Non farm farming is coming, can gold prices turn the tide?

Friday risk warning

At 15:00, Germany will release the quarterly adjusted industrial output rate and trade account for October;

At 3:00 pm, the UK will release the monthly rate of the Halifax seasonally adjusted house price index for November;

At 15:45, France will release its October trade account;

At 18:00, the Eurozone will announce the revised annual GDP rate for the third quarter and the final quarterly adjusted employment rate for the third quarter;

At 21:30, the United States will release the November unemployment rate, seasonally adjusted non farm payroll for November, and average annual wage rate for November. The market expects the United States to add 200000 new jobs in November, with the unemployment rate slightly rising to 4.2%;

At 21:30, Canada's employment figures for November;

At 22:15, Federal Reserve Governor Bauman delivered a speech;

At 23:00, the United States will release the initial expectations for the one-year inflation rate for December and the initial values for the University of Michigan Consumer Confidence Index for December;

At 1 o'clock the next day, Cleveland Fed Chairman Hamack delivered a speech on the economic outlook;

At 2:00 the next day, the United States will announce the total number of oil wells drilled for the week ending December 6th;

At 2 o'clock the next day, San Francisco Fed President Daly will give a speech.

① The conflict between Russia-Ukraine conflict continues, and the demand for gold as a safe haven continues

② The escalating tension in Syria continues to affect the safe haven demand for gold.

③ Gold is currently rising and breaking through the downtrend line, marking the end of its short-term downward trend.

④ Non farm payroll data is about to be released.

In summary, gold is currently transitioning from a short-term to a bullish trend.

Today, investors are paying attention to the support area of 2320 supported by the trend line below, and are bullish on gold after the gold price stabilizes and rebounds.

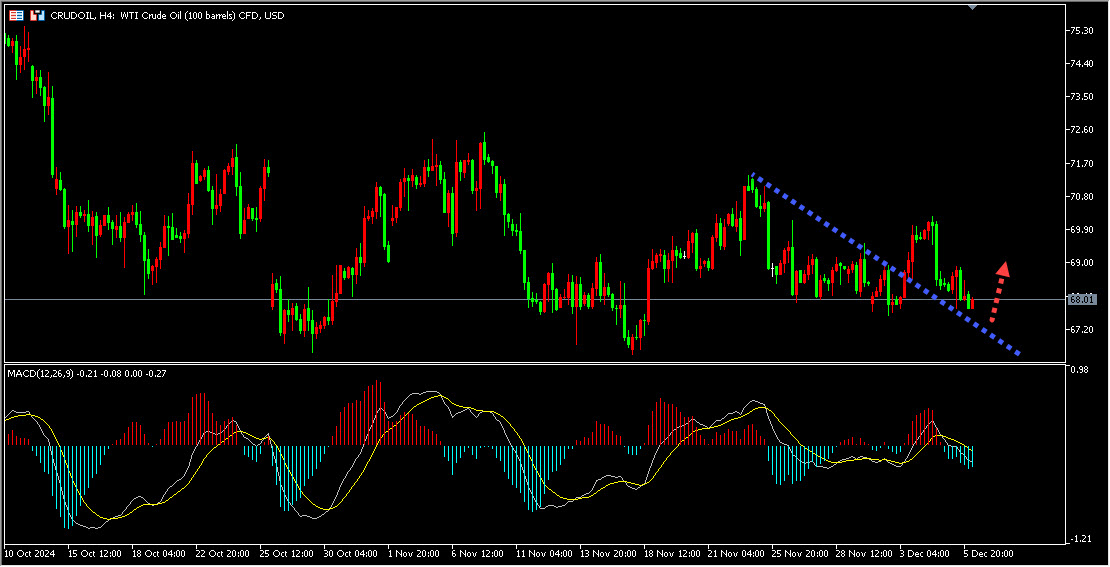

① OPEC+has decided to postpone its production increase plan until April 2025, which has provided some support for oil prices.

② The market's expectations for US non farm payroll data are relatively optimistic, which may affect crude oil demand.

③ Crude oil fell under pressure at the 1-hour pressure level as expected yesterday, and is now approaching the 4-hour support zone below as expected.

In summary, the future trend of crude oil may be relatively strong.

Today, investors are paying attention to the 4-hour support zone below, and will go long on crude oil after oil prices stabilize.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights