What will happen to the gold market when the Federal Reserve cuts interest rates in December?

Last week, the US dollar index continued to rise, closing near the 107.0 mark for the second consecutive week.

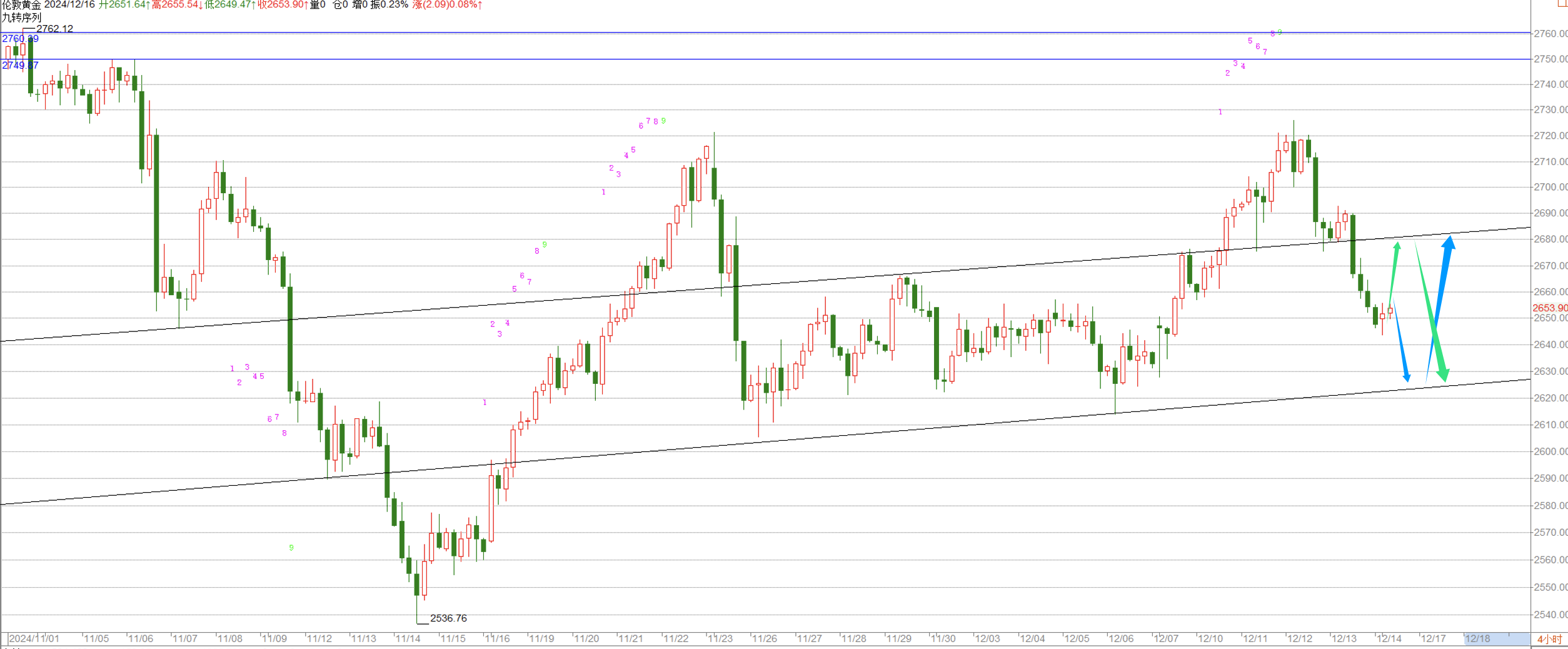

Spot gold rose first and then fell overall this week. After reaching 2725, it turned downwards and fell below the support level of 26802660, closing at $2648.

The most crucial event of this week is undoubtedly the Federal Reserve's interest rate decision to be announced early Thursday morning. In fact, according to last week's CPI data, the long-awaited decline in housing related costs (which have been keeping inflation high) has begun, which is an encouraging sign.

After the possible interest rate cut on Thursday, the subsequent pace of interest rate cuts by the Federal Reserve is even more uncertain. Powell has previously stated that a strong economy means the Federal Reserve does not need to "rush" to cut interest rates, but there is little specific explanation about the pace of the rate cuts. He also emphasized that the Federal Reserve is uncertain about where "neutrality" lies and "can only be known through practice".

So, the Fed's 25 point interest rate cut this time may be the last cut in the rate cutting cycle.

For gold at present, there will be ups and downs this week. From the current 4-hour chart:

After falling below the 2680 level last Friday, gold has actually opened the bearish door.

Currently, there are many options for the gold trend:

1) Gold can continue to retreat, hitting bottom support at 2630-25 before the interest rate decision, and then rebounding to around 2680 after the interest rate decision.

2) Before the interest rate decision, gold directly drew back to around 2680, and after the interest rate decision was implemented, gold fell again.

So, for those who pursue stability, it is best to wait until Thursday's interest rate decision before taking action, as there is also too much uncertainty before and after the interest rate decision.

Of course, if you are more aggressive, you can continue to look short at 2630-25 and then turn your back to buy long at 2680.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights