Expectations of Federal Reserve interest rate cuts increase, putting pressure on the Eurozone economy

The November US economic data and measures taken by multiple central banks have impacted the global economic landscape. The November PPI in the United States showed significant month on month and year-on-year increases, with different performances in segmented data. The positive report from the Department of Labor led to a downward revision of the core PCE inflation rate forecast, and the slowdown in the labor market consolidated market expectations for the Federal Reserve's third consecutive interest rate cut next week. The US dollar rose to a nearly two-week high on Thursday. The European Central Bank cut interest rates for the fourth time this year on Thursday, abandoning related language to leave room for more loose policies, as its economy is threatened by regional politics and the US trade war, posing a downside risk to growth. The Swiss National Bank also cut interest rates by 50 basis points, the largest decline in nearly 10 years, due to weak inflation in Switzerland. Overall, the inflation data in the United States reflects different trends in prices, and changes in the labor market affect expectations of interest rate cuts. The actions of the European Central Bank and the Swiss National Bank reflect global economic growth pressures and inflation changes, while the future trend of US inflation is still influenced by the policies of the Trump administration, and many related developments need to be continuously monitored.

In terms of the US dollar index, the overall price of the US dollar index showed an upward trend on Thursday. The highest price of the day rose to 107.016, the lowest was 106.327, and closed at 106.969. Looking back at the performance of the US dollar index on Thursday, after the morning opening, the price was initially under pressure and fell in the short term. Then the price hit the four hour and daily support range and stopped, and then quickly rose. At the same time, during the US trading period, the price fluctuated and then rose, and finally closed at a high level. Currently, it seems that there is still further room for the US dollar index price to rise. If the price is above the daily support level of 106.30, it should be treated as a bullish band. For short-term operations, focus on the 4-hour support range of 106.70-80, and above it, focus on the 107.20-107.50 area. If it is strong, focus on the 108 area.

Buy long in the 106.70-80 range of the US Composite Index, defend 40 points, target 107.20-107.50-108

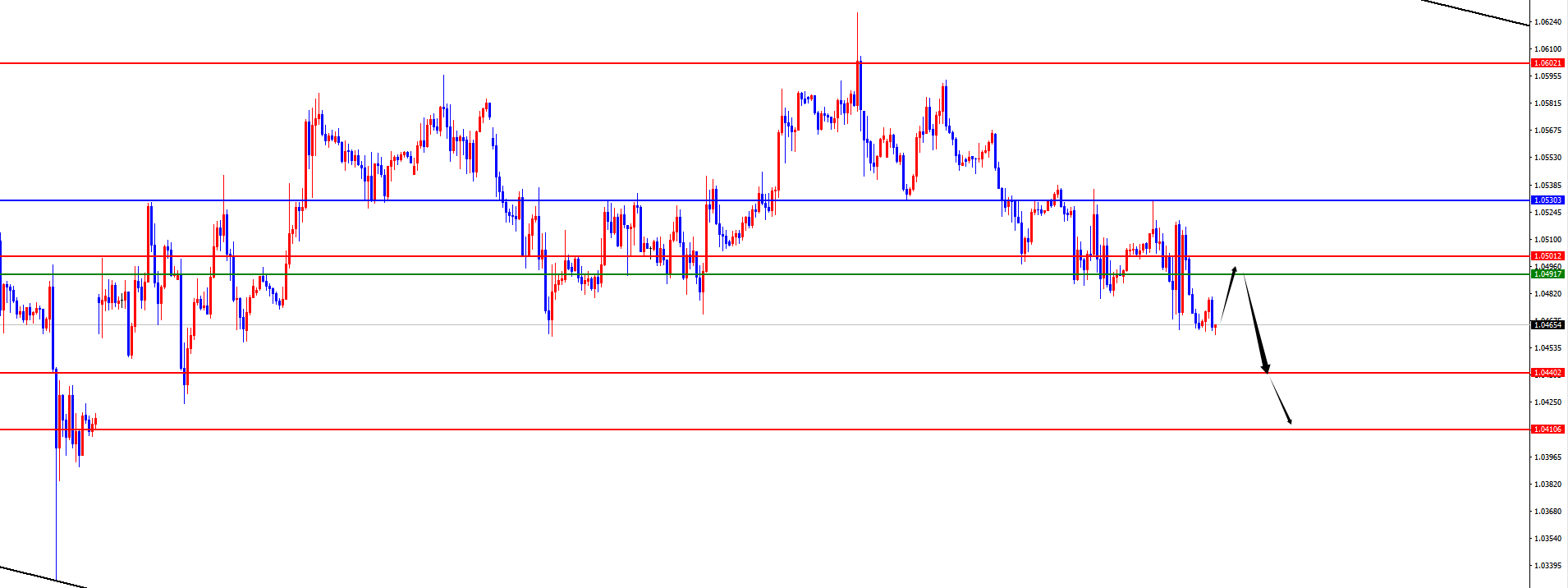

In terms of EURUSD, the overall price of EURUSD showed a downward trend on Thursday. The lowest price of the day fell to 1.0463, the highest rose to 1.0530, and closed at 1.0466. Looking back at the EURUSD market performance on Thursday, the price corrected upward in the short term during the morning session, then stopped when the price reached the four hour and daily resistance range, and continued to be weak during the European session. At the same time, there was a volatile pressure during the US session, and the daily line ended in a big bearish trend. Currently, the price has not stabilized upward, so it is still weak for the time being. In terms of operation, we temporarily rely on the resistance range of 1.0490-1.0500 within the four hour resistance to bear pressure, and pay attention to the 1.0440-1.0410 area below.

Short selling in the EUR/USD 1.0490-1.0500 range, defending 40 points, targeting 1.0440-1.0410

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights