The pessimistic sentiment in the European market may peak, and a magnificent turnaround may occur in 2025

For Europe, the situation in the coming year is not optimistic, as its financial markets have been heavily hit by concerns about US tariffs and political turmoil in France and Germany. However, some investors believe that pessimism has reached its peak and are buying on dips.

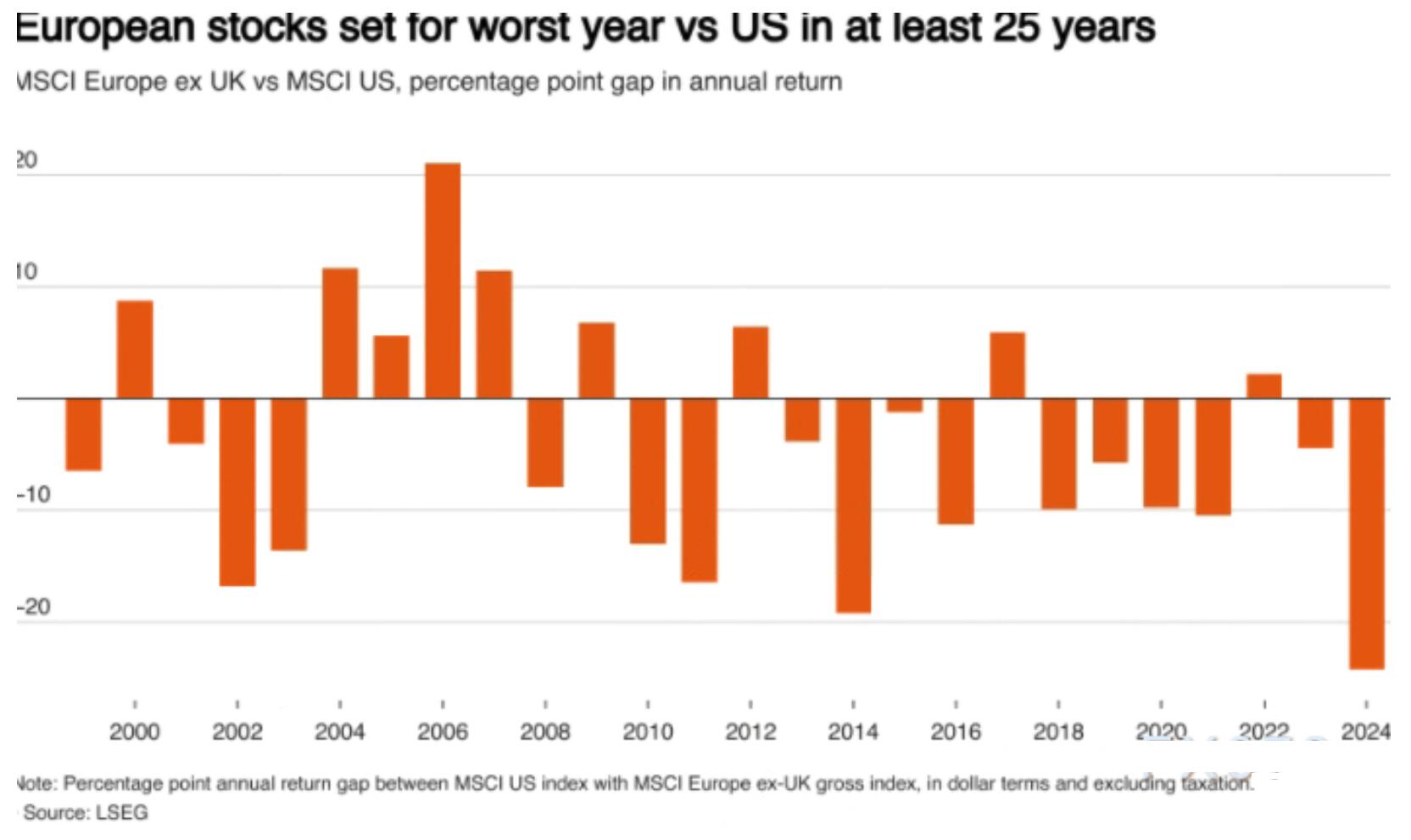

MSCI data shows that the performance of European stock markets will lag behind that of the US stock market to at least a 25 year high. The euro has fallen more than 5% against the US dollar, and some forecasters expect continued bad news to drag the euro below $1.

But as asset prices in the European market decline, investors' interest in buying on dips is increasing. They believe that asset prices have fully reflected more disappointing factors, and if the geopolitical and economic background improves, these assets may rebound strongly.

Caroline Gauthier, co head of stocks at Edmond de Rothschild, said, "We believe that Europe may surprise investors with insufficient exposure, and our negative sentiment is about to peak, which is good news

The MSCI European Stock Index has risen 4.6% this year. The comparable US index surged by 29%, driven by the AI boom that propelled tech giants dominating the Wall Street stock market to astonishing gains. Sonja Laud, Chief Investment Officer of Legal&General Investment Management, the largest asset management company in the UK, said, "Valuation levels in Europe are (now) more attractive

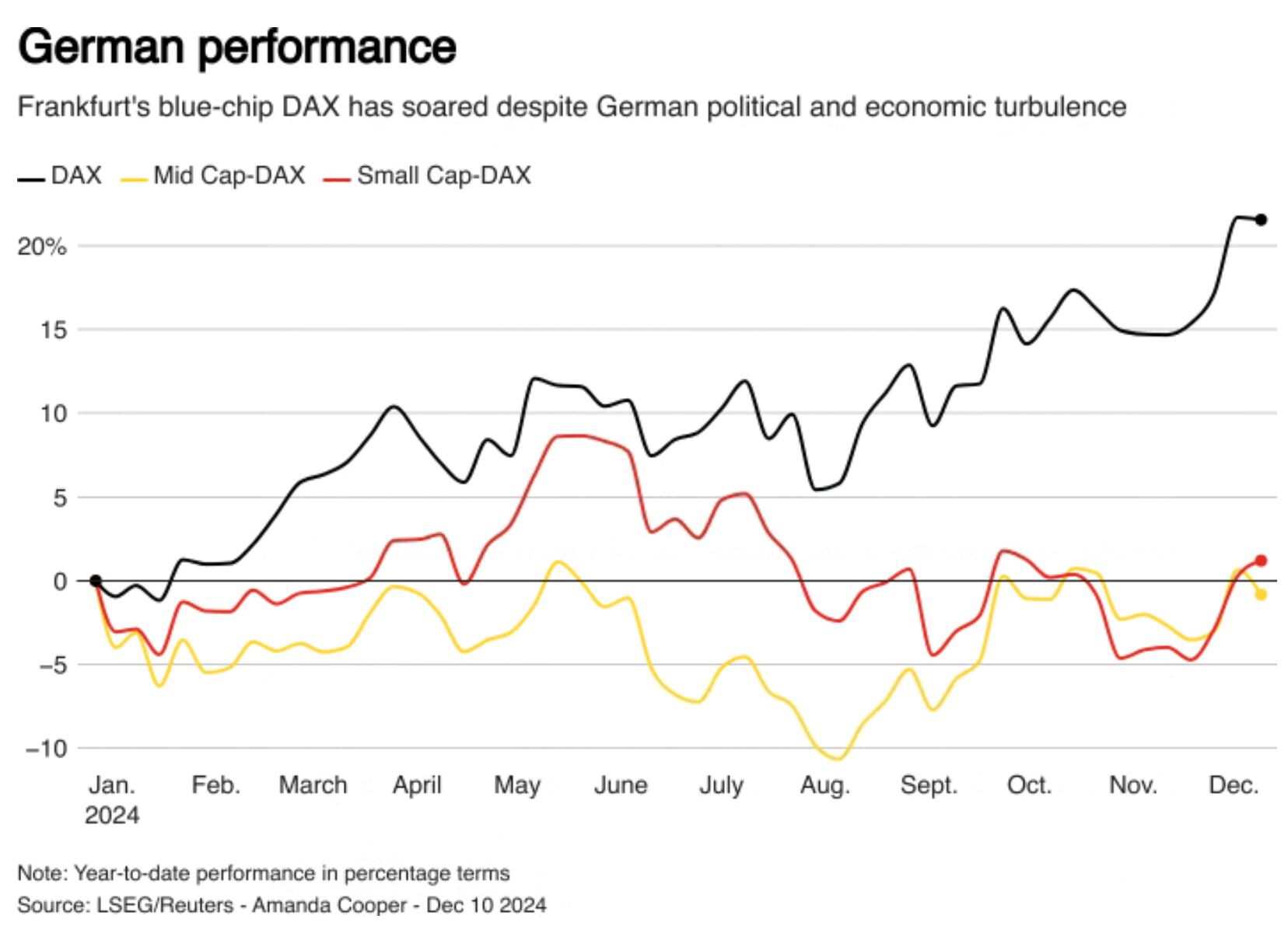

Traders believe that one sign of extreme market pricing is that the German stock market has begun to soar. The German DAX index has risen 4% so far in December and is expected to achieve its best monthly performance since March.

Europe's largest asset management company, Orient Bank Asset Management, predicts that the euro will rise strongly next year, while other major European investors have shown strong interest in the hit French stocks.

Kevin Thozet, a member of the investment committee of Carmignac, a European asset management company, said, "We are trying to fully exploit the pessimism in Europe." He added that he is increasing his holdings in stocks of European multinational companies with similar businesses to his American counterparts but lower valuations.

It can be confirmed that the economic trend in the eurozone is still not optimistic. Citigroup's Eurozone Economic Surprise Index is below zero, indicating that the data is generally below expectations. But it has stopped falling sharply, indicating that the severity of the negative data impact on the market has eased.

Citi strategists stated that bearish positions in Europe have reached an extreme and advised clients to buy stocks in the region, as currency and government stimulus measures will benefit cyclical industries such as manufacturing and tourism.

Bank of America strategist Michael Hartnett stated in a report to clients that potential US tariffs will push up US inflation and interest rates in the spring of 2025, triggering an investment boom in "cheap" international alternatives to US stocks.

According to data from investment group Simcorp, the US stock market heavily relies on the fate of large tech stocks, whose rapid growth has led to record levels of concentration risk (which increases as the number of dominant stocks in the market decreases).

Hartnett predicts that the US stock market will experience a "significant correction" in the first half of 2025, and expects European companies to attract more investment as a result.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights