The bleak economic outlook in Europe may force policymakers to cut interest rates beyond market expectations

Investors such as Pimco and Fidelity International have stated that the bleak economic outlook in Europe may force policymakers to cut interest rates more than market expectations.

The latest pricing indicates that the European Central Bank will lower its key interest rate to 1.75% next year, following officials' third consecutive rate cut to 3% on Thursday. However, Fidelity stated that borrowing costs may further decrease to 1.5%, and Pimco also sees the risk of further decline.

Further repricing may promote the rebound of European debt, which will outperform the US and UK bond markets in 2024. The Bloomberg index, which tracks the return on euro government debt, rose more than 3% this year, while the US treasury bond bond rose by 2%.

Salman Ahmed, Global Head of Macro and Strategic Asset Allocation at Fidelity, said that the market "is still more hawkish than we expected, and if downside risks become a reality, the European Central Bank may further cut interest rates

ECB President Lagarde's tone at the press conference was not as mild as market expectations, leading to a decline in European bonds on Thursday. Italian bonds, which are often more sensitive to changes in monetary policy, have experienced significant declines.

Nevertheless, the overall outlook for economic activity in the region remains bleak. The manufacturing and service industries are facing difficulties, and the economic powerhouse Germany has faced a second consecutive year of contraction. At the same time, the two largest economies of the European Union are experiencing political turmoil.

On the 11th, German Chancellor Scholz officially proposed to the German Bundestag (lower house of parliament) that a vote of confidence in his government will be held on the 16th. The German Bundestag has a total of 733 members, and in order to gain parliamentary trust, Scholz must obtain over 367 votes to continue in power. But currently, only the German Social Democratic Party parliamentary group with 207 members has expressed support for the Chancellor, while the ruling partner Green Party parliamentary group with 117 members is expected to abstain in the vote of confidence, and the largest opposition party, the Christian Democratic Union, will not support Scholz. The German media generally believes that Scholz will not be able to pass the vote of confidence unless there are unexpected circumstances.

According to the latest forecast from Ifo Institute, Germany's economic growth rate in 2025 will be between 0.4% and 1.1%. If Germany cannot overcome structural challenges, the growth rate may only be 0.4%; But if the right economic policies are adopted, the growth rate is expected to reach 1.1%.

The Ifo Institute has proposed two economic forecast scenarios, previously predicting a growth rate of 0.9% in its September forecast.

Timo Wollmershaeuser, Director of Forecasting at Ifo Institute, stated that it is currently unclear whether the current economic stagnation is temporary or permanent, which will bring painful changes to the economy.

French President Macron hopes to avoid holding further parliamentary elections before the end of his term. The Barnier government resigned last week due to the failure to pass a vote of no confidence in parliament. Macron originally planned to appoint a new prime minister within 48 hours. But so far, no new prime minister has been appointed. According to sources familiar with the French government, President Macron will appoint a prime minister on December 24th. Holding parliamentary elections again is widely seen as an option for Macron to break the political deadlock. French political parties have been looking forward to holding another vote next summer.

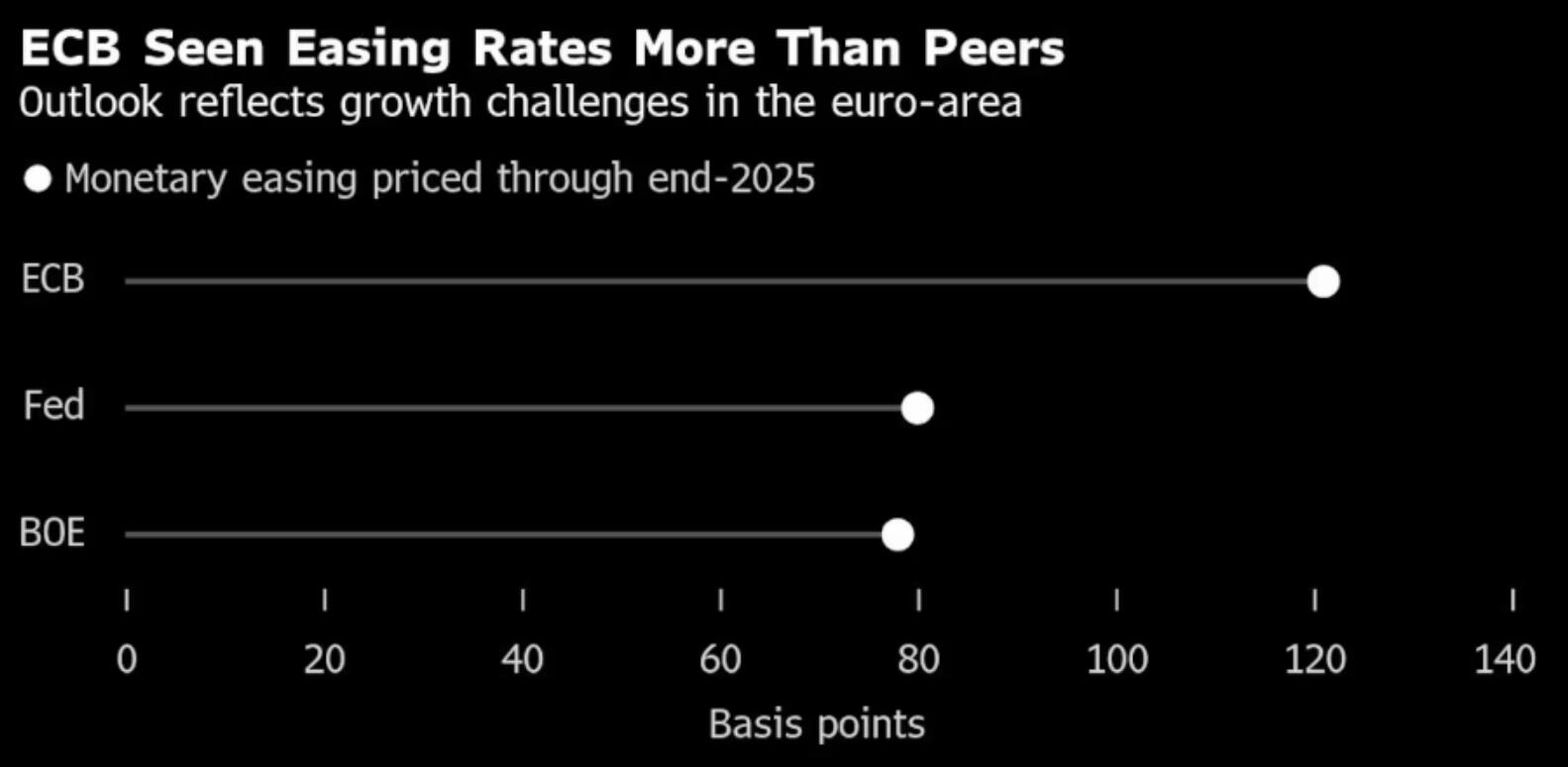

The political turmoil in the two major economies of the European Union, coupled with the potential impact of Trump's return to the US presidency on global trade, supports reasons for more aggressive interest rate cuts than other countries. The Federal Reserve and the Bank of England expect to reduce borrowing costs by about 80 basis points by the end of next year. In contrast, the European Central Bank cut interest rates by 25 basis points on Thursday, with a reduction of approximately 125 basis points.

Nicolas Forest, Chief Investment Officer of Candriam, said, "The monetary policy divergence between the United States and Europe is expected to continue to widen in 2025, and compared to US interest rates, we still lean towards European interest rates in terms of maturity. The outlook for Europe is becoming bleak

The statement accompanying the decision by the European Central Bank has opened the door for further interest rate cuts. Officials have given up stating that the policy will maintain "sufficient restrictions" as long as necessary. This suggests a possible shift towards a stimulus monetary policy, with a focus on boosting prices rather than suppressing them.

The new quarterly forecast also reflects the need for more support, and the forecast for next year's economic expansion and inflation has been lowered. Nevertheless, Fidelity's Ahmed stated that these estimates seem "somewhat optimistic" and do not reflect the risks of Trump's trade policies.

We believe that economic growth will continue to be weaker than the expectations of the European Central Bank and see the possibility of the market lowering final interest rates. The data flow in the coming months will determine the speed and scale of monetary easing, "said Konstantin Veit, portfolio manager at Pimco

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights