The US Composite Index broke through the daily support as scheduled, and the EUR/USD is concerned about stabilizing the daily resistance in the future

Macroscopic perspective

In terms of consumer spending in the United States, the expenditure growth in October slightly exceeded expectations, and there was also a slight increase after adjusting for inflation. Factors such as low unemployment rate supported consumption, and household savings rate and disposable income both increased. But the cooling of inflation is slowing down, and if Trump imposes tariffs, it may lead to an increase in inflation. The job market is mixed, with low initial jobless claims and high renewal claims, making it difficult for laid-off workers to find new employment and maintaining a stable unemployment rate. Enterprise equipment expenditures have started weakly. The US dollar fell in the market on Wednesday as it digested economic data, assessed the risk of a tariff war, and weakened safe haven demand due to ceasefire agreements. The decline in US bond yields has also supported gold prices due to weak consumer confidence in Europe. The market's expectations for the Federal Reserve's monetary policy have changed. Although it is expected to cut interest rates for the third time in December, the possibility of further rate cuts in 2025 is considered to be decreasing. Overall, the US economy has shown positive performance but also faces many uncertainties. The November employment report is crucial for the Federal Reserve's interest rate decision. This trading day, we will pay attention to the geopolitical situation and news related to Trump.

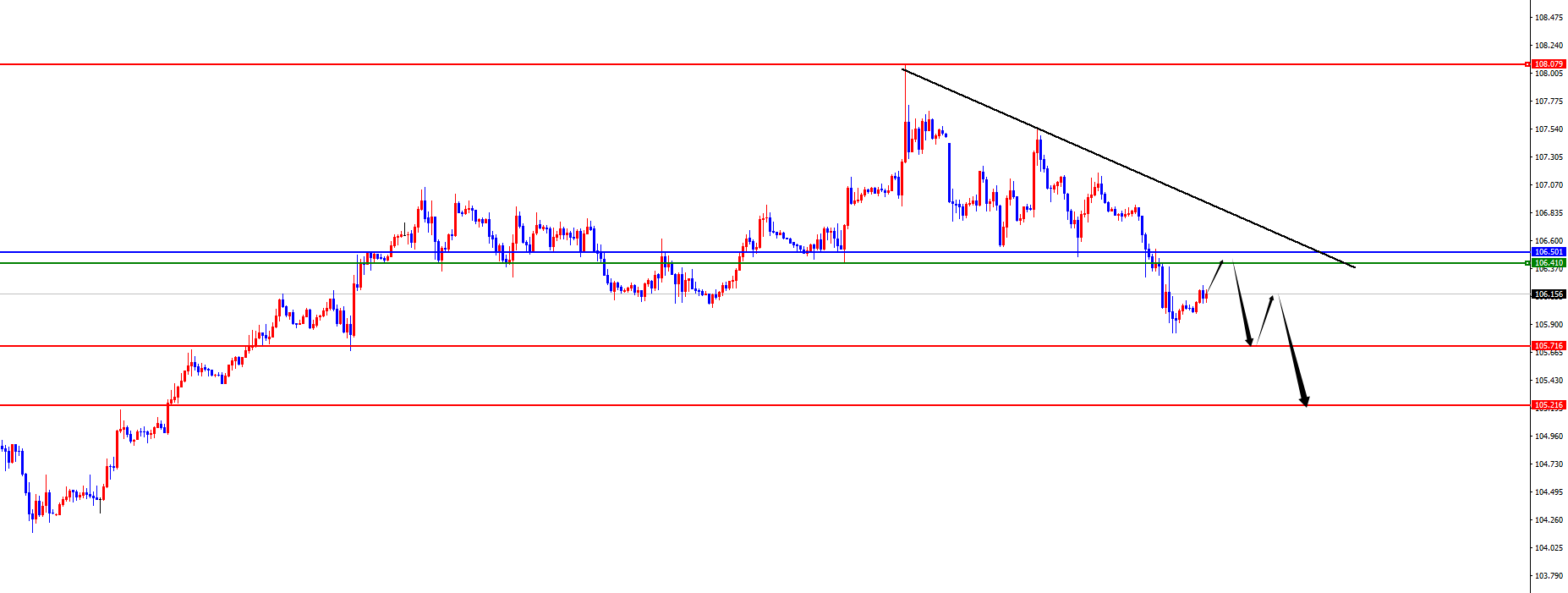

The US Dollar Index

In terms of the US dollar index, the overall price of the US dollar index showed a downward trend as scheduled on Wednesday. The highest price of the day rose to 106.90, the lowest was 105.826, and closed at 106036. Looking back at the price performance of the US Composite Index on Wednesday, after the morning opening, the price first fluctuated in the short term, then hit a four hour resistance and continued to be under pressure and weak. At the same time, it quickly fell below the daily support level in the US market, which is why we have always emphasized the need to pay attention to subsequent price breaks. The price eventually closed in a bearish state on the day. At present, we are focusing on the resistance in the 106.40-50 range above the US Composite Index, and will lay out after the price is in place. Below, we will pay attention to the support in the 105.70-105.20 range.

The US Composite Index is empty in the 106.40-50 range, with a defense of $5 and a target of 105.70-105.20

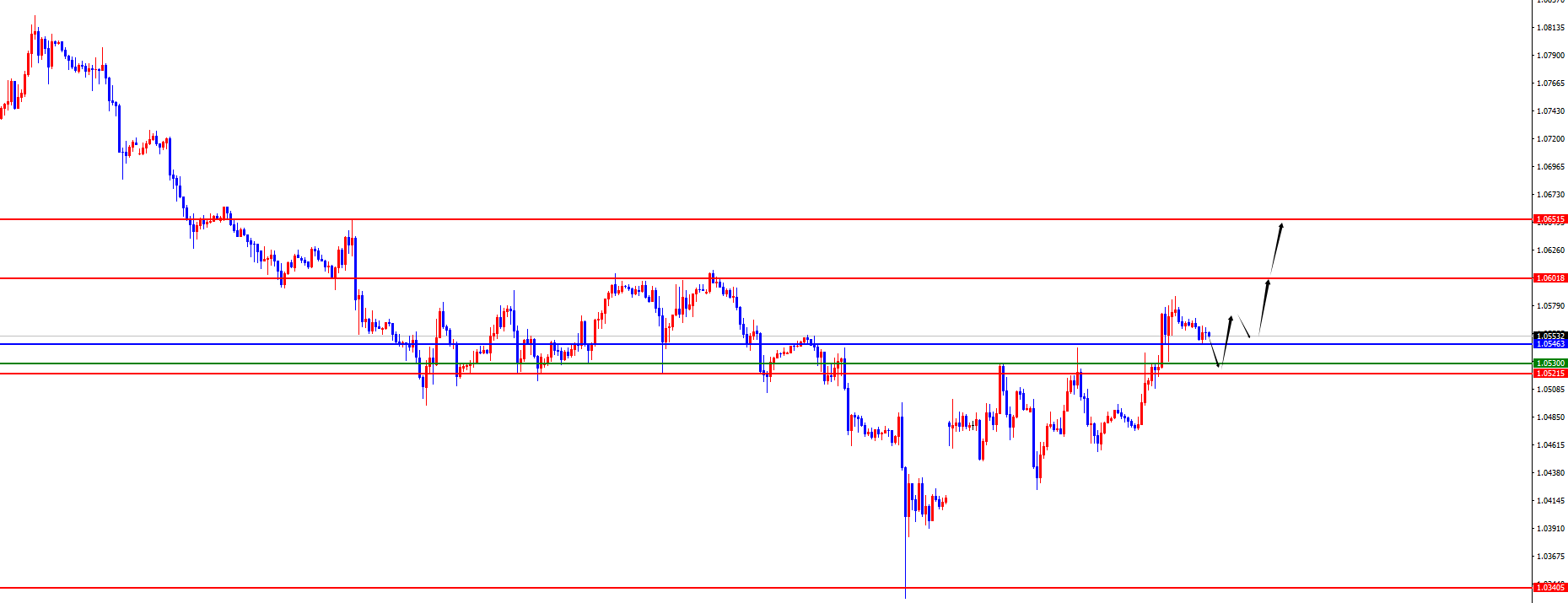

In terms of EUR/USD, European and American prices showed an overall upward trend as scheduled on Wednesday. The lowest price of the day fell to 1.0473, the highest rose to 1.0587, and closed at 1.0564. Looking back at the performance of the European and American markets on Wednesday, the price first rose in the short term during the morning session, then slightly corrected and rose again. The price broke through the four hour resistance level before the European session, then continued to rise and eventually broke through the daily resistance level. The daily level received a bullish trend, and the focus was on further continuing the upward trend after breaking through the daily line. Short term support is expected to remain within the 1.0520-30 range for four hours. Once the price returns to its designated level, we will look for an upward trend and focus on the 1.0600-1.0650 area above.

EUR/USD 1.0520-30 is mostly in the range, with a defense of 40 points and a target of 1.0600-1.0650

Today's focus on financial data and events: Thursday, November 28, 2024

① 16:55 Speech by Reserve Bank of Australia President Brock

② 18:00 Eurozone Industrial Sentiment Index for November

③ 18:00 Eurozone November Economic Sentiment Index

④ 21:00 Initial value of November CPI monthly rate in Germany

⑤ 21:30 Canadian Q3 Current Account

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights