Reserve Bank of Australia interest rate decision: Potential inflation remains too high, keep cash rate unchanged

On Tuesday (November 5th), the Reserve Bank of Australia announced its latest interest rate decision. At today's meeting, the Reserve Bank of Australia decided to maintain its cash rate target at 4.35% and the interest rate paid on foreign exchange settlement balances at 4.25%. The Reserve Bank of Australia pointed out that overall inflation has decreased, but potential inflation remains too high. The cash interest rate will remain restrictive until it is confirmed that inflation can sustainably rise to the middle of the target range of 2% to 3%.

The policy statement of the Reserve Bank of Australia implies that there is no rush to change interest rates, and the Reserve Bank of Australia will be data-driven; However, the last paragraph of the statement still retains the phrase 'does not exclude any possibility'.

Potential inflation remains too high

The Reserve Bank of Australia's policy statement states that the recent decline in overall inflation rate is expected to be temporary, and with the lifting of cost of living relief measures, the overall inflation rate is expected to rise again. Basic inflation is a better indicator of inflation momentum, but its slowdown rate is even slower. The labor market remains tight, and the total demand for goods and services still exceeds supply. But the supply-demand gap is narrowing, and inflation is slowly declining.

Economic growth is expected to recover

The Reserve Bank of Australia stated, "The recovery in GDP growth is expected to be slightly later than the August forecast, but household spending is still expected to increase as tax cuts and inflation ease lead to an increase in real income. Growth in Australia's major trading partners is expected to be moderate, but we have slightly raised our forecast for 2025 after China announced its economic stimulus plan

The tight labor market situation is expected to gradually ease

The Reserve Bank of Australia pointed out that as overall labor demand and supply roughly return to balance, the unemployment rate is expected to rise in the coming year. During this period, wage growth is expected to continue to gradually slow down.

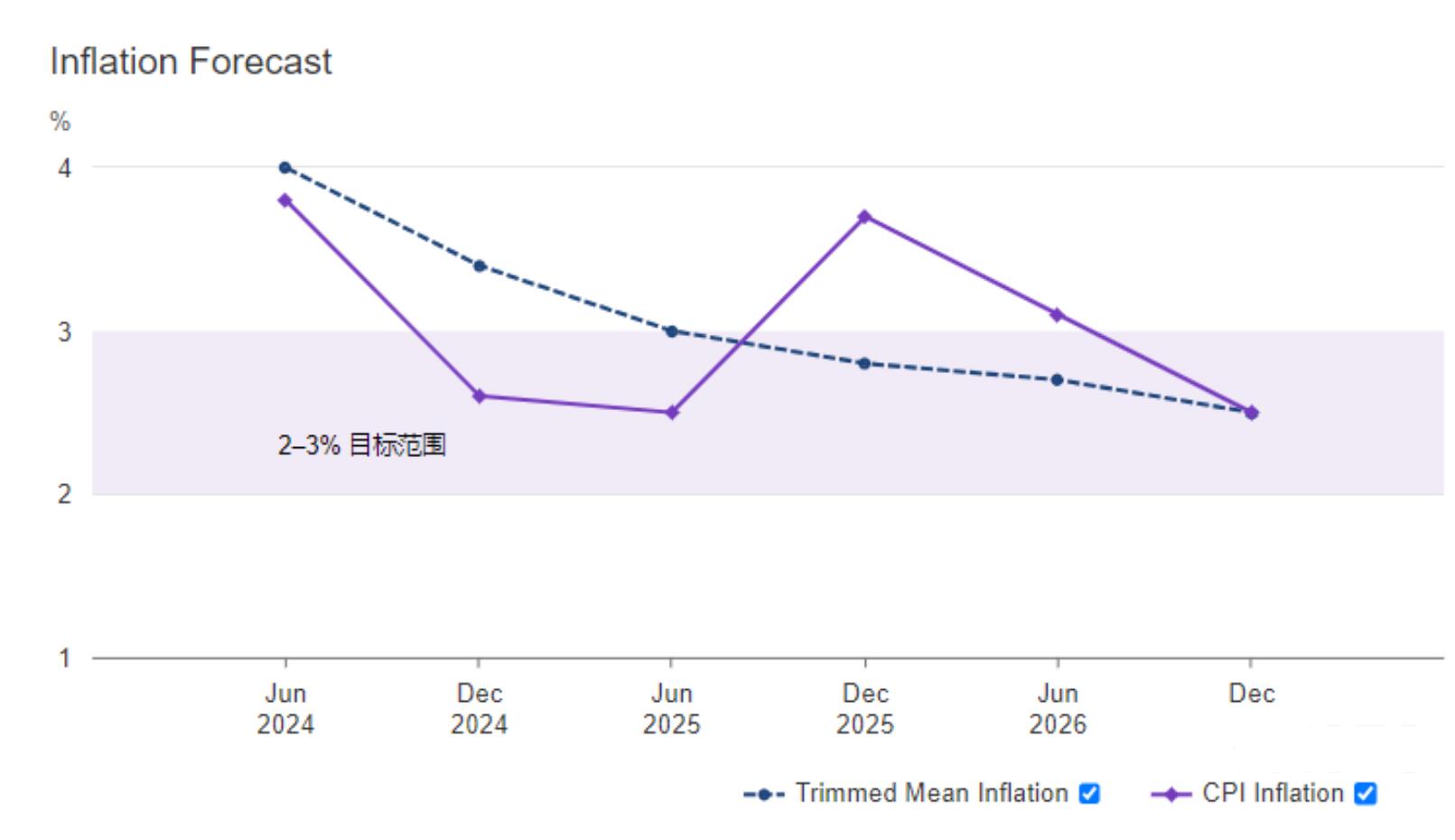

By the end of 2026, the inflation rate is expected to reach 2.5%

The Reserve Bank of Australia expects that potential inflation will slowly ease as economic demand and supply recover. Although it is expected that overall inflation will be within the target range in the first half of next year, part of the reason is the temporary easing of living costs.

The outlook is highly uncertain. On the one hand, if the labor market conditions are stronger than expected and productivity growth remains weak, this may slow down the progress of inflation reaching the target. On the other hand, the growth rate of household spending may not be as fast as expected, which could mean inflation returning to target levels faster. The increasing geopolitical risks and potential changes in foreign trade and fiscal policies have heightened this uncertainty.

The Reserve Bank of Australia stated that "today's decision will support the return of inflation to target and balance the two objectives of monetary policy - price stability and full employment

(Australian Federal Reserve Inflation Expectations)

Market reaction

The interest rate decision of the Reserve Bank of Australia is basically in line with market expectations, with little fluctuation in AUD/USD, which is still fluctuating around 0.6588. More investors are paying attention to the performance of the US presidential election and this week's Federal Reserve interest rate decision.

Technical aspect: The moving averages on the 10th and 21st have fallen, the Bollinger Bands on the 21st have relaxed, and the daily momentum indicators have fluctuated. The downward trend in October is still playing a role.

The initial support is at last week's low of 0.6537, followed by 0.6477, which is the 78.6% retracement level of the August September uptrend. The next resistance level is the 21 day moving average of 0.6652.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights