US index focuses on daily resistance suppression, EURUSD focuses on daily support for upward movement

Macroscopic perspective

Recently, the gold market has been affected by multiple intertwined factors, and the situation is complex. From the demand side, the Chinese factor is receiving attention. In 2023, China will be the largest official buyer of gold. If purchases resume, it is expected to support domestic investment demand. The impact of global central bank monetary policies is also significant. The Federal Reserve has initiated a cycle of interest rate cuts, and traders expect an 86% probability of further cuts in December. In addition, the European Central Bank and others will also cut interest rates in the face of the eurozone crisis, reducing the cost of holding gold and increasing its attractiveness. Geopolitically, Syria has been frequently attacked by Israel, and the ongoing stalemate between Russia and Ukraine has led to an increase in demand for gold as a safe haven. However, there are also unfavorable factors. Overnight, the US dollar index and US Treasury yields rose slightly, causing the gold price to temporarily fall into a nearly two-week oscillation range, and it is highly likely to remain volatile before the release of US CPI data on Wednesday. Although the market is optimistic about the Fed's interest rate cut next week, investors are still waiting for price data as it will affect their expectations of a rate cut. In addition, the Reserve Bank of Australia's interest rate decision on this trading day is also worth paying attention to, and the subsequent changes in the gold market are worth continuing to monitor.

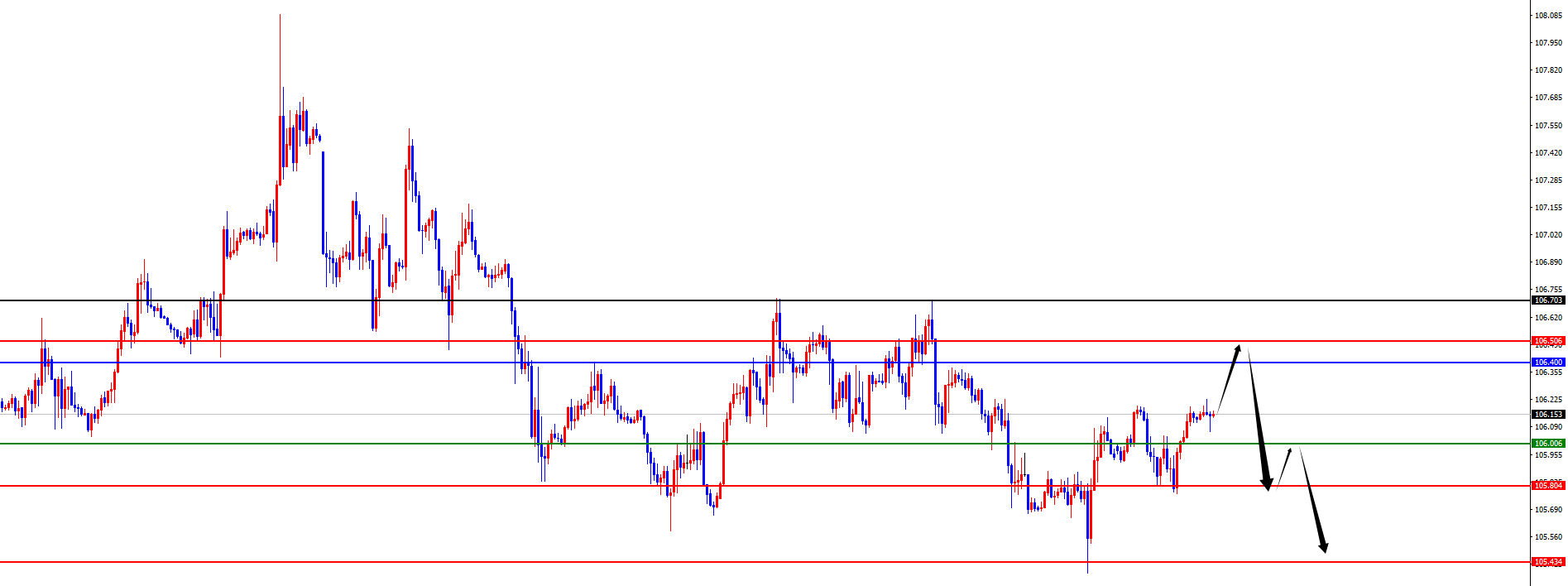

The US Dollar Index

In terms of the US dollar index, the overall price of the US dollar index showed an upward trend on Monday. The highest price of the day rose to 106.19, the lowest was 105.768, and closed at 106.136. Looking back at the performance of the US dollar index on Monday, after the morning opening, the price first fluctuated upwards in the short term, and then the short-term pressure broke through the low point of the morning session. However, for the US market, it rose again and eventually closed with a bullish candlestick. At present, the US dollar index continues to be suppressed in the daily resistance area of 106.40, so we will continue to pay attention to the pressure in this area until the daily resistance is broken. In the future, we will focus on the pressure in the 106.40-50 range, and below it, we will focus on the support in the 105.80-105.40 range.

Short selling in the 106.40-50 range of the US Composite Index, defending against $5, with a target of 105.80-105.40

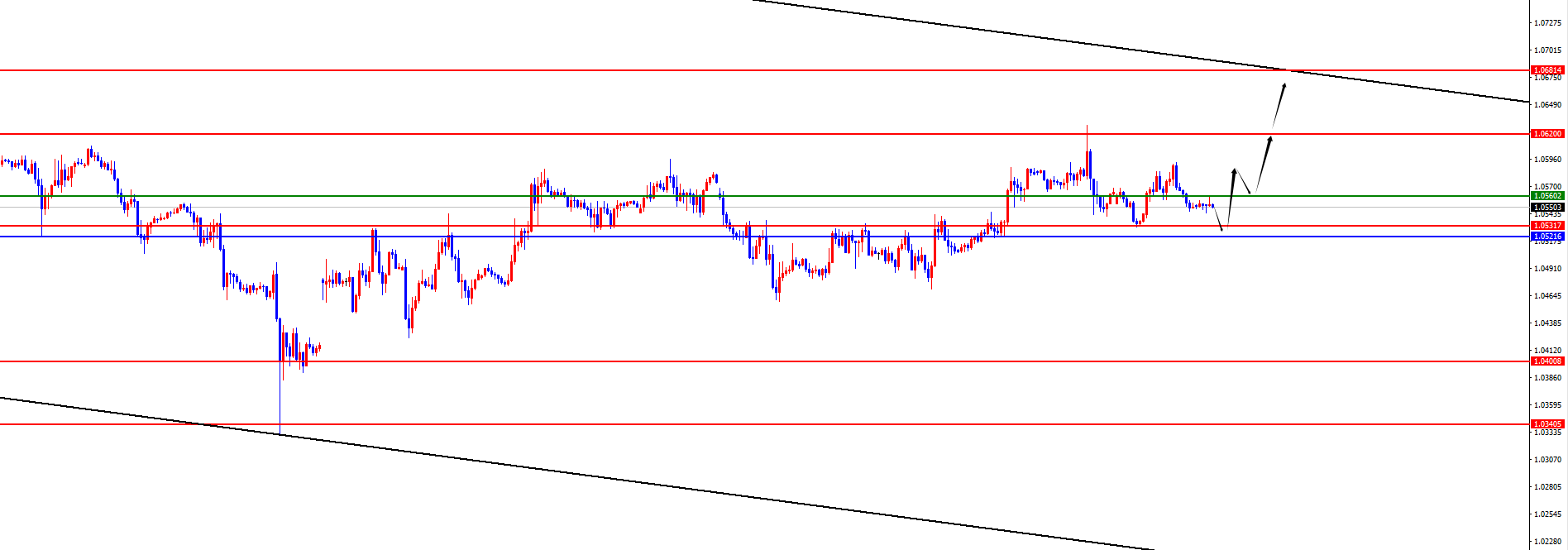

In terms of EURUSD, the overall price of EURUSD showed a fluctuating state as scheduled on Monday. The lowest price of the day fell to 1.0531, the highest rose to 1.0594, and closed at 1.0552. Looking back at the performance of the European and American markets on Monday, the price initially fell under short-term pressure during the morning session, and then gained support above the daily support to further rise. However, during the US session, the price continued to rise in the short term and instead came under pressure again, indicating that the price is still oscillating. As the price is currently running above the daily support, as long as it does not break, we will rely on the daily support to continue to see oscillating increases. The daily support is temporarily focused on the 1.0520 area, and the four hour support is temporarily focused on the 1.0560 area. Therefore, we will temporarily focus on the daily support of the 1.0520-30 range to see an upward trend, and the four hour resistance breakthrough performance above it. After breaking, we will focus on the 1.0620 area.

EURUSD 1.0520-30 range, defend 40 points, target 1.0560-1.0620

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights