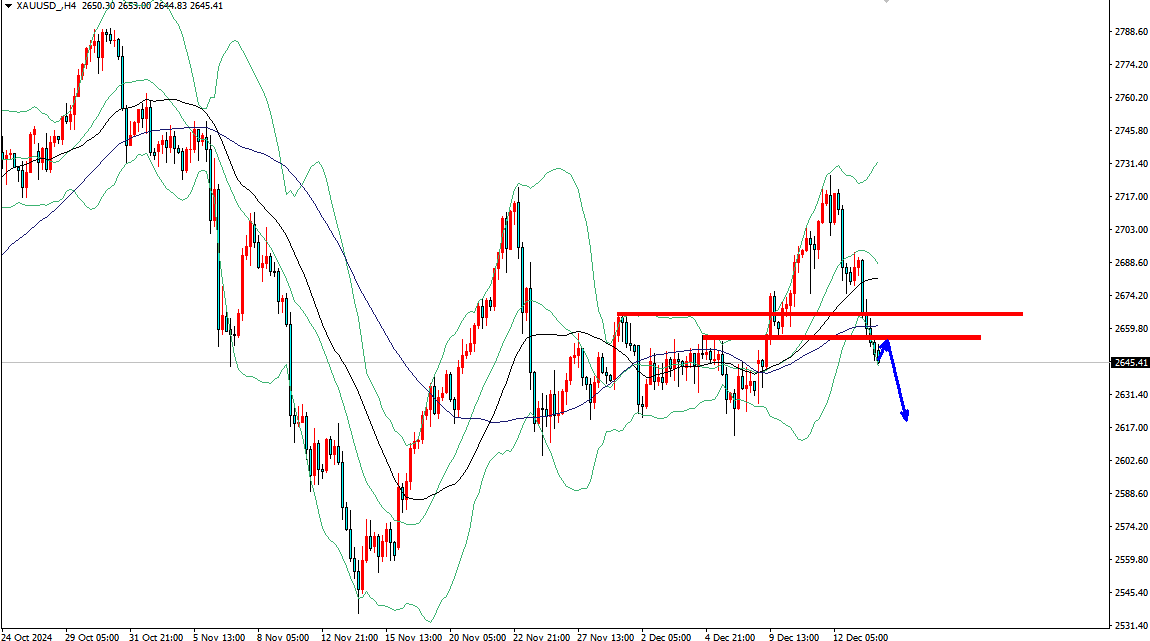

Gold is about to plummet by $25, so go short on 2655 directly

Gold is still in a downward trend, and it is absolutely not advisable to buy at the bottom. If it falls, there is no bottom, but rebounds with a 2655 line gap.

As mentioned in the previous article, the rise during the 4-hour cycle of gold is a false breakthrough. When gold falls, it will inevitably seek support downwards, which is at the 2655 level. Now that the support has broken, it has turned into resistance and rebounded by 2655. Short selling on the first line.

The analysis is already very clear, let's see if we can proceed with the execution.

The daily cycle is not yet a one-sided trend, after all, it is above the daily moving average. So now the market is fluctuating in daily cycles and falling in 4-hour cycles. We cannot be overly bearish, and the target for this decline is around 2626. This week there is also the Federal Reserve's interest rate decision, and the market will not be small this week, but everything is within my analysis. The market has been under my control, and the continuous correctness in the past is a good proof. This week, we will continue to build on the past and open up the future.

Trading strategy: Short selling gold 2655, stop loss 2665, target 2626

Personal investment sharing requires caution when entering the market

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights