Institutions predict that silver may outperform gold again next year, with spot prices expected to reach $40

Heraeus precious metals analysts say that although the possible economic recession in the second quarter of the United States will affect industrial demand for silver, most of the recent strength of this gray metal is expected to continue into the new year, and silver prices are expected to outperform gold by 2025.

In the 'Precious Metals Forecast 2025', analysts stated that if market conditions develop as expected, they believe silver will once again surpass gold in 2025.

They pointed out that "silver prices have risen the most among all precious metals this year (up 26.82% as of the end of November). Earlier this year, the next phase of the global interest rate cycle began, which has been helpful for both gold and silver. At the same time, the sustained growth in demand for solar photovoltaics and the strong rebound in implicit demand in India have also supported physical prices

Analysts point out that the rise in the gold to silver ratio indicates that despite the industry-leading uptrend this year, silver is still historically undervalued relative to gold. Due to the rise in silver prices, the return of the 27 year average gold to silver ratio of 67 means that silver prices will reach $40 per ounce.

However, Heraeus warns that investors should not underestimate the risk of economic recession and its impact on demand. Analysts said, "Earlier this year, the US Treasury yield curve experienced a reversal after the longest inversion period since 1980. This indicator has a very strong record in predicting a US economic recession in the next 6-12 months. Although many sectors of the US economy, including the stock market, are showing relatively strong performance from the yield curve, the US may fall into a recession by the second quarter of 2025

They pointed out, "In economic downturns, silver often performs worse than gold. If industrial activity shrinks as a result, industrial silver demand may hardly increase, except for electrical and electronic products, especially solar photovoltaic demand

As for silverware and jewelry, Heraeus warns that India's demand in these areas may decline next year.

They wrote, "India is the largest market for silverware and jewelry manufacturing demand, and silver imports have surged this year as jewelers and manufacturers replenish their inventories after a sluggish 2023." "With the decline in silver landed prices, import tariff cuts in mid-2024 have driven up consumption. The historical cycle of silver imports in India suggests that 2025 may be a weak year, and with psychological incentives fading, silver price increases above pre tariff levels may also discourage some purchases

On the other hand, it is expected that solar energy demand will continue to maintain its recent strong momentum in 2025.

Analysts say, "The strong demand for silver in the solar energy industry, especially in major Asian countries, has been one of the main driving forces for the growth of total silver demand in recent years." "The country is expected to catch up with the record high installed capacity in 2023, and the overcapacity in the country's photovoltaic manufacturing industry means that there is no demand constraint on the installed capacity in the near future. It is expected that the demand for silver from solar energy will continue to be strong next year, and more and more countries are moving towards gigawatt level installed capacity. Deploying more topcon type batteries with higher silver content per watt will also support silver demand, which may rise again in 2025

Recycling is another area that Heraeus expects to grow in the coming year. They wrote, "Historically, the scrap rate and recycling rate of silver have been closely related to silver prices." "This year, it is expected that the recycling volume will reach the highest level in 12 years. As prices rise, extracting and recycling more silver in various applications becomes economical. It is estimated that this situation will continue in 2025 as silver prices remain above $28 per ounce

They also pointed out that the restart of some new and existing mines is scheduled to start production next year, "which could increase primary supply by about 10 million ounces, equivalent to a projected production growth of about 1.2% in 2024

They added, "Most of the extracted silver is a byproduct of copper, lead, and zinc mines. It is expected that by 2025, the production of these three commodities will increase year-on-year and may increase the supply of mined silver

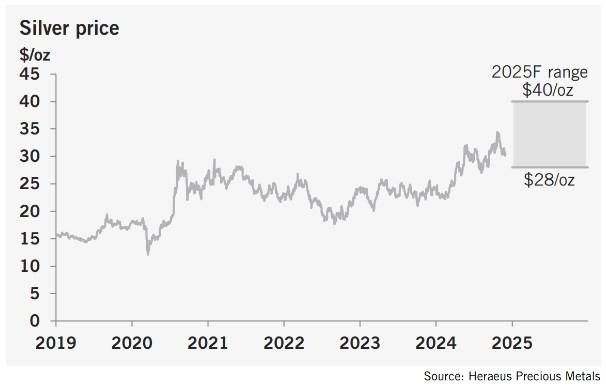

Heraeus expects silver spot prices to be between $28 and $40 per ounce by 2025.

Figure: Silver price forecast range for 2025. Note: Spot silver closed at $31.88 per ounce on December 11th.

Analysts said, "Driven by the continued expansion of demand for solar photovoltaics, industrial demand is expected to grow by 2025. Due to the risk of economic recession in the United States, the Federal Reserve may continue to cut interest rates, which could weaken the US dollar and support gold and silver prices

They concluded, "As a metal with a high beta coefficient, it is expected that silver will relatively outperform gold

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights