The impact of Trump's tariff policy is significant, which may cause a 13% depreciation of the Canadian dollar!

Goldman Sachs has studied the potential impact of Trump's tariff policies on the Canadian dollar and quantified the potential depreciation of the Canadian dollar in the future.

Goldman Sachs macro strategist Isabella Rosenberg hypothesized a scenario and studied the impact of Trump imposing a 25% tariff on all imported goods from Canada.

She pointed out that the direct impact of such tariffs would be an increase in US export prices compared to import prices. This usually leads to currency appreciation in countries implementing tariffs.

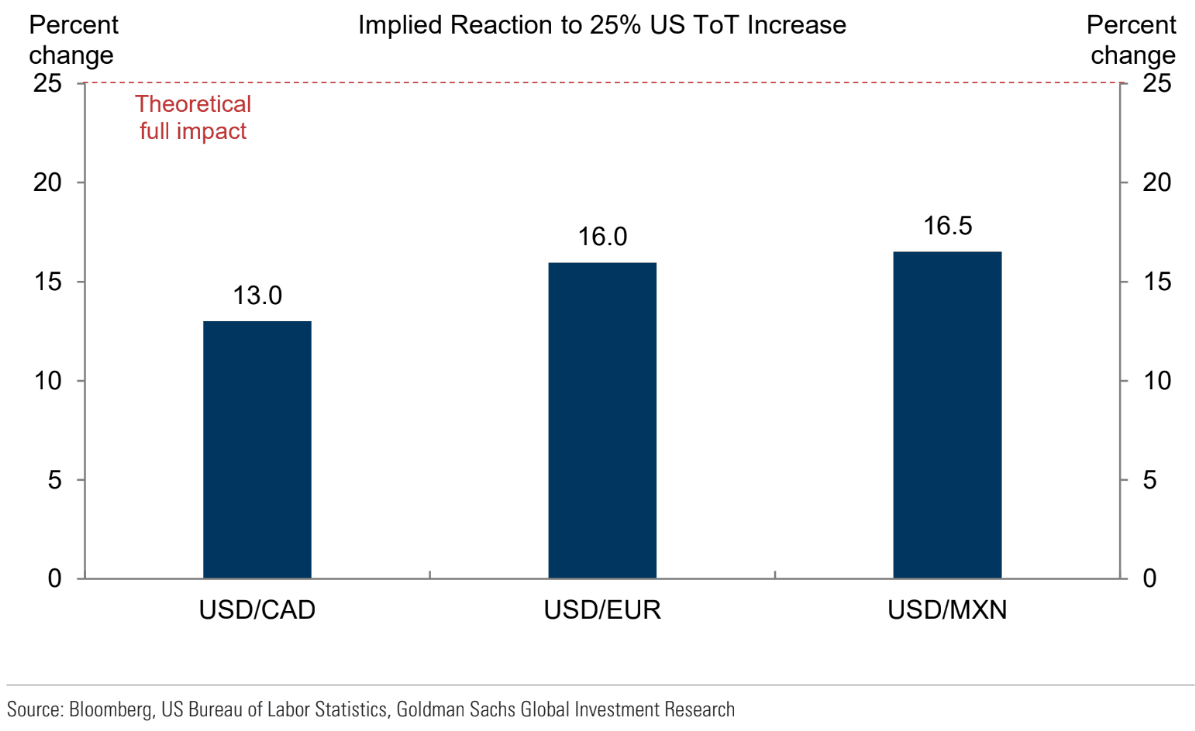

Based on analyzing the historical relationship between exchange rates and trade terms, Rosenberg estimated that a 25% tariff could lead to a 13% appreciation of the US dollar against the Canadian dollar. However, she warned that this is only the theoretical upper limit, and the actual decline of the Canadian dollar may be smaller than this expectation.

Goldman Sachs' research was released at a time when Trump was threatening to impose a 25% tariff on Mexico and Canada. Subsequently, the USD/CAD fell by over 1%; At the close, CAD/EUR and GBP fell by 0.8%.

According to Goldman Sachs' research, this may only be the beginning of the depreciation of the Canadian dollar.

Rosenberg provided several factors that may mitigate the impact of tariffs on exchange rates:

1. Exchange rate adjustment: The Canadian dollar may only partially depreciate in response to tariffs.

2. Prices for American consumers: American consumers may bear some of the tariff costs by offering higher prices for Canadian goods.

3. Corporate profit margin: US and Canadian companies may reduce their profit margins to absorb some of the tariff costs.

4. Canada's negotiating ability: Canada may be able to pass on some tariff costs to the United States, especially in key and complex products (which the United States finds difficult to import from elsewhere).

5. Monetary Policy Response: The Bank of Canada may adopt a more relaxed monetary policy in response to the impact of tariffs, which could further weaken the Canadian dollar.

(Theoretical reaction of the US dollar against major currencies)

Rosenberg also pointed out that it is unlikely for the United States to impose a 25% tariff on all goods imported from Canada, as the main factor causing the trade imbalance between the United States and Canada is crude oil. The possibility of the United States imposing tariffs on crude oil imports is relatively small, due to possible increases in gasoline prices and the dependence of the US refining system on Canadian heavy crude oil.

In addition to the direct impact of tariffs, Rosenberg also listed other factors that may affect the US dollar against the Canadian dollar:

1. Renegotiation of the USMCA: The upcoming renegotiation of the USMCA in 2026 has added uncertainty to the prospects of the US dollar against the Canadian dollar. This uncertainty may lead to the embedding of sustained risk premiums in the exchange rate, thereby maintaining the high position of the US dollar against the Canadian dollar.

2. Domestic economic factors: The interaction between domestic economic conditions in the United States and Canada will also have an impact on the trend of the US dollar against the Canadian dollar.

Rosenberg concluded that the combination of tariff risks and domestic economic factors on both sides may lead to a high USD/CAD ratio in the short term. However, she expects that the weakness of the Canadian dollar will mainly be driven by its domestic economic background, and tariff risks will play a more significant role when they are in line with macroeconomic trends.

Daily chart of USD/CAD exchange rate

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights