The Trump administration's policy changes have limited impact on the trajectory of the economy and monetary policy

Goldman Sachs Chief US Economist David Mericle stated in a report that after the Republican Party's sweeping victory in Washington, some key policy changes are expected to affect the economy, with US GDP expected to grow by 2.5% for the full year of 2025.

Tightening policies may reduce net immigration to 750000 per year, slightly lower than the pre pandemic average of 1 million per year. In addition, the tax reduction measures for 2017 are expected to be fully extended instead of expiring, and there will be moderate additional tax reductions.

How will Trump's policies affect the US economy?

Merrick believes that expected policy changes under the leadership of President elect Trump may have significant impacts, but these impacts are unlikely to substantially alter the trajectory of the economy or monetary policy.

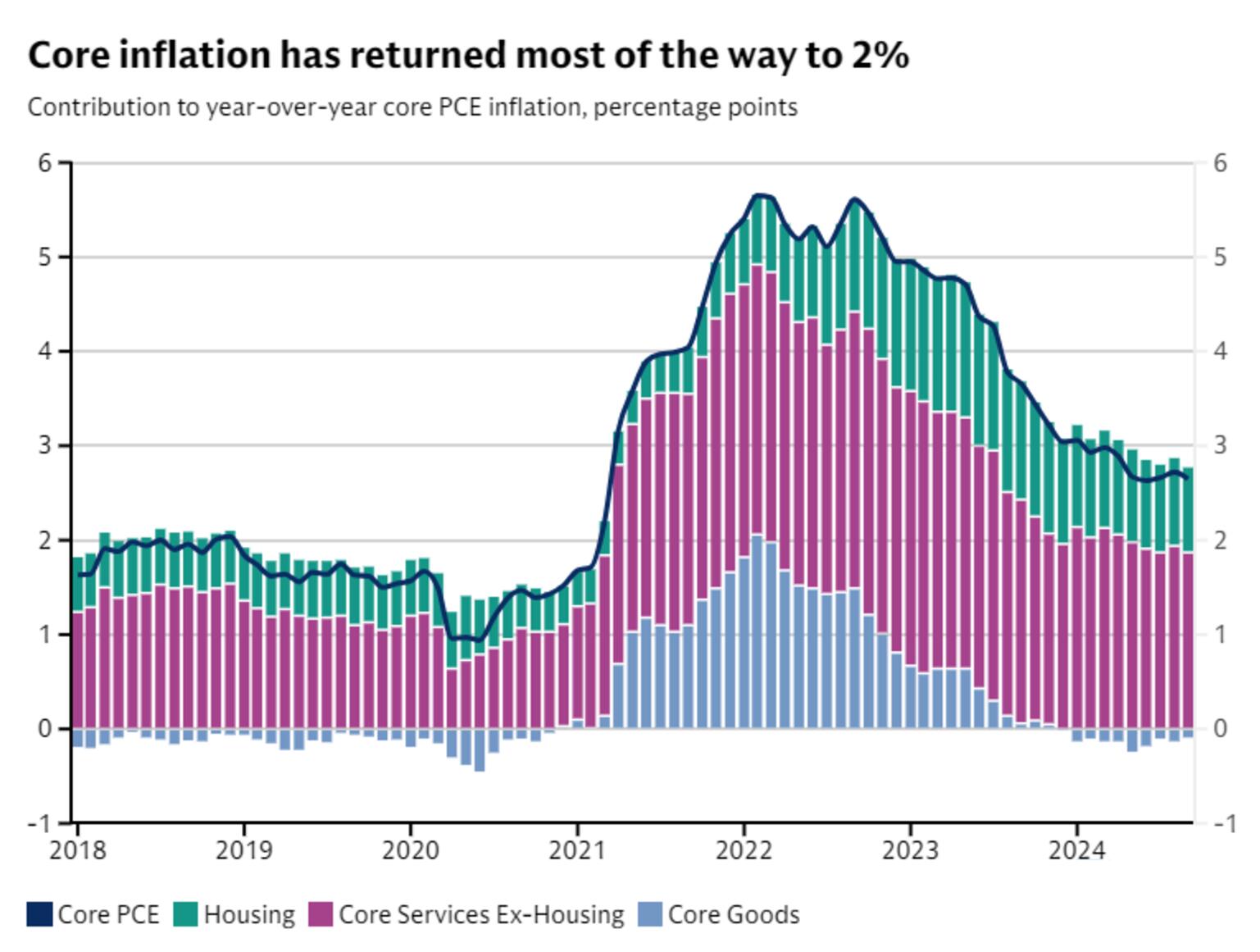

Merrick said, 'Their impact may be most quickly reflected in inflation data. Wage pressures are cooling down and inflation expectations are returning to normal. The remaining hot inflation seems to be lagging behind' catch-up 'inflation, such as official housing prices catching up with the level reflected by market rents for new tenants.'.

(US inflation trend, data source: Goldman Sachs, US Department of Commerce)

Goldman Sachs research predicts that by the end of 2025, the PCE core inflation rate (excluding the impact of tariffs) will decrease to 2.1%. Tariffs may push this inflation indicator up to 2.4%, although this is only a one-time price level effect. The analysis of the impact of tariffs during the first Trump administration shows that for every 1 percentage point increase in the effective tariff rate, PCE core prices will increase by 0.1 percentage points.

Merrick wrote, "Although we have not yet seen clear evidence of labor market stability, trend employment growth seems strong enough to stabilize and ultimately reduce unemployment rates, as immigration is slowing down." In the past two years, the growth rate of the US economy has exceeded Goldman Sachs' estimate of potential GDP growth, partly due to the surge in immigration boosting labor growth. Next year, the tight job market is expected to replace the role of high immigration.

At the same time, it is expected that policy changes will have a roughly offsetting impact on economic expansion in the next two years. The drag of reduced tariffs and immigration may emerge earlier in 2025, while tax cuts may stimulate spending for a longer period of time, "Merrick wrote.

Policy changes may also occur in other areas, such as relaxing regulations. But these impacts are expected to mainly occur at the industry level rather than the macroeconomic level.

What is the likelihood of an economic recession in the United States?

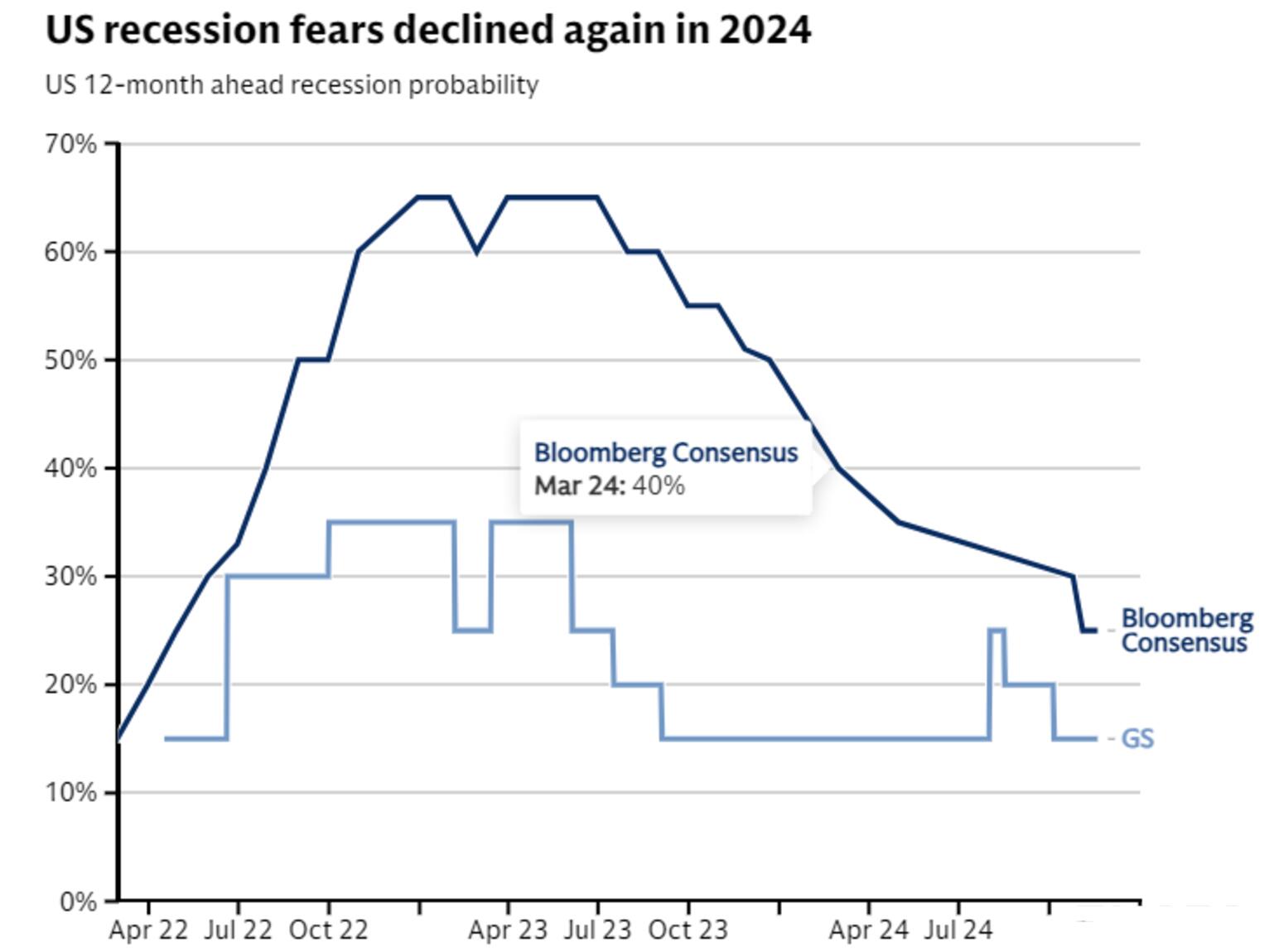

(Source of data on the possibility of a US recession: Bloomberg, Goldman Sachs)

Merrick stated that according to Goldman Sachs' research, "as the downside risks that have raised market concerns have not become a reality, concerns about a recession have subsided," there is a 15% chance that the United States will fall into a recession in the next 12 months, which is roughly in line with historical averages.

Merrick wrote, "Consumer spending should remain the core pillar of strong growth, supported by solid labor market driven real income growth and additional wealth effects. Even if the factory construction boom subsides, business investment will rebound

However, there are also risks in the economy. A universal tariff of 10% may push inflation to a peak slightly above 3% and hit GDP growth.

At a time when the debt to GDP ratio is approaching historical highs, the deficit is much higher than normal, and real interest rates are much higher than decision-makers expected in the previous cycle, the market may begin to worry about fiscal sustainability.

The prospects of the Federal Reserve during the Trump administration

Goldman Sachs research predicts that the Federal Reserve will continue to lower interest rates to the final rate of 3.25% to 3.5% (the current policy rate is 4.5% to 4.75%), which will be 100 basis points higher than the previous cycle.

This is because Goldman Sachs economists expect the Federal Open Market Committee to continue raising its estimate of neutral interest rates (typically considered neither stimulating nor slowing down the economy). In addition, the tailwinds of non monetary policies, particularly large fiscal deficits and resilient risk sentiment, are offsetting the impact of rising interest rates on demand.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights