The gains and losses of daily support for the US index are crucial, and EURUSD is concerned about the gains and losses of daily resistance

The report from the US Department of Labor shows that the month on month increase in CPI in November reached its largest in seven months. Although overall inflation remains high, price pressures in areas such as rent and motor vehicle insurance have eased, driving a slowdown in service sector inflation. The cooling trend in the labor market is being monitored by the Federal Reserve, and the market expects it to cut interest rates by 25 basis points for the third consecutive time next week. The Bank of Canada cut interest rates by 50 basis points to 3.25% on Wednesday, and considering external factors such as Trump's potential tariffs, future interest rate cuts will be more gradual. US President elect Trump plans to issue over 25 executive orders on his first day in office to reshape policies in multiple areas. The European Central Bank is almost certain to cut interest rates again on Thursday due to inflation and economic conditions, with hawks possibly leading a slight 25 basis point reduction. The current market has digested expectations of interest rate cuts from the US and Europe, and investors are focusing on changes in US PPI data and initial jobless claims. At the same time, the direction of Trump's policies and geopolitical risks are also highly concerned. The global economic situation is complex, and central bank decisions are influenced by multiple factors. Investors need to make investment decisions based on economic data and policy dynamics.

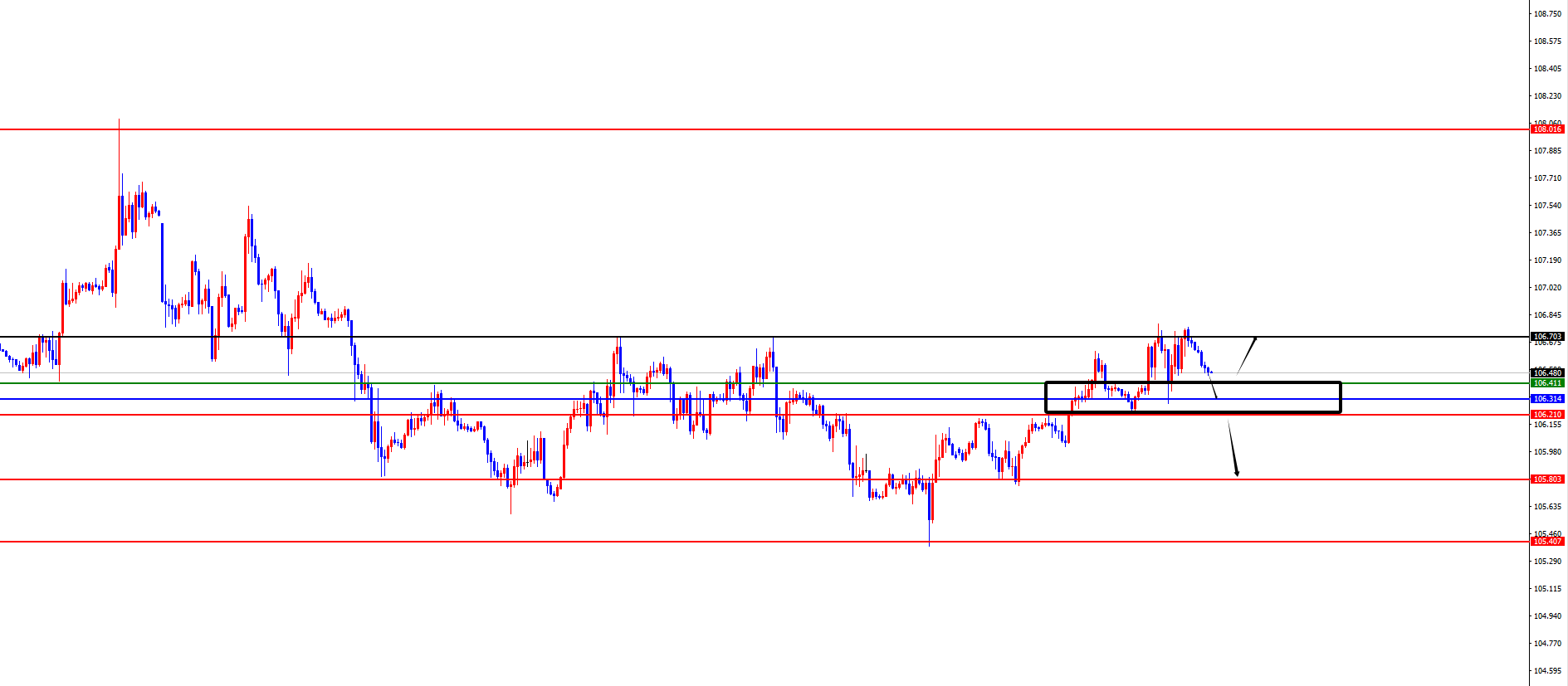

The US Dollar Index

In terms of the US dollar index, the overall price of the US dollar index showed an upward trend on Wednesday. The highest price of the day rose to 106.786, the lowest was 106.242, and closed at 106.624. Looking back at the price performance of the US dollar index on Wednesday, after the morning opening, the price was initially under pressure and corrected in the short term, and then rose based on four hours of support. However, for the price range fluctuations after the European market, the overall price is still fluctuating within the range. We will focus on the gains and losses within the 106.20-30 range in the future. Once the price breaks, there will still be pressure in the future.

The US Index focuses on the gains and losses of the 106.20-40 watershed

【EUR/USD】

In terms of EURUSD, the overall price of EURUSD showed a downward trend on Wednesday. The lowest price of the day fell to 1.0479, the highest rose to 1.0539, and closed at 1.0492. Looking back at the performance of the EURUSD market on Wednesday, during the morning session, the price was adjusted upwards in the short term to test the resistance for four hours, and then came under pressure again. Subsequently, it maintained a volatile decline throughout the day, and the daily price still ended in a bearish trend. At present, the short-term market in Europe and America is still under pressure, but once the price breaks through the resistance range of 1.0520-30 in the future, it is expected to further open up an upward trend. Otherwise, it will still be treated as fluctuating pressure for the time being.

EURUSD focuses on the gains and losses of the 1.0520-30 watershed

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights