Strong support from three major factors, gold price is expected to further rise in 2025

ING Group stated that optimistic macroeconomic conditions, ongoing geopolitical risks, and strong sovereign buying will drive gold prices to reach a new high in 2025.

Commodity strategist Ewa Mantey wrote in her ING 2025 gold forecast: "Gold is one of the best performing commodities among major commodities this year. Since the beginning of the year, gold prices have soared by over 25%, with record highs supported by optimistic interest rate cuts, strong central bank buying, and strong Asian buying. The intensification of geopolitical risks and the risk aversion demand brought about by the uncertainty before the November US election have also supported gold's record breaking rise this year

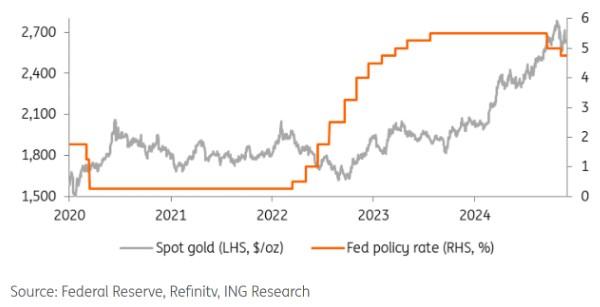

Figure 1: Amid the Federal Reserve's interest rate cuts and tensions in the Middle East, gold hits a new high in 2024 (yellow line refers to gold, gray line refers to the US dollar index)

The start of the Federal Reserve's interest rate cut cycle significantly boosted gold prices in 2024. She said, "The Federal Reserve implemented the long-awaited interest rate cut in September, the first time since March 2020, by 50 basis points, providing favorable conditions for gold prices. The Fed also cut interest rates by 25 basis points at its November meeting, keeping the target range for the federal funds rate at 4.5-4.75%

Mantey added, "The main question currently facing the gold market is how quickly the Federal Reserve will relax its policies after Trump wins the US presidential election, and the inflationary impact of Trump's policies may lead to lower interest rates than previously expected. Our US economist James Knightley believes that the US central bank will cut interest rates by another 25 basis points in December, but the outlook thereafter is not very clear, and there is a high possibility of suspending interest rate cuts at the Federal Open Market Committee (FOMC) meeting in January

Figure 2: The decrease in borrowing costs is beneficial for gold (gray line refers to spot gold, yellow line refers to the Federal Reserve policy rate)

Knight has lowered its expectation for interest rate cuts in 2025 from 50 basis points to 25 basis points on a quarterly basis starting from the first quarter of 2025, and the interest rate is expected to bottom out at 3.75% in the third quarter of 2025.

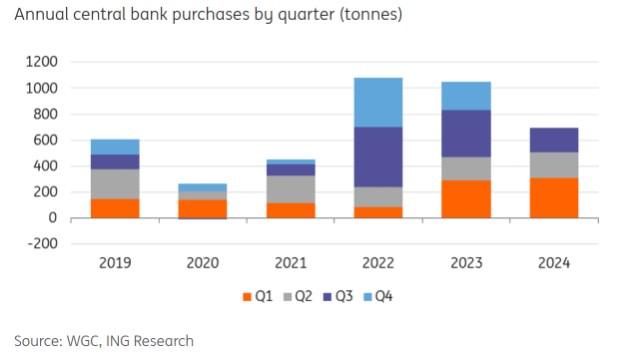

ING expects that central bank gold demand will remain strong in the coming year, which will continue to support gold prices at historic highs.

Mantey wrote, "Central banks around the world continue to increase their gold reserves, but the pace of purchases slowed down in the third quarter as high prices prevented some buying. The healthy demand for gold from central banks around the world is also driven by factors such as concerns about similar sanctions on their overseas assets after the United States and Europe decided to freeze Russian assets, as well as a shift in foreign exchange reserve strategies

She stated that although sovereign buying remains strong this year, ING expects the total for the year to be lower than the total for 2022 and 2023.

Figure 3: Annual central bank demand may be lower than the previous two years (each color represents a quarter)

Mantey said, "Looking ahead to next year, due to geopolitical tensions and economic conditions, we expect central banks around the world to remain buyers of gold. A survey conducted by the World Gold Council in April 2024 found that 29% of central bank respondents plan to increase their gold reserves in the next 12 months

ING also expects that the inflow of ETF funds will resume growth in the near future and continue to grow in 2025.

She pointed out, "With the support of funds from North America and Asia, global gold ETFs have seen inflows for six consecutive months. Investors' holdings of gold ETFs usually increase when gold prices rise, and vice versa. However, for most of 2024, the holdings of gold ETFs have been declining, while spot gold prices have hit new highs. ETF fund flows finally turned positive in May

Mantey said that although ETF holdings declined in early November after the US election, "looking ahead to 2025, we believe that as the Federal Reserve continues to cut interest rates, capital inflows should continue

ING's overall stance is that gold prices will continue to rise in 2025, and the bank expects the average price in the first and second quarters of 2025 to approach this year's historical high.

She said, "We believe that the positive momentum of gold will continue in the short to medium term, and the macro background may continue to favor precious metals, as interest rates decline and foreign exchange reserves continue to diversify under geopolitical tensions, creating a perfect storm for gold

She concluded, "In the long run, the policies proposed by Trump, including tariffs and stricter immigration controls, are essentially inflationary and will limit the Fed's interest rate cuts. The strengthening of the US dollar and tightening monetary policy may ultimately bring some resistance to gold, but intensifying trade frictions may increase its safe haven appeal

ING expects the average spot gold price to be $2800 per ounce in the first and second quarters of 2025, then fall back to $2750 in the third quarter, $2700 in the fourth quarter, and $2760 per ounce in 2025.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights