Dutch International Group: Service sector inflation remains high, Bank of England will continue to cut interest rates

Service sector inflation is expected to rebound by around 5% before entering winter, while the overall CPI in January may approach 3%. This reduces the possibility of a rate cut in December, but in the spring, ING (Dutch International Group) believes that the Bank of England is still likely to accelerate its easing cycle.

The service sector inflation in the UK in October was slightly higher than economists' general expectations, but 5% was only slightly higher than September, which is in line with the Bank of England's forecast. However, interestingly, when delving into the details, you will find that the recent stickiness is largely in categories that central banks seem to consider less important/less indicative of "sustained" inflation.

For example, in terms of rent, the month on month performance in October was particularly strong, but this may be related to social rent, which is only updated once every quarter. As is well known, the prices of air tickets and vacation packages fluctuate greatly, which also explains the recent rise in inflation in some service industries.

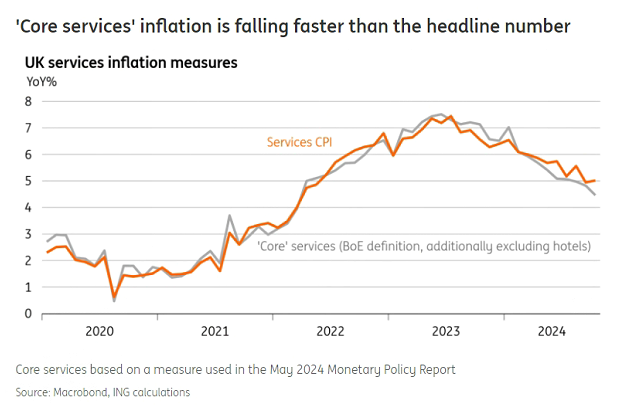

The Bank of England likes to eliminate these factors and focus on so-called 'core service sector' inflation. There is no single definition, but in the chart below, the favorite measure, imitating the work done by the Bank of England before, decreased from 4.8% to 4.5%. This is completely different from what the overall service industry data tells us.

Figure: The rate of inflation decline in the 'core service industry' is faster than the overall data (UK service industry inflation indicator) (the vertical axis is year-on-year percentage, the yellow line is service industry CPI) (the gray line is' core service industry ', defined by the Bank of England, excluding hotels)

What impact does this have on the Bank of England's decision in December? ING is skeptical about this, but remember we had another reading before that. The institution, like the Bank of England, expects service sector inflation to rebound by around 5% in the next four months, followed by a significant decline in the second quarter. Meanwhile, overall inflation in January may approach 3%, mainly due to energy. All of this means that the Bank of England is highly likely to continue its' gradual 'path of interest rate cuts, which is widely believed to mean quarterly rate cuts. ING expects the meeting next month to be suspended.

But the subtle differences in core service industry inflation are important. ING believes that the downward trend will continue, but it may not be in the coming months. Assuming this is the case, ING believes that it means the Bank of England can take more aggressive interest rate cuts in a timely manner. Timing is not easy, but ING believes that a rate cut in February and another one in March (followed by consecutive rate cuts) is still a reasonable basic situation.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights