US economic data mixed, Middle East situation and Federal Reserve policy critical

The economic situation in the United States is complex, with multiple factors intertwined. The escalation of the conflict between Israel and Lebanon in the Middle East has made the ceasefire agreement more fragile due to clashes within a week of its implementation. The domestic economy is mixed, with improvements in the manufacturing industry in November, such as a slowdown in contraction and an increase in new orders, but still struggling. Although PMI has risen, most industries are shrinking, and manufacturers are pessimistic. The expenditure on enterprise equipment has increased, and employment has also improved. The construction sector's October spending exceeded expectations compared to the previous month, and the Atlanta Fed raised its GDP forecast for the fourth quarter. Several officials from the Federal Reserve have expressed their opinions. Williams said there may be a rate cut in the future, but did not specify the timing; Waller is inclined to cut interest rates in December, depending on the progress of inflation and other factors, or change his mind and mention the trend of interest rates next year; Bostic is open to a rate cut in December, depending on employment data, and is concerned that policy changes may trigger inflationary pressures. Investors expect another 25 basis points interest rate cut in December, but recent inflation data is poor. There are many key economic events in the United States this week, with job vacancy data released tonight, speeches by Federal Reserve governors, and the release of the employment report on Friday. The geopolitical situation also needs attention, as there are many variables in the future direction of the US economy.

In terms of the US dollar index, the overall price of the US dollar index showed an upward trend on Monday. The highest price of the day rose to 106.711, the lowest was 105.744, and closed at 106.377. Looking back at the performance of the US dollar index on Monday, the price received short-term support and further corrected upwards after the morning opening. In terms of rhythm, the price broke through the four hour resistance in the morning session, and for the price to rise again after the US session, it was corrected and adjusted during the overnight period, and the daily level finally ended with a strong bullish trend. At present, the short-term price is still undergoing correction, and the key watershed is the support level of 106.20 in the next four hours. The price tends to rise above this level, and it is important to pay attention to whether it can be under pressure again after the subsequent rise. The upper part temporarily focuses on the resistance in the 107.20-30 range, while the lower part focuses on the gains and losses of support in the 106.20 area. Once it breaks down, further pressure will be monitored.

The US Composite Index is mostly in the 106.20-30 range, with a defense of $5 and a target of 106.80-107.20

The US Composite Index is empty in the 107.20-30 range, with a defense of $5 and a target of 106.50-106

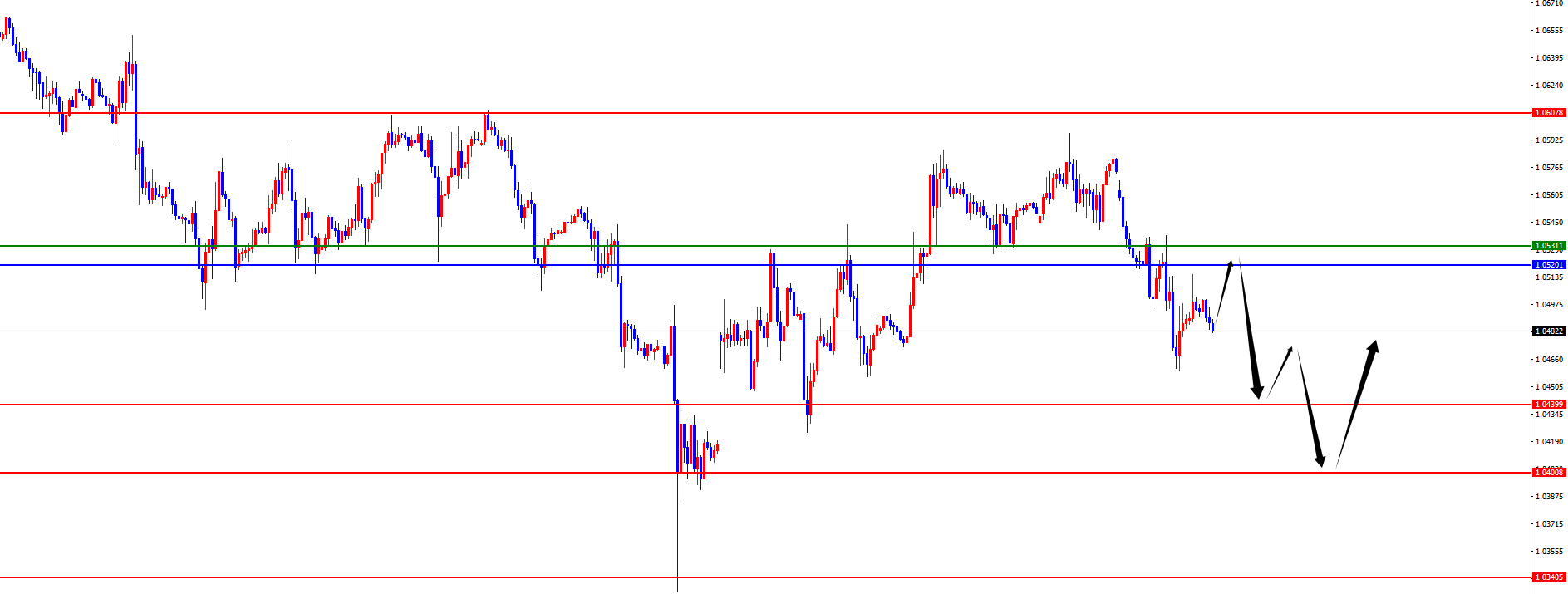

In terms of EUR/USD, the overall prices of Europe and the United States showed a downward trend on Monday. The lowest price of the day fell to 1.0460, the highest rose to 1.0569, and closed at 1.0496. Looking back at the performance of the European and American markets on Monday, prices were directly under pressure and fell in the short term during the morning session, and then maintained a volatile downward trend throughout the day. Prices continued to be suppressed at the four hour level resistance. Currently, the daily resistance in Europe and America is in the 1.0520 area, and the four hour resistance is in the 1.0530 area. Therefore, we will temporarily focus on this area under pressure in the future. Below, we will focus on the 1.0440-1.0400 area. In the future, when the price reaches this area, we also need to pay attention to whether the price can further rise, which is the key.

EUR/USD 1.0520-30 range empty, defend 40 points, target 1.0440-1.0400

EUR/USD 1.0390-1.0400 is mostly in the range, with a defense of 40 points and a target of 1.0500-1.0560

Today's focus on financial data and events: Tuesday, December 3, 2024

① 15:30 Swiss November CPI Monthly Rate

② 23:00 JOLTs job vacancies for October in the United States

③ At 01:35 the next day, Federal Reserve Governor Kugler delivered a speech

④ The next day at 05:30, API crude oil inventory for the week of November 29th in the United States

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights