After stepping back on the daily resistance, the US index is under pressure, and the EUR/USD is expected to rise after short-term fluctuations

Macroscopic perspective

The gold price fell by 3.4% in November, mainly due to "Trump's excitement". The expected policies after his victory led to a 1.8% increase in the US dollar in November, which hindered the rise of gold prices and led to selling. Although the US dollar index hit a new low last Friday, it had already impacted gold prices, with a drop of over 2% last week. At present, gold is facing pressure, and raising tariff expectations or stimulating inflation may make the Federal Reserve more cautious in cutting interest rates. However, the uncertain implementation of tariffs has a certain positive impact on gold from a safe haven perspective; The crackdown on illegal immigration policies may also reignite inflation, and economic data may affect expectations of interest rate cuts. The upcoming release of a series of economic data has attracted much attention, and this Friday's November employment report is particularly crucial, as its performance will affect expectations of interest rate cuts by the Federal Reserve. In addition, there are many economic data and speeches by Federal Reserve officials this week. From the perspective of market expectations, Wall Street analysts' bearish sentiment has decreased, with most leaning towards neutral or bullish, and retail investors also tend to be bullish in the future. In short, the gold market is influenced by multiple intertwined factors, and the subsequent trend requires attention to relevant news and data releases.

The US Dollar Index

In terms of the US dollar index, the overall price of the US dollar index showed a downward trend last Friday. The highest price of the day rose to 106.162, the lowest was 105.585, and closed at 105.753. Looking back at the price performance of the US dollar index last Friday, after the morning opening, the price first fell under pressure in the short term, and then continued to weaken until it stopped before the European market. Although the European market corrected upwards, the price continued to be under pressure in the four hour resistance, so the price fell again under pressure in the evening. From the weekly and daily lines, the price ended in a bearish trend. This week, the focus was on the support in the 103.70 area, the daily line level temporarily focused on the resistance in the 106.50 area, and the four hour level temporarily focused on the resistance in the 106.05 area. During the morning session, the price broke through the four hour resistance upwards, so we will temporarily observe the correction of the price in the short term, and wait until the price reaches the daily resistance area before further pressure.

The US Composite Index is empty in the 106.50-60 range, with a defense of $5 and a target of 106-105.70-105.20

【 EURUSD 】

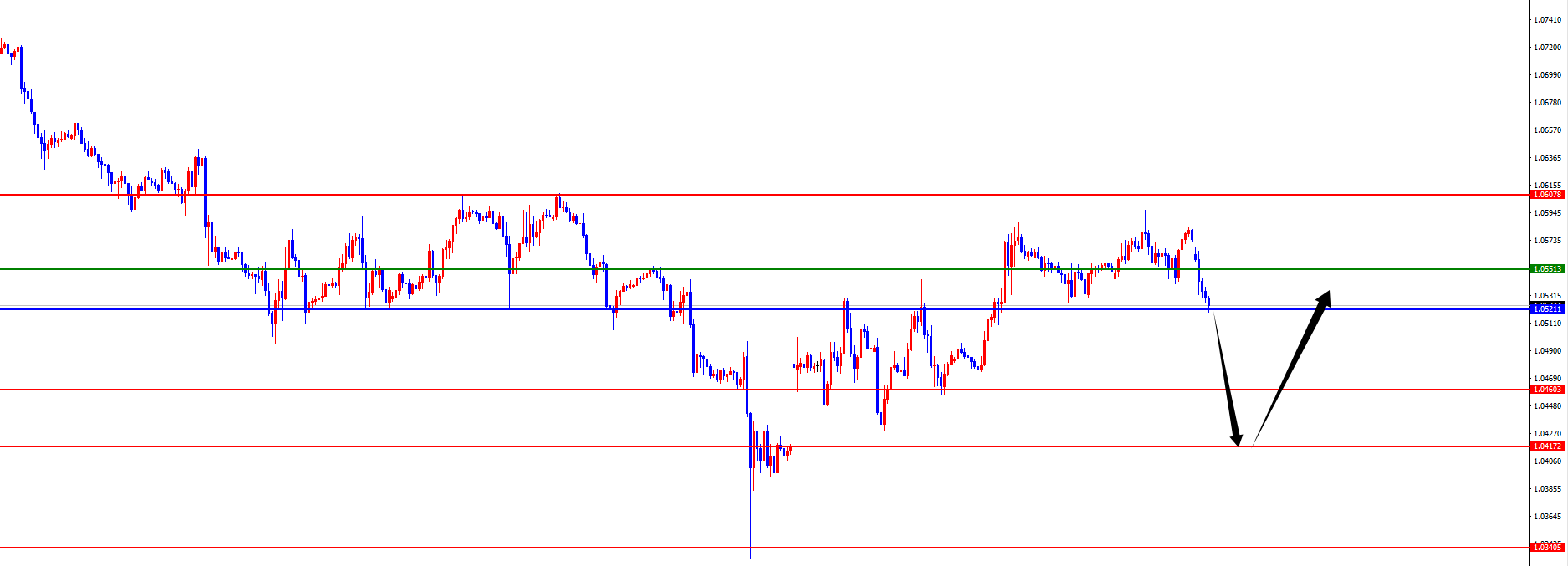

In terms of EURUSD, the overall price of EURUSD showed an upward trend last Friday. The lowest price of the day fell to 1.0540, the highest rose to 1.0596, and closed at 1.0576. Looking back at the performance of the European and American markets last Friday, prices first gained short-term support and rose during the morning session, followed by a correction in the European session. Although the US session rose, it did not reach a new high for the day. Last Friday was the final closing day of the monthly chart, leaving a long bearish candlestick above and below the monthly line. We will pay attention to the gains and losses of the 1.0820 long short watershed above this level, and below this level, the long-term chart will still be bearish. For the weekly price trend of a strong bullish ending, the key resistance above is in the 1.0830 area, so the subsequent 1.0820-30 range is a key watershed for the long-term trend of Europe and America. At the same time, based on the daily line level, we will temporarily focus on the support of the 1.0520 area. From the four hour and daily lines, we are cautious of short-term price fluctuations at low levels before moving up. Therefore, we will pay close attention to price fluctuations before laying out our strategy.

EUR/USD 0.410-20 is mostly in the range, with a defense of 40 points and a target of 1.0460-1.0520-1.0630

Today's focus on financial data and events: Monday, December 2, 2024

① 09:45 China's November Caixin Manufacturing PMI

② 15:00 UK November Nationwide House Price Index Monthly Rate

③ 15:30 Switzerland's actual retail sales annual rate for October

④ 16:50 French November Manufacturing PMI Final Value

⑤ 16:55 Germany's November Manufacturing PMI Final Value

⑥ 17:00 Eurozone November Manufacturing PMI Final Value

⑦ 17:30 UK November Manufacturing PMI Final Value

⑧ 18:00 Eurozone October unemployment rate

⑨ 22:45 US November S&P Global Manufacturing PMI Final Value

⑩ 23:00 US November ISM Manufacturing PMI

⑪ 23:00 Monthly rate of construction expenditure in October in the United States

⑫ At 04:15 the next day, Federal Reserve Governor Waller delivered a speech

⑬ The next day at 05:30, Fed's Williams will participate in the conversation

Note: The above is only a personal opinion and strategy, for reference and communication purposes only. No investment advice has been given to the client, and it is not related to the client's investment, nor is it used as a basis for placing an order.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights