COT report: Japanese yen strengthens, traders turn to net long yen exposure

The COT report displays the holdings of different participants in the US futures market in the Chicago Mercantile Exchange futures market, which can serve as an emotional indicator for analyzing the market. There is a 3-day lag between the release date of the report and the actual positions held by the recorded traders. The report was released on Friday, but only the data up to Tuesday is included. In terms of announcement time, it is more suitable for long-term traders. The following is partial position data disclosed in the COT report released by the US Commodity Exchange Commission as of Tuesday, December 3, 2024.

Large speculators have switched to net long yen futures for the first time in six weeks. In the past two weeks, market positions have sent signals. The bullish position is certainly not extreme, with only 24000 contracts, but given the possibility of the Bank of Japan raising interest rates and asset management companies having a net short position of only 58000 contracts, and the potential turbulence that Trump's second term may face, we may see the yen strengthen at the beginning of the new year.

In addition, data also shows that traders' bearish views on GBP/USD futures have reached their lowest level in 28 weeks. Asset management companies have net short positions on VIX futures for the second consecutive week. Large speculators and asset management companies have increased their net long exposure to gold futures for the second consecutive week, with an increase of 94000 and 15000 contracts, respectively. The net long exposure to silver and copper futures has also slightly increased.

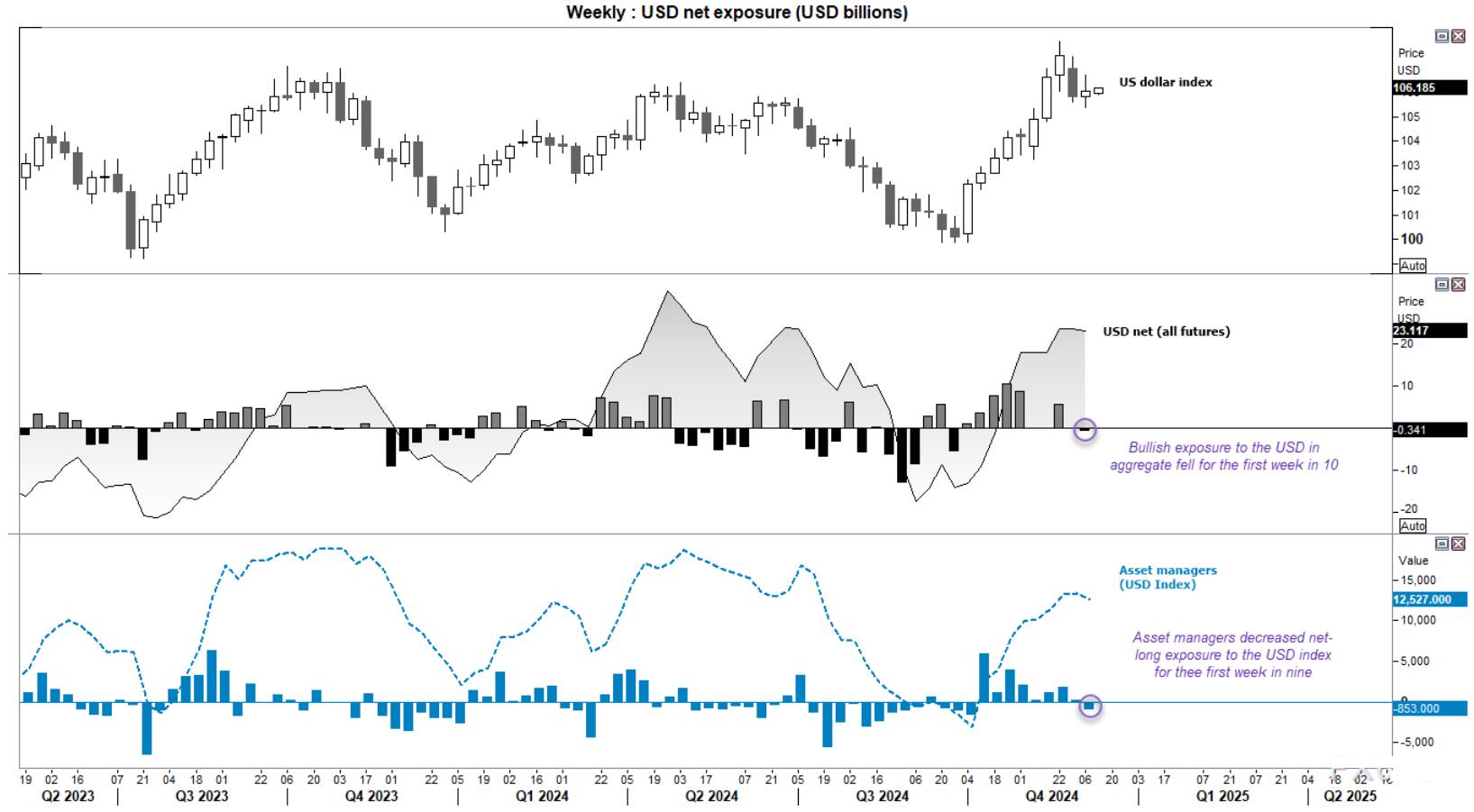

USD Position (IMM Data)

The trend of the US dollar index, the net exposure of all futures to the US dollar, and the net exposure of asset managers to the US dollar index, as well as the bullish exposure to the US dollar, have all decreased for the first time in 10 weeks

Last week, there were some small but potentially important signs in the US dollar position, indicating that the US dollar will face some adjustments. Asset management companies reduced their net long exposure in the first week of 9 years, and traders were generally not optimistic about the US dollar in the first week of 10 years.

This is not a call for excessive bearish sentiment towards the US dollar, but rather a further emphasis on the clues that the strong upward trend starting from $100 has changed its nature. I believe that the US dollar may rise in the first half of 2025, but before this trend resumes, we first need a trend pause (if not a correction). The important first step is to slightly reduce the long exposure of traders.

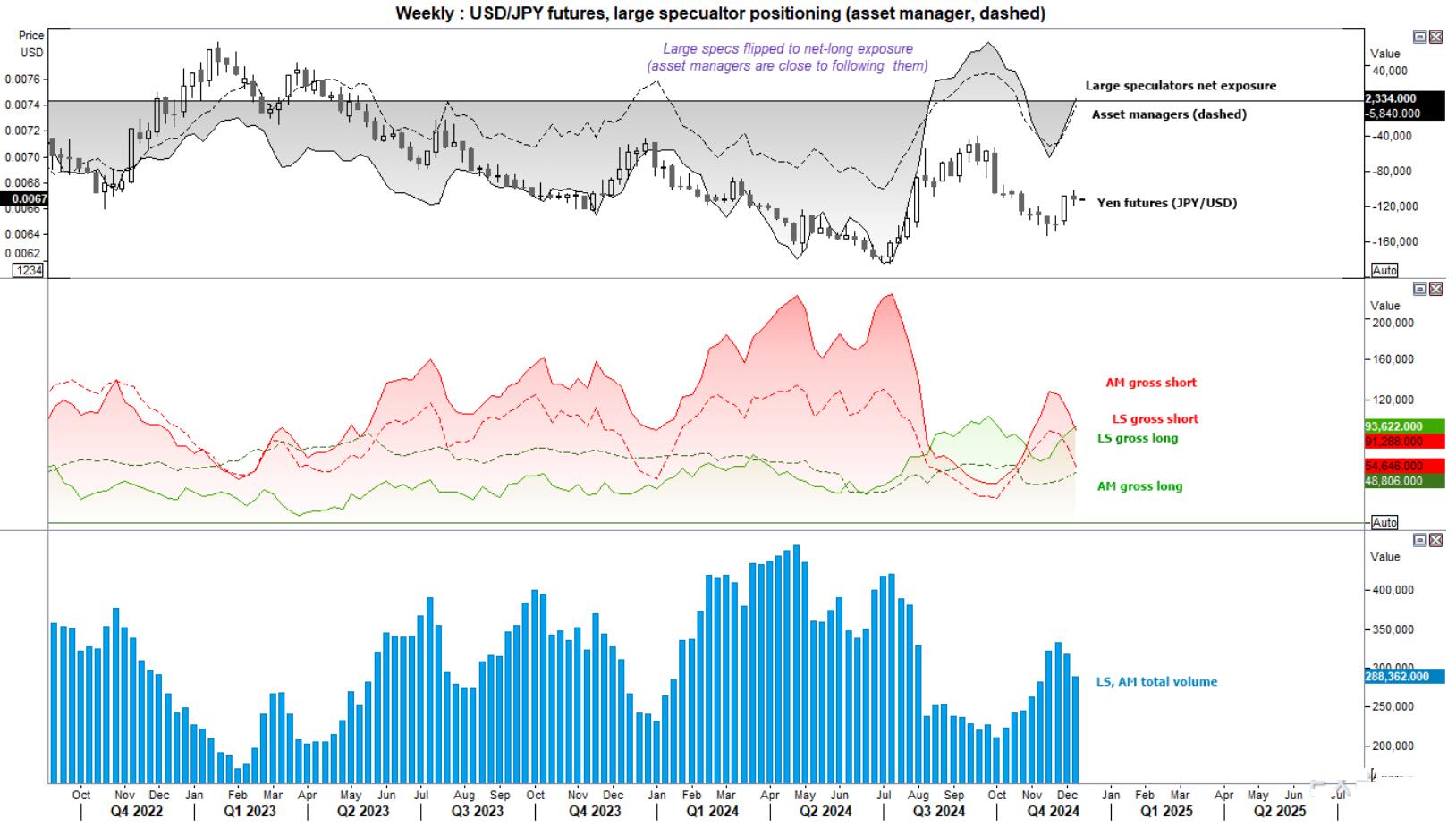

USD/JPY (Japanese Yen Futures) Position

The holdings of Japanese yen futures by asset managers (AM) and large speculators (LS) from the fourth quarter of 2022 to the second quarter of 2025

Large speculators have switched to net long yen futures for the first time in six weeks. In the past two weeks, market positions have issued warnings. Both types of traders have increased their long positions in the past four weeks and reduced their short positions in the past three weeks.

The bullish position is certainly not extreme, with only 24000 contracts, but given the possibility of the Bank of Japan raising interest rates and asset management companies having a net short position of only 58000 contracts, and the potential turbulence that Trump's second term may face, we may see the yen strengthen at the beginning of the new year.

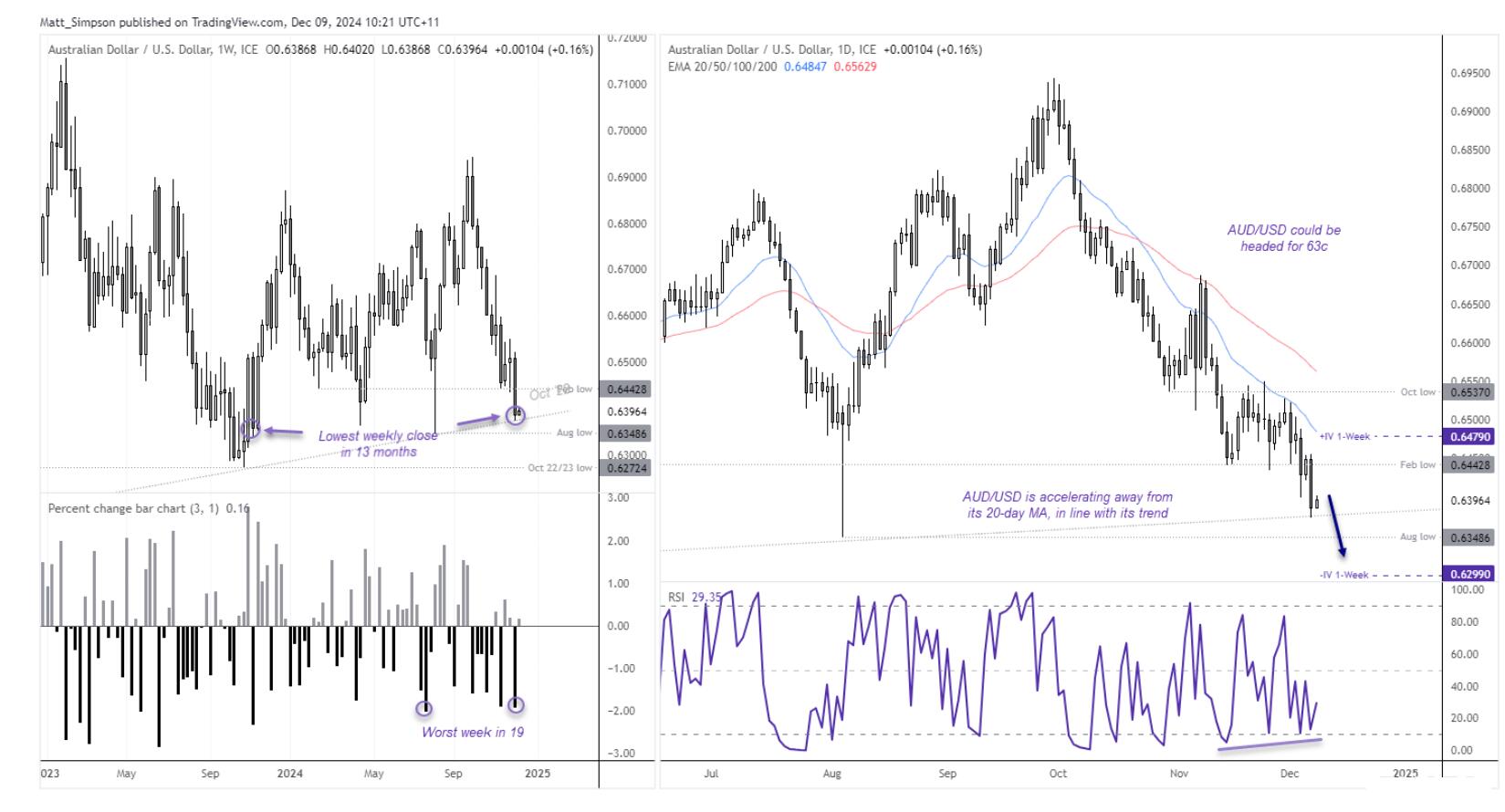

AUD/USD (Australian dollar futures) position

(AUD/USD exchange rate trends, moving averages, and RSI indicators)

Last week, futures traders made a bearish adjustment on AUD/USD and sold approximately 19000 contracts. Large speculators reduced their net long exposure by 104000 contracts, while asset management companies increased their net short exposure by 84000 contracts. In both cases, the trend is driven by an increase in bears and a decrease in bulls.

With the trend support for price testing in 2022, given the increasing possibility of the Reserve Bank of Australia cutting interest rates and strong US economic data, the likelihood of falling below this support seems to be greater.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights