How do gold, oil, and foreign exchange fluctuate? Tonight we're watching the Bank of Canada resolution, and this week we're also watching the US CPI!

On Wednesday (December 11th), the financial market showed a highly volatile trend driven by both heavy data and key events. The US dollar rose before the release of the US Consumer Price Index (CPI) data, precious metal prices fluctuated steadily, and crude oil rose due to the optimistic outlook of China's economic policies. The following are the latest developments and analysis of major markets:

Crude oil market: improved demand outlook drives oil price rebound

Brent crude oil is currently trading at $72.83 per barrel, up 1.12%, while US crude oil prices are at $69.24 per barrel, up 0.95%. The main driving force behind the rise in oil prices comes from China's commitment to adopt a "moderately loose" monetary policy to promote economic growth. This news has boosted optimistic expectations in the market for a rebound in demand from the world's largest crude oil importing country.

China's crude oil imports in November increased by over 14% year-on-year, marking the first year-on-year growth in seven months. Meanwhile, analysts point out that China may shift from its past stimulus policies focused on infrastructure and new energy to encouraging consumer spending. This move may further boost demand for crude oil.

Despite the high bullish sentiment in the oil market, the market still needs to be vigilant about potential uncertainties. The United States may increase sanctions on Russian oil trade, which will have an impact on the supply chain. In addition, the growth of US crude oil and fuel inventories may limit the upward potential of oil prices. In the short term, oil prices may fluctuate within the range of $72-74 per barrel, waiting for clearer demand signals.

Precious metal market: Gold prices remain stable, awaiting guidance from inflation data

Spot gold prices fell slightly by 0.03% to $2693.36 per ounce, indicating cautious trading in the overall market. Prior to the release of CPI data, investors' assessment of the Federal Reserve's policy outlook will have a significant impact on the trend of gold prices.

Gold, as a safe haven asset, has always been highly sensitive to changes in Federal Reserve policies. Analysis suggests that if CPI data meets expectations, the Federal Reserve is expected to cut interest rates by 25 basis points next week, and market expectations for this have reached 86%. The environment of interest rate cuts is usually favorable for gold prices, but if inflation data unexpectedly remains high, it may delay the implementation of loose policies and suppress the upward trend of gold prices.

It is worth noting that the market still has confidence in the long-term prospects of gold. Renowned institutions predict that by the end of 2025, gold prices may reach $3000 per ounce. But the potential risk is that if the Federal Reserve's easing falls short of expectations, the rise in gold prices may be limited. In the short term, gold prices may fluctuate between $2650-2750 per ounce, and we need to pay attention to the direct impact of tonight's data on market sentiment.

Foreign exchange market: US dollar index strengthens, non US currencies under pressure

The US dollar index is currently up 0.29%, trading at 106.7151. The US CPI data is about to be released, and investors are generally concerned that if the data is higher than expected, it may weaken market confidence in the Fed's interest rate cuts, thereby driving the US dollar stronger.

EUR/USD fell 0.31% to 1.0493; GBP/USD fell 0.38% to 1.2722. The market's expectations for the European Central Bank's policy meeting are biased towards caution, and inflation data may become a key driving factor for the trend of European currencies in the coming days.

In terms of Asian currencies, the Chinese yuan fell due to reports, while the US dollar rose 0.23% against onshore Chinese yuan and 0.24% against offshore Chinese yuan. At the same time, both the Australian dollar and the New Zealand dollar hit a new low for the year, with the Australian dollar at $0.6358 and the New Zealand dollar at $0.578, respectively falling 0.3% during the day.

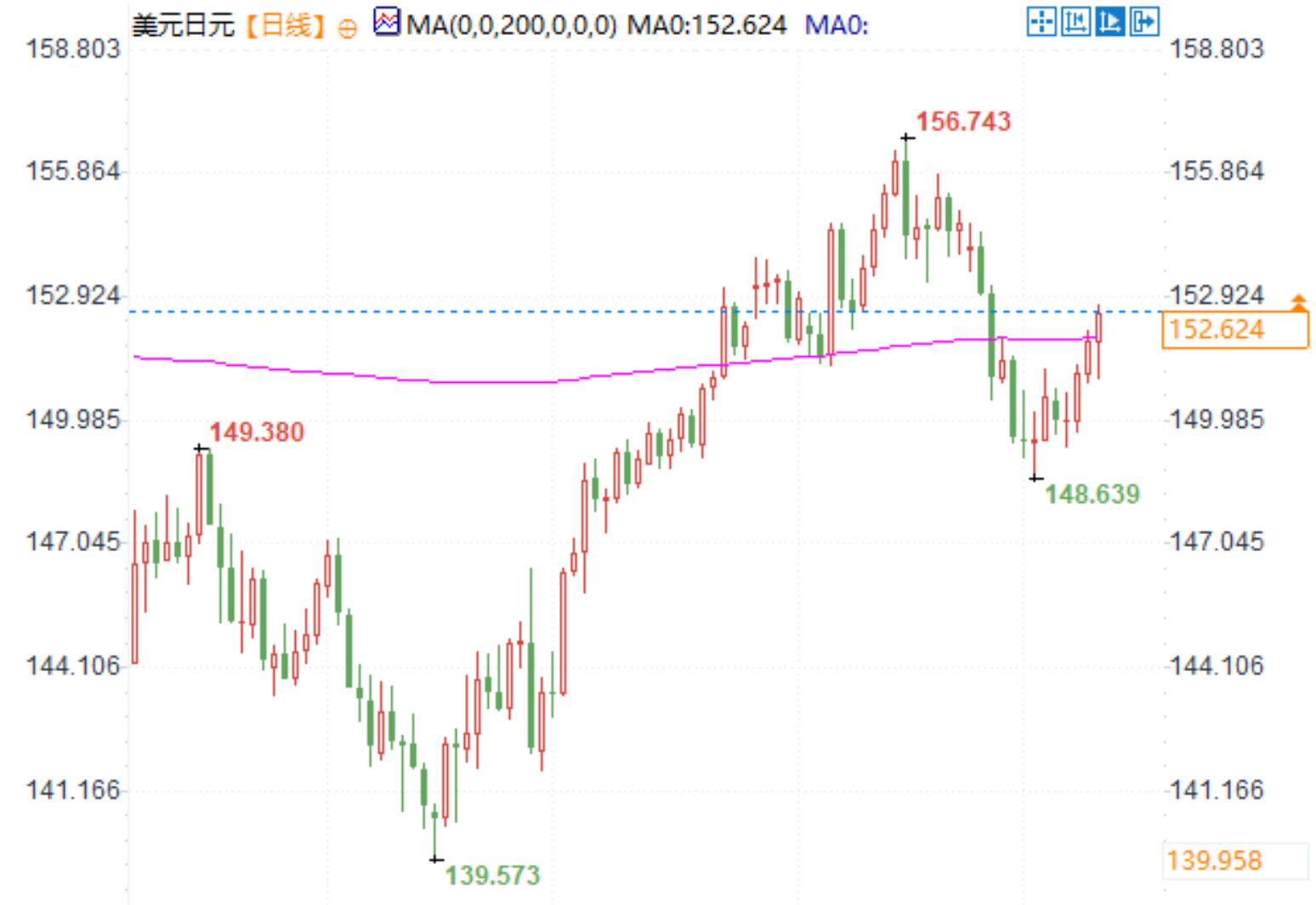

The trend of the Japanese yen is relatively strong, and the expectation of the Bank of Japan raising interest rates in December has increased due to the acceleration of wholesale inflation in Japan. The US dollar rose 0.44% against the Japanese yen to 152.626, but the market is concerned about whether there will be more signals supporting interest rate hikes.

Bond Market Dynamics: Focusing on the Policy Prospects of the Federal Reserve

The market expects a high possibility of the Federal Reserve cutting interest rates, but if the CPI data is higher than expected, it may shake this expectation. Bond market investors will closely monitor the changes in the yield curve after the data is released, as well as the policy interpretation by Federal Reserve Chairman Powell next week. US Treasury yields may remain volatile at high levels in the short term until market expectations become further clear.

Market outlook: Multiple factors drive trends

Tonight's US CPI data is undoubtedly the core focus of the market. The result will directly affect the short-term direction of the US dollar, precious metals, and bond markets, while also providing important clues for next week's Federal Reserve meeting.

For the crude oil market, China's policy shift and seasonal demand growth may provide support for oil prices, but the risk of escalation of US sanctions against Russia needs to be cautious. In terms of precious metals, gold may benefit from the expectation of interest rate cuts after inflation data meets expectations, but if the data unexpectedly rises, gold prices may come under pressure in the short term.

In the foreign exchange market, the strength of the US dollar may continue, while non US currencies still face many pressures, especially those with high economic ties to China. Overall, the market will continue to be guided by data and policies in the short term, and investors need to remain cautious and closely monitor new news developments.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights