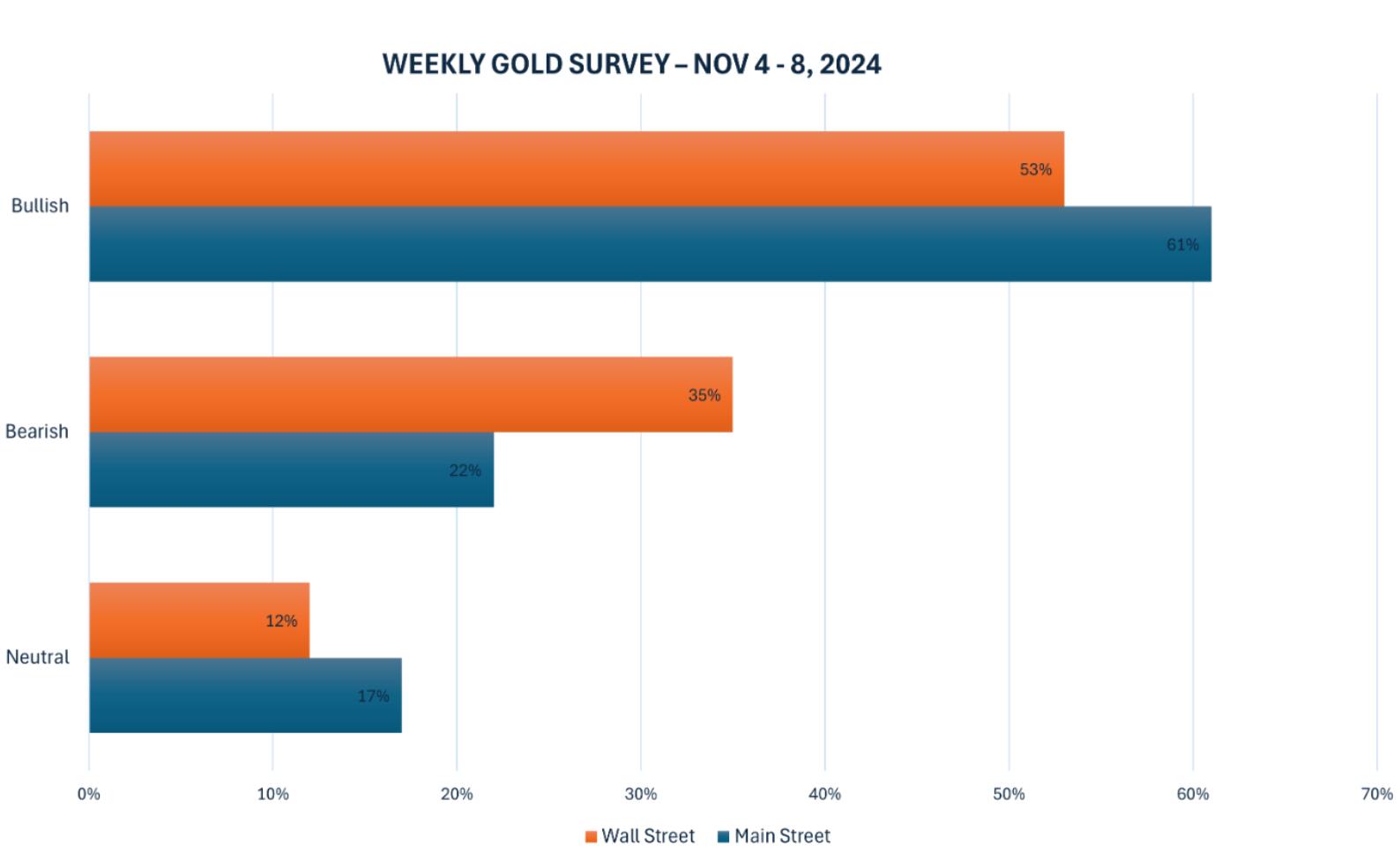

Most analysts and retail investors are still bullish on the future market, but the bullish ratio has narrowed

Last week, 17 analysts participated in the Kitco News gold survey, and it was found that many analysts were still bullish on the future, but the majority of bullish sentiment narrowed further last week. Nine experts (53%) expect gold prices to rise in the coming week, while six analysts (35%) expect

precious metal prices to fall. The remaining two analysts (12% of the total) are observing what the election and the

Federal Reserve will bring.

Meanwhile, Kitco's online poll conducted a total of 139 votes, and although many of the votes were cast before the Halloween sell-off, the majority of optimistic mainstream investors held a bullish bias. 85 retail traders (61%) expect gold prices to rise in the coming week, while another 31 retail traders (22%) expect gold prices to fall. The remaining 23 investors (17% of the total) believe that gold prices will decline in the coming week.