What is the trend of the US dollar and Japanese yen in 2025?

After Trump's re-election, there has been a divergence in policy expectations between the Federal Reserve and the Bank of Japan. As the Federal Reserve's interest rate cut bets decrease, the US dollar is bullish. Will those who are bearish on the Japanese yen regain their dominant position in 2025?

The 'Trump deal' strengthens dollar bulls

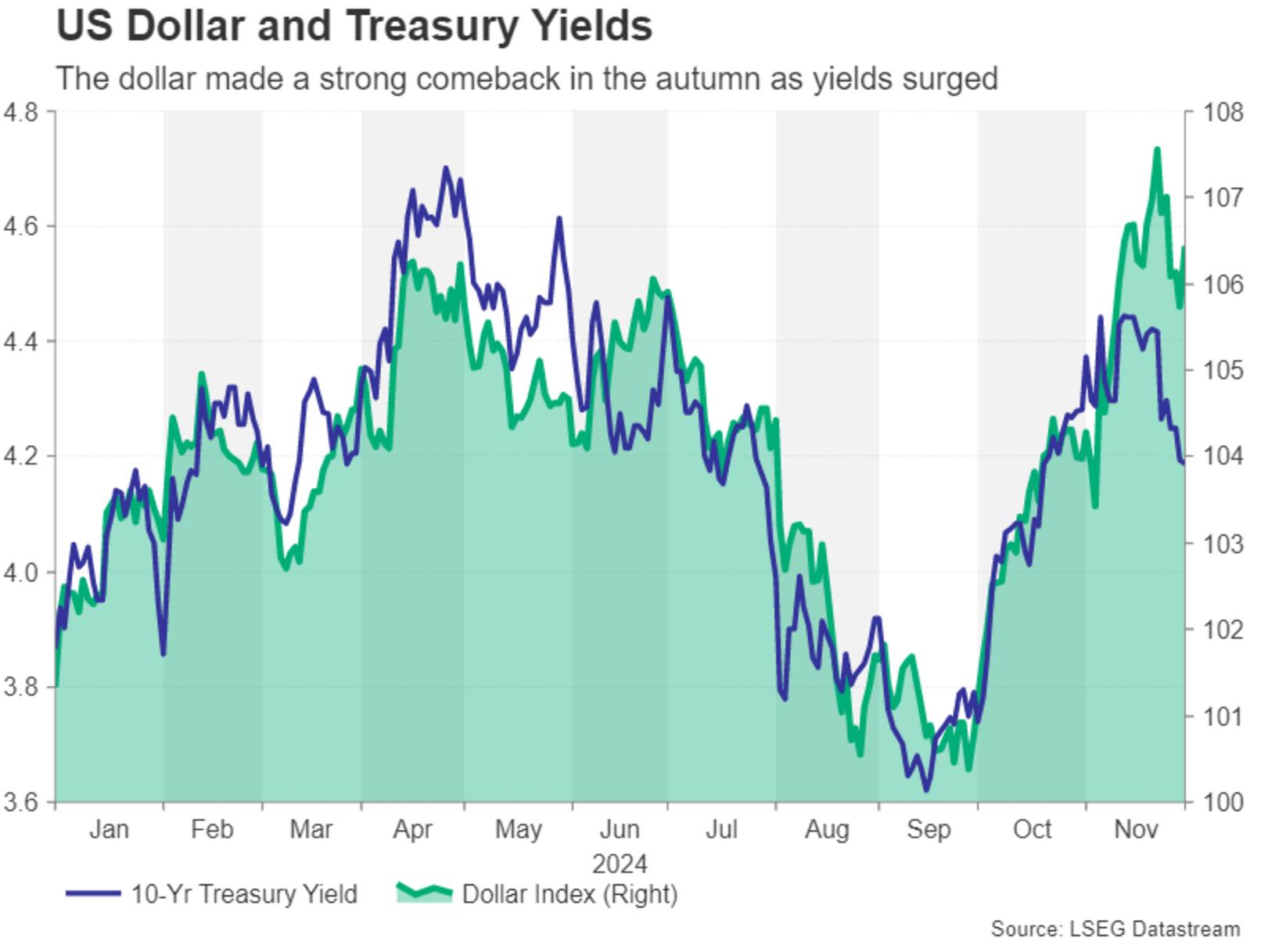

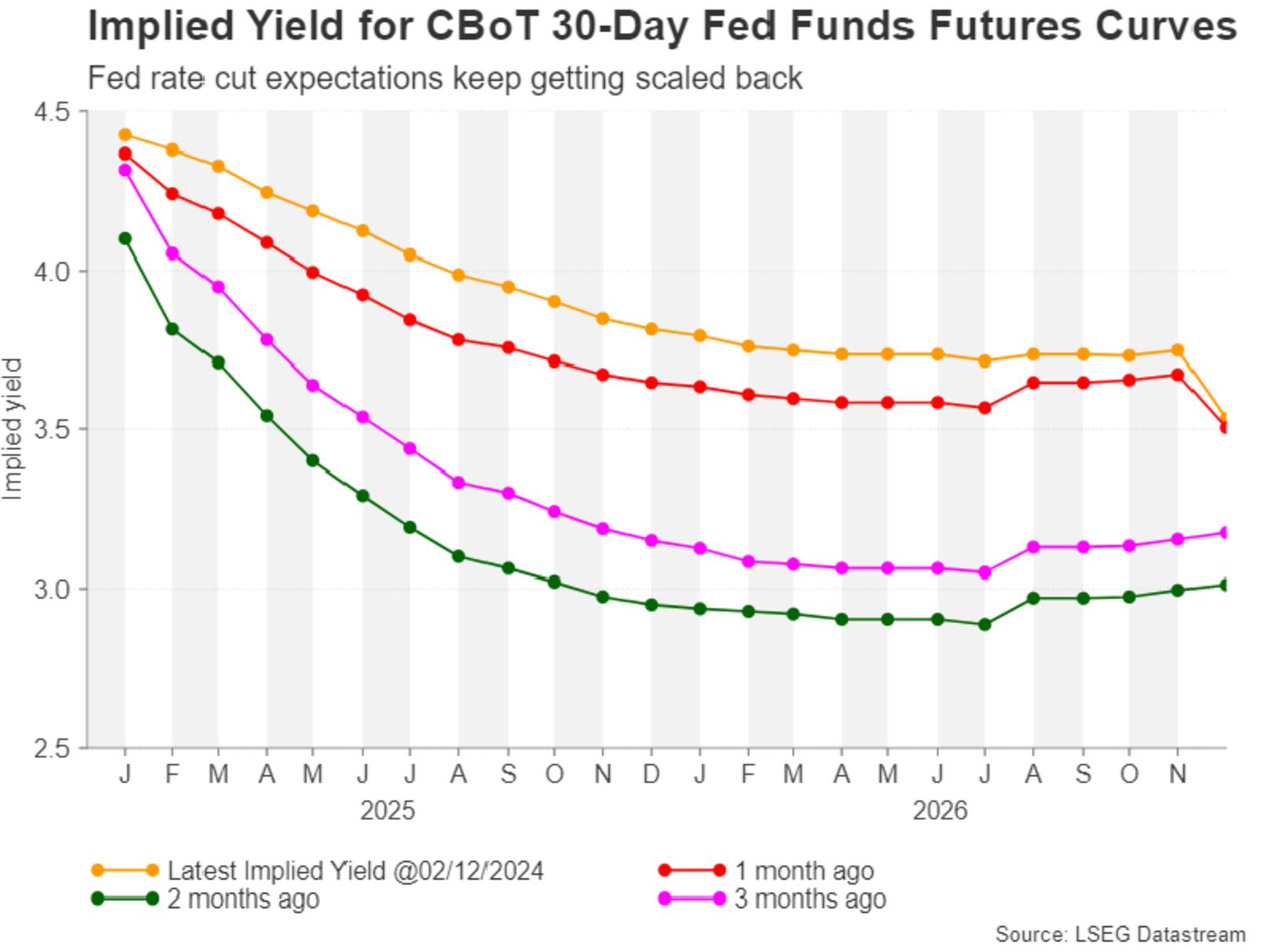

The Federal Reserve cut interest rates in September last year, but instead of falling, the US dollar began a new round of rise as policymakers shattered people's hopes of actively relaxing policies. With the arrival of 2025, the advantage of the US dollar is undeniable. The US dollar will not only be supported by a resilient US economy and sustained price pressures, but also by expectations that the incoming Trump administration will enact further policies to boost economic growth and inflation.

(The US dollar index and the yield of US 10-year treasury bond bonds rebounded strongly in autumn due to the soaring yield.)

Trump's historic victory in the 2024 presidential election will be the decisive narrative for the financial markets of 2025. However, while assets such as the US dollar and stocks are cheering for the prospect of Republican control of Congress, not everyone is celebrating Trump's return to the White House.

Setting aside the risks of countries potentially benefiting from Trump's trade rhetoric, his campaign promises are believed to lead to inflation, which could be a headache for the Federal Reserve. The expectation that substantial tax cuts and tariff increases will exacerbate inflation has pushed the yield of US treasury bond bonds to their highest level in several months, pushing the US dollar higher.

How much inflation will Trump's policies cause?

The question for the 2025 outlook is how quickly the Republican Party can push their tax agenda, and how easily Trump will resort to imposing higher tariffs when starting trade negotiations with major US trading partners such as the European Union and Mexico?

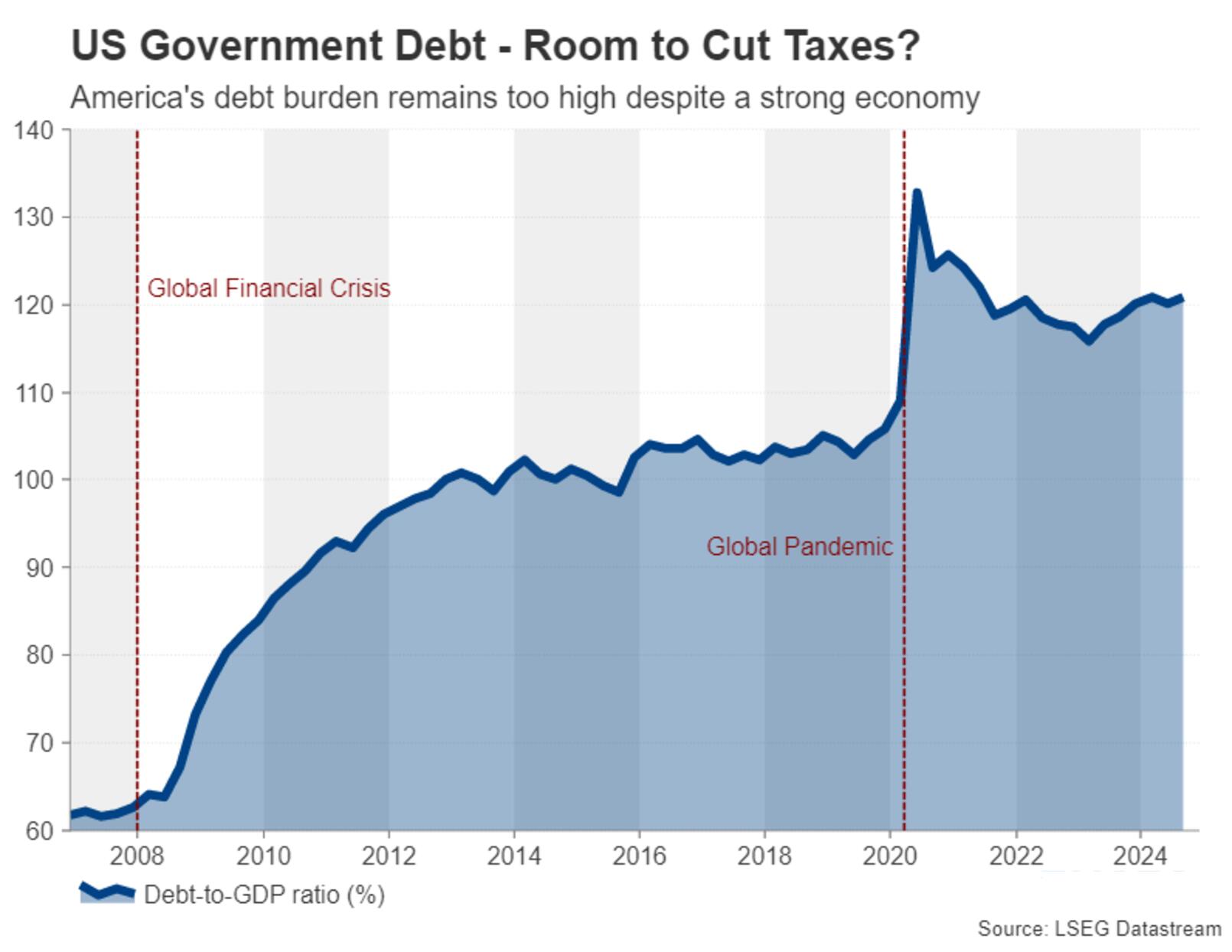

But it's not just a matter of timing. Since the budget deficit is more than 6% of GDP and the treasury bond is expanding, Republicans can cut spending to pay for their tax incentives and offset some tax cuts to boost the economy.

In terms of tariffs, it is still unclear to what extent the new Trump administration will impose higher tariffs on imported goods, and Trump tends to use sensationalism as a negotiation strategy.

Despite the strong economy, the debt burden of the US government is too high

Therefore, for the US dollar, the key is how much has been digested and how much has not yet been digested by investors. Any indication that Trump's campaign promises have been downplayed could have a negative impact on the US dollar in 2025. Similarly, if newly elected lawmakers delay in preparing and agreeing to Trump's legislative agenda, the US dollar is likely to rebound.

However, if Republicans quickly take tax cuts and Trump shows an unwillingness to compromise on trade issues, the US dollar is likely to climb to the high point of the Federal Reserve's massive interest rate hike in 2022.

The Federal Reserve's Inflation Dilemma

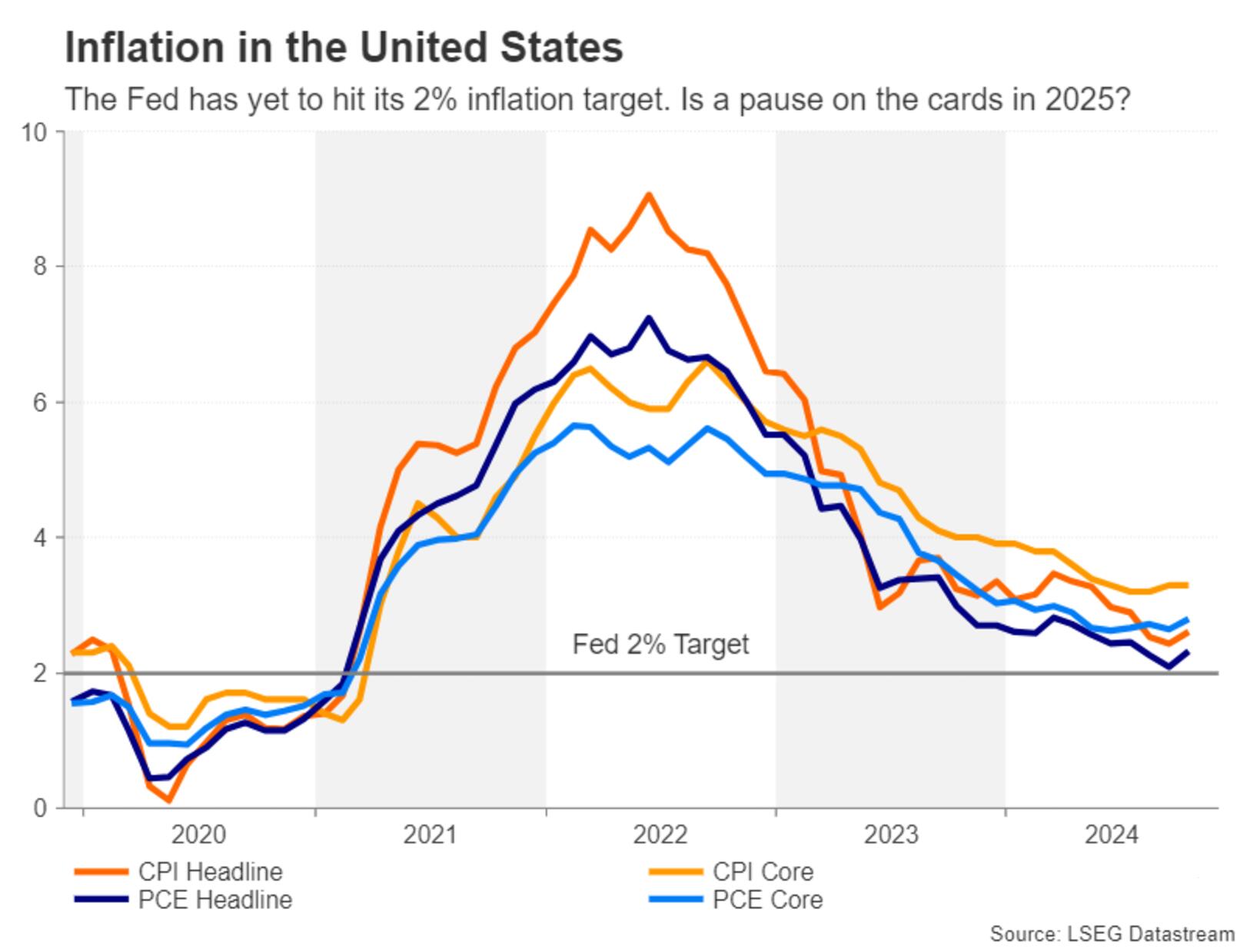

Although the days of tightening policy by the Federal Reserve have come to an end and borrowing costs are decreasing, the battle against inflation has not been won, and policymakers are cautious about cutting interest rates too quickly. The unexpectedly tough stance of the Federal Reserve highlights the bullish outlook for the US dollar. People's main concern is that the inflation rate seems to be approaching 2.5% instead of the Federal Reserve's target of 2.0%.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights