If Trump wins, the positive correlation between the Australian dollar and the stock market may no longer exist

Tommy von Broemsen, foreign exchange strategist at Handelsbanken, said that typically, stock market gains are closely related to the movement of the Australian dollar, but if Trump wins re-election, this long established connection may no longer exist.

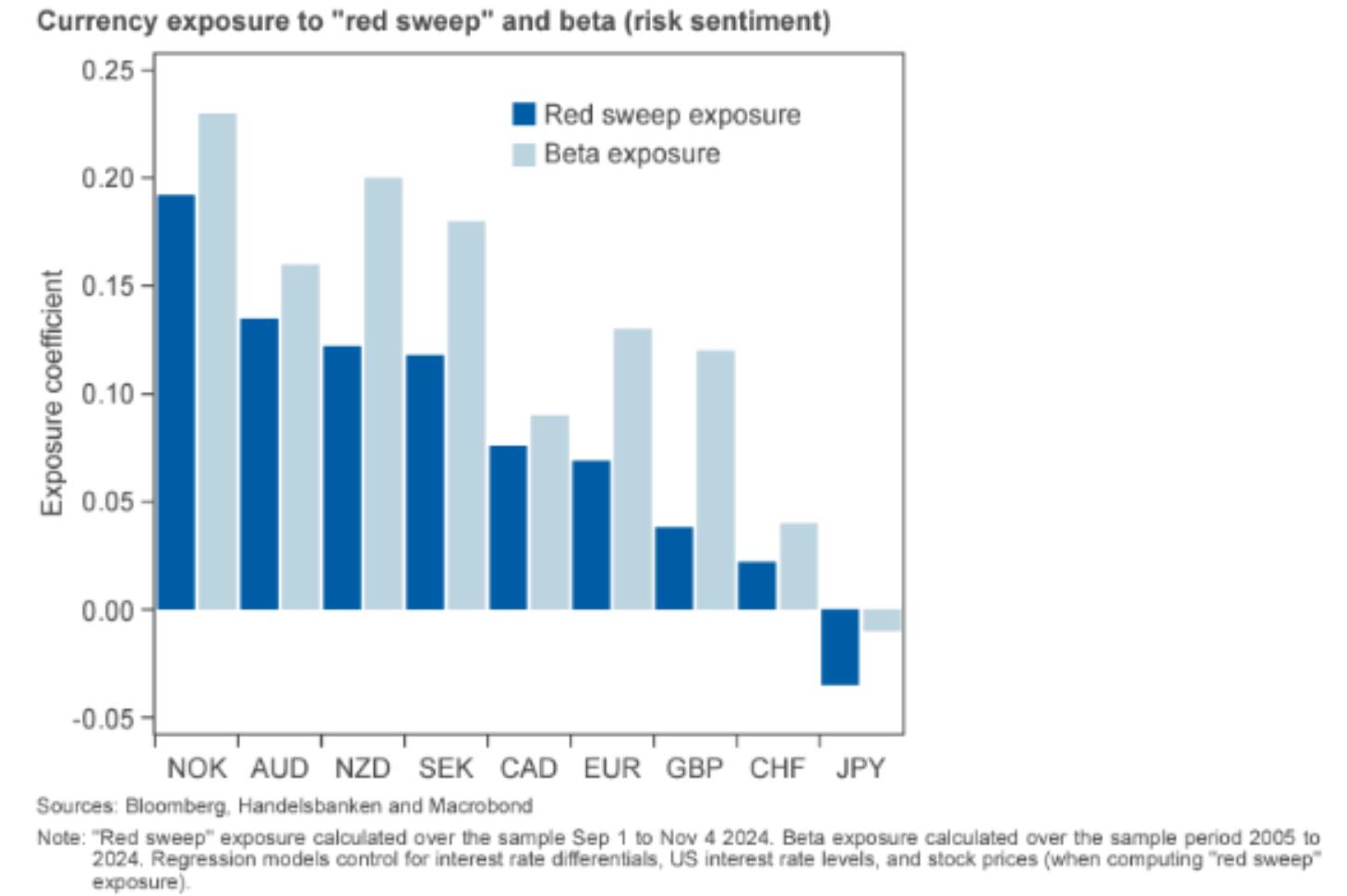

He said, "Typical 'high beta' currencies (Norwegian krone, Australian dollar, New Zealand dollar, Swedish krone) have a high risk exposure to the 'Trump trade'

The weakening of the Australian dollar is a manifestation of the 'Trump deal'

He explained that Trump's proposal to increase import tariffs could affect global trade flows and potentially harm economies heavily reliant on exports, such as Australia.

Increasing government spending and tax cuts may lead to an increase in US interest rates, making US assets more attractive to investors and driving capital away from other currencies such as the Australian dollar.

Figure: Blue refers to red sweeping exposure, light blue refers to Beta exposure (the vertical axis is the exposure coefficient, and the horizontal axis starts from the left and represents Norwegian krone, Australian dollar, New Zealand dollar, Swedish krone, Canadian dollar, euro, pound sterling, Swiss franc, and Japanese yen, respectively)

Von Broemsen stated that the unpredictability of US actions on the global stage may also trigger investors' risk aversion, leading them to seek safer assets and causing currency depreciation such as the Australian dollar.

His analysis emphasizes that 'Trump Trade' will not have an equal impact on all currencies. Currencies such as the Australian dollar, Norwegian krone, New Zealand dollar, and Swedish krone are classified as "high beta" currencies and are particularly susceptible to the influence of the "Trump trade", which may depreciate against the US dollar.

He compared the sensitivity of "high beta" currencies to "Trump trades" with their response to "risk sentiment". This indicates that when investors become more risk averse, these currencies tend to weaken, just as Trump's election as president and its associated uncertainties may occur.

Von Broemsen provided evidence for this trend, pointing out the exchange rate trend in October 2024, when the likelihood of a "red sweep" (Republican victory over the president and both houses of Congress) increased. During this period, the yield on 2-year US Treasury bonds significantly increased, the US dollar index appreciated, and the Australian dollar, New Zealand dollar, and Swedish krona depreciated against the US dollar.

Why does a strong stock market not boost the Australian dollar?

Von Broemsen's statistical model confirms that the Australian dollar has a high exposure to the 'Trump trade', and if Trump wins, the Australian dollar is likely to depreciate.

Although acknowledging Trump's victory may boost the stock market, which could provide indirect support for the Australian dollar due to its "beta" risk exposure, von Broemsen believes that the direct impact of the "Trump trade" may prevail, leading to a depreciation of the Australian dollar.

This conclusion is supported by two key factors:

His model has taken into account the "beta" risk exposure, which means that the estimated impact of the "Trump trade" exceeds the impact of stock market volatility.

The potential stock market rally may stem from specific expectations, such as a reduction in corporate taxes, rather than a general improvement in risk sentiment, which weakens the link with the appreciation of the Australian dollar.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights