US CPI data hits, US index, EURUSD trend analysis

Macroscopic perspective

Recently, the situation in the Middle East has been tense. Israel announced on the early morning of December 11th that it had struck 320 strategic targets in Syria and would deploy troops in the border military buffer zone. At the same time, the Israeli delegation went to Cairo to discuss the ceasefire in Gaza and other matters, and the Syrian capital is also undergoing positive changes. On the economic front, the global easing trend is receiving attention. The central banks of Canada, Europe, and Switzerland are expected to cut interest rates later this week, and the Federal Reserve is likely to cut interest rates next week, but may pause at the end of January. The cooling down of the US job market has shown resilience, consolidating expectations of interest rate cuts. This trading day also has some highlights, The impact of CPI and PPI data is significant, and gold should have appreciated in a low interest rate environment. However, the continued rise in the US dollar index and US Treasury yields on Tuesday has limited its performance. The Bank of Canada's interest rate decision is expected to be released, with the market expecting a 50 basis point rate cut, and Iran's top leader will give a speech on the situation in the Middle East. Many factors affect the international and economic situation, and investors need to closely monitor changes to make decisions.

The US Dollar Index

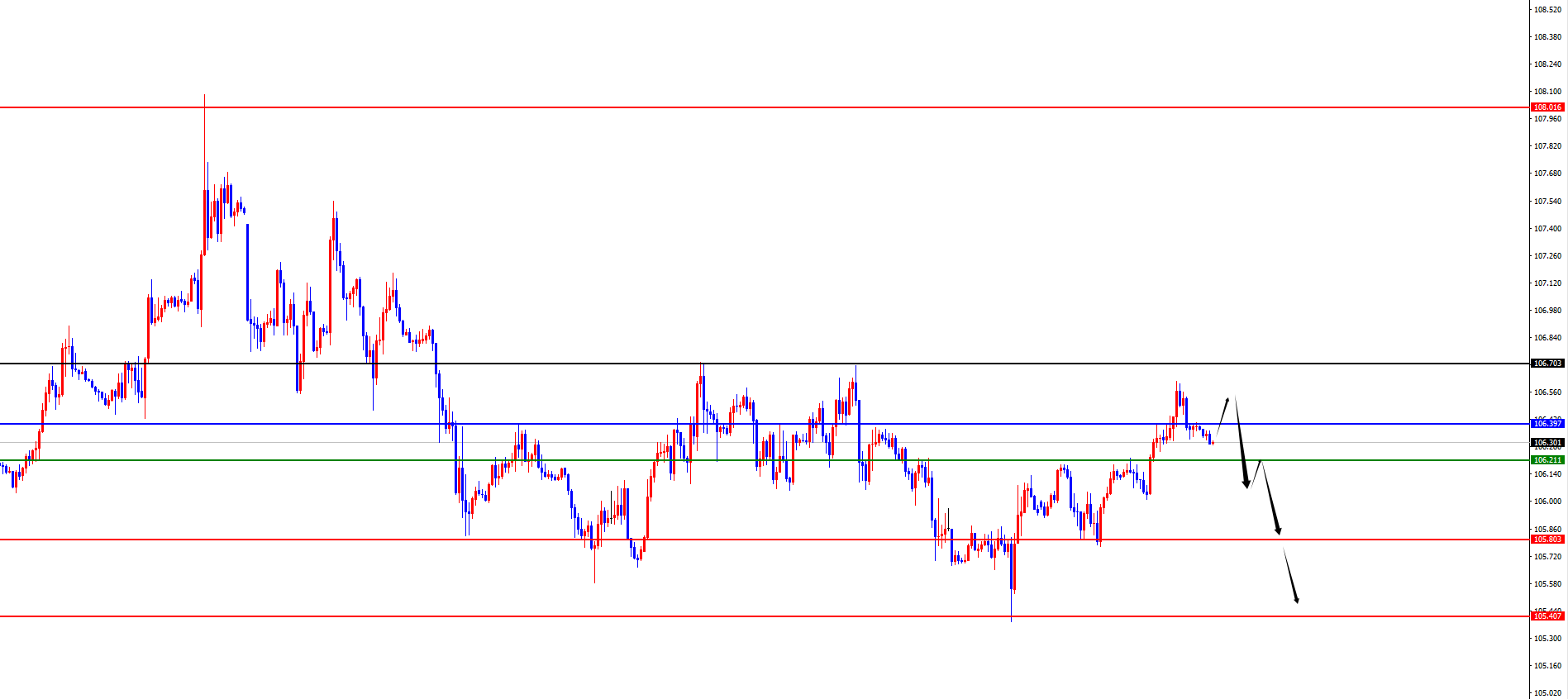

In terms of the US dollar index, the overall price of the US dollar index showed an upward trend on Tuesday. The highest price of the day rose to 106.614, the lowest was 106.012, and closed at 106.383. Looking back at the performance of the US dollar index on Tuesday, after the morning opening, the price first fluctuated in the short term and then continued to rise after four hours of support. Subsequently, as the author mentioned, the price tested the key resistance area, and the daily level finally ended with a strong bullish trend. At present, the weekly support of the US Composite Index is in the 104 area, and the daily resistance is in the 106.70 area. In the early stage, the price broke through the daily support and is currently oscillating under the resistance of the daily line. Therefore, before breaking above 106.70, it will be treated as under pressure, and only after breaking above the daily support will it continue to rise further. At present, in the short term, we continue to pay attention to the watershed of the 106.20 area for four hours, and after breaking it down, we will continue to be under pressure.

Short selling in the 106.40-50 range of the US Composite Index, defending against $5, with a target of 105.70-105.40

【EURUSD】

In terms of EURUSD, the overall price of EURUSD showed a downward trend on Tuesday. The lowest price of the day fell to 1.0497, the highest rose to 1.0567, and closed at 1.0526. Looking back at the EURUSD market performance on Tuesday, the price fluctuated briefly during the morning session, then tested the resistance for four hours before falling under pressure. The price tested the daily support area downwards, although it broke through in the evening, the final closing was still above the daily support. Currently, the EURUSD price is showing further upward performance, but it is important to note that it must break through the resistance of 1.0550 for four hours, otherwise it is necessary to be cautious of further bottoming out and rebounding.

EURUSD 1.0520-30 range, defend 40 points, target 1.0570-1.0620

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights