12.10 Gold Trading Strategy: Turbulent Upward Resistance

Your profit comes from the losses of others. That is to say, when someone makes a mistake, the market will generate profits that can be earned by others. However, you cannot calculate or predict how many people will make mistakes or make big mistakes in the next step, nor can you guarantee that you will always stand on the right side. So, in trading, the only thing you can do is to try to make your mistakes as short as possible when they occur. The rest is to wait for others' mistakes and encourage them together.

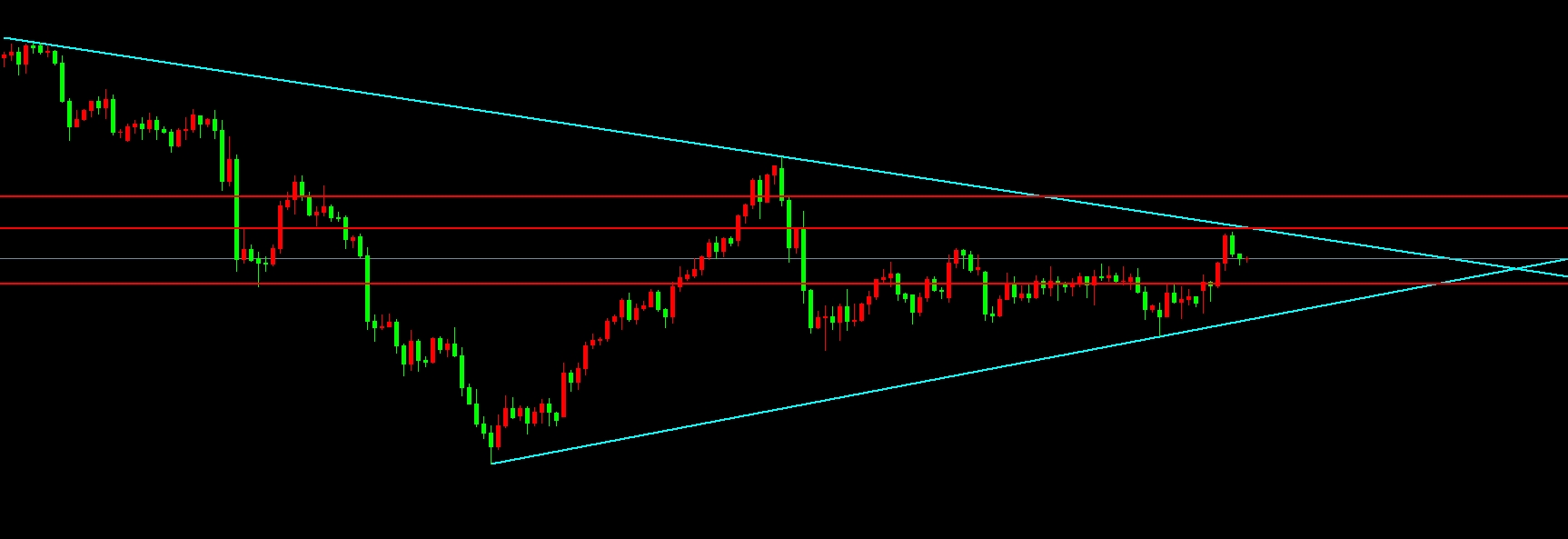

Yesterday, the gold market experienced a wide intraday washout, with prices opening high and falling low in the morning session. As expected, there was a wave of upward movement in the Asian session, followed by a new high in the European session after continuing the washout in the afternoon. The US session formed a surge and fell back, with the daily chart closing at 60 with a small bullish line with upper and lower shadows. From the perspective of the market, the daily chart rebound remained unchanged, and the short-term moving average formed a cohesive upward trend. However, overall, it is still in a rebound, with a wide range of fluctuations in the trend. Yesterday, the market rose and fell back, and today's expectations will be corrected before further testing the sideline and upper limit. From the channel perspective, this wave of rebound is mainly based on buying low and short selling, with high short selling as a supplement, until there is no bearish signal in the daily chart. It is expected that this Analyzing from multiple charts, the probability of testing 0.618 once is still high, For intraday traders, it is better to stick to the edge and sell when the market rises first, and buy when the market falls first.

Point on the Asian market: support 43 pressure 73 turning point 53 breakthrough above 88-93 below 36-24

In terms of operation: high throwing and low suction.

GBPJPY: The daily chart returns to the bottom line and confirms an upward trend. The market will continue to be bullish, with intraday reference support at 192.2-191.7-191

Crude oil: oversold rebound, bulls replenishing the market, targeting 69 and 67 points today.

The above ideas are for reference only. There are risks in the market, and investment needs to be cautious.

Trading is for profit, not for gambling or trading, so traders must understand what actions to take when the price is at a certain stage! Traders are not always long or short, they always change with the market! Traders must have their own defense system to control risks! Risk control and fund management are essential in your trading!

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights