Top 10 Predictions for US Real Estate in 2025

According to the latest data from the US Census, the median selling price of a single family home in the US was US $437300 in October, higher than US $426800 a month ago.

Meanwhile, according to Redfin, an online real estate brokerage company, the average rental price in the United States in October was $1619, which was basically the same as the same period last year or increased by 0.2%, and decreased by 0.6% compared to a month ago.

Although it is difficult to accurately predict how the real estate market will develop in 2025, several economists have made predictions for what may happen next year in a new report by online real estate brokerage firm Redfin. It is expected that housing sales will increase in 2025, mainly due to suppressed demand. But some potential homebuyers will still be excluded due to rising housing prices, with mortgage rates remaining around 7%. On the other hand, rental prices should remain unchanged while wages rise, thereby increasing the affordability of renters. Politicians from both parties have promised to reduce the housing costs for the American working class and build more housing; I hope this will happen in the coming years.

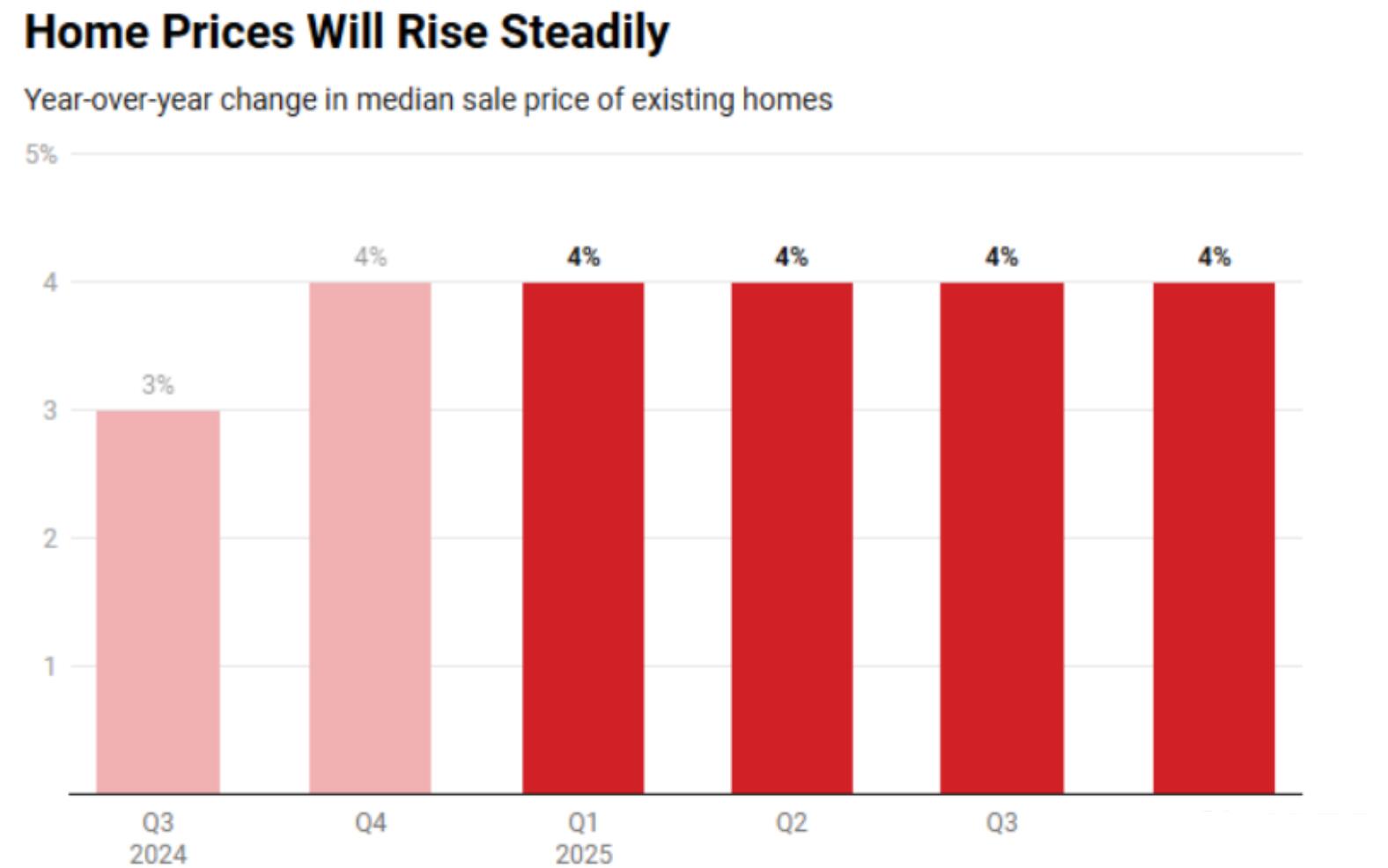

Prediction 1: House prices will rise by 4% by 2025

Economists predict that the median selling price of US homes will steadily rise by 2025, and by the end of the year, it will be 4% higher than in 2024. The rate of price increase will be similar to the second half of 2024, as it is expected that there will not be enough new inventory to meet demand. Price rise is one of the factors that many Americans cannot own a house, leading some potential buyers to rent instead.

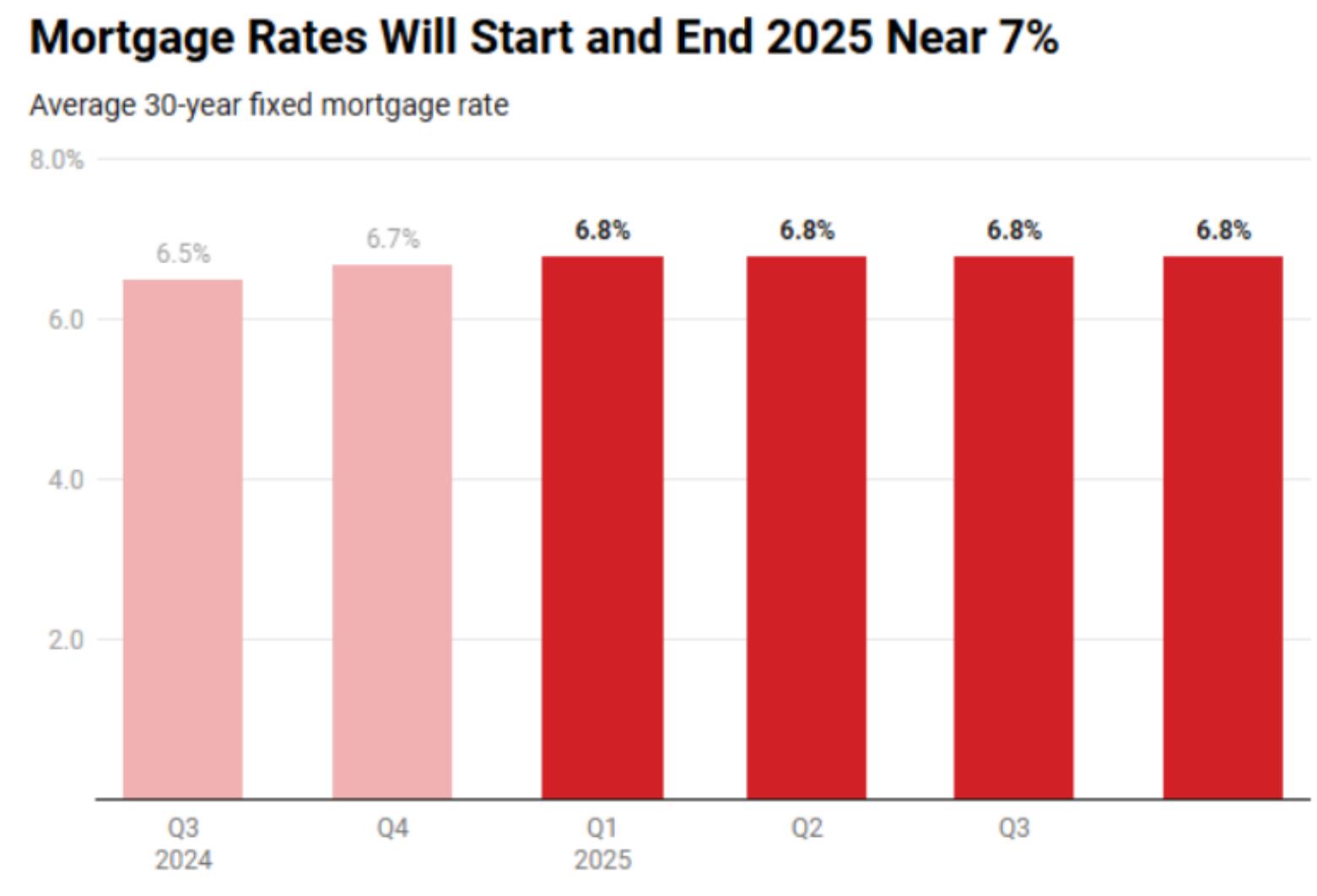

Prediction 2: Mortgage interest rates will remain around 7%

Mortgage interest rates may remain at a high level of 6% in 2025, with weekly average rates fluctuating throughout the year, but averaging around 6.8%. Investors expect that if President elect Trump implements a significant portion of his proposed tax cuts and tariffs, and the economy remains strong, the Federal Reserve will only lower policy rates twice in 2025, keeping mortgage rates high. Tariffs may trigger inflation, while implementing more tax cuts will increase the US deficit, both of which will push up mortgage rates. The high mortgage interest rate is the second part that makes buying a house unaffordable.

Another scenario: If the economy weakens or tariffs and tax reduction plans are cancelled, mortgage rates may drop to a low level of 6%. Any presidential election in a year is unpredictable, especially this year.

Prediction 3: The sales volume of houses in 2025 will exceed that of 2024

It is expected that the sales volume of existing houses will increase next year, with an annualized growth rate of 4.1 million to 4.4 million units by 2025. This means a year-on-year growth of 2% to 9%. The sales scope showcased this year is exceptionally broad, as although high housing costs may deter some potential buyers, there is also considerable suppressed demand in the market. If sales only increase slightly, it will be due to high mortgage rates and low inventory, as homeowners continue to hold onto their homes.

If the decline in mortgage interest rates exceeds expectations, or if there is a sustained surge in housing demand in the near future, sales may experience even greater growth. Despite maintaining mortgage interest rates at around 7%, there was still a significant increase in demand for home purchases in the weeks following the November election. Part of the reason is that buyers wait for uncertainty to pass before making large purchases, and part of the reason is that many people have more confidence in the financial commitments of the Republican led government. Even before the election, the data also showed that the rise in mortgage interest rates did not stop buyers as expected, partly because many Americans have become accustomed to high mortgage interest rates. If the economy remains strong and there are enough people who can afford the high housing costs next year, this will drive sales.

Prediction 4: 2025 will be the rental market

Many Americans will continue to rent or become renters. Although the cost of buying a house will increase, the ability to afford rent will also increase. It is expected that the median asking rent in the United States will remain unchanged year-on-year in 2025. This will make the average American more affordable to rent because wages will rise.

There will be more new rental properties listed on the market, and many builders are about to achieve results in the apartments they started building during the pandemic apartment construction boom. This will create more supply than demand, incentivizing landlords to offer discounts such as free parking, free one month rent, more amenities, or temporary rent increases to retain residents. Due to rent remaining stable or even decreasing next year, while housing prices may rise due to the possibility of high interest rates, the gap in affordability between renting and purchasing may widen.

Prediction 5: Fewer building regulations will lead to more residential construction

It is expected that residential builders will build more single family homes by 2025, although the increase in residential construction will take several years to make buying a house cheaper. The Republican Party's sweeping victories in the White House, Senate, and House of Representatives have brought about a new optimism that the regulatory burden may be reduced, thereby enhancing the confidence of builders. Builders will also hope for the fact that the lock-in effect of mortgage interest rates will limit competition between existing inventory and new construction.

Relaxing regulation should also lead to a rebound in multi household housing construction. This will be reversed from 2024, when builders reduced apartment construction due to oversupply.

It should be noted that builders face some resistance. Firstly, interest rates may remain high. Secondly, the incoming government has stated that it will reduce immigration, which may lead to a decrease in residential construction as immigrants make up approximately 30% of the country's construction workforce.

Prediction 6: With a slight decrease in commissions, the cost of buying and selling homes for the wealthy will decrease

In the first full year of the implementation of the new commission rules by the National Association of Real Estate Agents (NAR), it is expected that real estate commissions will slightly decrease. This is especially true for luxury residences, as brokers have the greatest room to reduce fees, and in the fiercely competitive real estate market, fees are increasingly becoming a negotiating point in bidding wars. It remains to be seen to what extent anti-monopoly enforcers in the incoming government will drive further reforms in the real estate industry. The US Department of Justice stated in a recent document that it "continues to review policies and practices in the residential real estate industry that may suppress competition," but it is unclear whether any formal action will be taken.

Prediction 7: The real estate industry will consolidate

Under the leadership of the new government, the Federal Trade Commission will be more likely to approve mergers and acquisitions between large companies. Unlike other industries with only a few dominant companies, the US real estate industry has long been fragmented, with multiple real estate search websites and brokerage firms of various sizes and business models competing for agents and clients. Although it is not uncommon for large brokerage firms to provide collateral loans or property rights services, we may see more brokerage firms, lenders, and property rights companies merging in hopes of gaining more business from each client.

Prediction 8: Climate risks will affect individual residences, especially in coastal areas of Florida

The risk of natural disasters will begin to lower housing prices or slow down price growth in climate risk areas, such as coastal areas of Florida, wildfire prone areas of California, and hurricane prone areas of Texas. Buyers and their agents will inevitably have a better understanding of the risks associated with each property. More homebuyers will move to relatively cheaper areas in the Midwest and Northeast, which can provide relative protection from climate driven disasters.

For many low - and middle-income homeowners in Florida, Hurricane Helen and Hurricane Milton were a turning point. This autumn, compared to a year ago, more homebuyers are looking to leave Florida, while the number of out of town homebuyers looking to move into the state has decreased. It is expected that this trend will translate into some Floridians moving out of the coastal areas of the state after getting tired of the destructive hurricane life, and as insurance costs, management fees, and property taxes soar, housing costs continue to rise despite the decline in housing prices. The coastal areas of Florida may become places where only wealthy people who can afford sky high insurance premiums or have cash to rebuild can live. It is expected that the luxury goods market along the coast of Florida will remain strong.

Prediction 9: The mayor of the blue city will help reverse the trend of people fleeing the city center

San Francisco has elected a pro business Democrat as its new mayor this year, Portland, Oregon has elected a mayor who promises to end homelessness, and several other major cities in the Blue State are implementing tough crime policies to revitalize the city center and retain residents. These political factors, coupled with many large companies (including tech companies) bringing employees back to the office, may lead people to flee coastal cities.

This is expected to be particularly true in California. Many residents of Jinzhou will have the motivation to stay because housing supply will continue to improve and price increases will be suppressed; Specifically, the ADU construction boom in places such as Los Angeles and the Bay Area is expected to continue providing more housing. Furthermore, chasing housing affordability in the desert is no longer meaningful, as housing prices in places like Phoenix and Las Vegas have risen and the climate has become hotter. Autonomous vehicle will begin to become more common. Under the leadership of the new government, more areas of California will become more livable. With the approval of self driving taxi hailing applications and buses, urban areas such as San Francisco and downtown Los Angeles will become more attractive, while suburban areas will also become more attractive, because personal autonomous vehicle will improve commuting conditions.

Prediction 10: Generation Z will rewrite the American Dream by removing homeownership from the script

Compared to high priced housing, low-priced housing is expected to flourish in 2025, but this is not because young or working-class Americans are starting to own homes. On the contrary, affordable housing will be snapped up by older buyers as their prices exceed higher price levels. Meanwhile, Generation Z will continue to live or rent with their families until their 30s and choose to accumulate wealth in other ways.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights