The Federal Reserve's interest rate cut hides hidden secrets: hawkish signals may stir market expectations!

The market expects the Federal Reserve to cut interest rates by 25 basis points this week, lowering the target range for the federal funds rate to 4.25% -4.50%. Due to the increasingly data-driven policies of the Federal Reserve, the market is closely monitoring the tone of Chairman Powell's post meeting speech and the latest (September) economic forecast summary, especially the dot matrix chart, which will provide guidance on the interest rate path for 2025 and beyond.

Federal Reserve cuts interest rate this week: or is it a 'hawkish rate cut'?

Federal Reserve fund futures show a 95% probability of the market expecting a 25 basis point rate cut at the December meeting, which will continue a similar situation in November. Market expectations may be based on the following factors:

The labor market is weak: the unemployment rate rose to 4.2% in November, while the labor force participation rate decreased. The weakening of the labor market may become a reason for additional interest rate cuts to avoid excessive weakness in the job market.

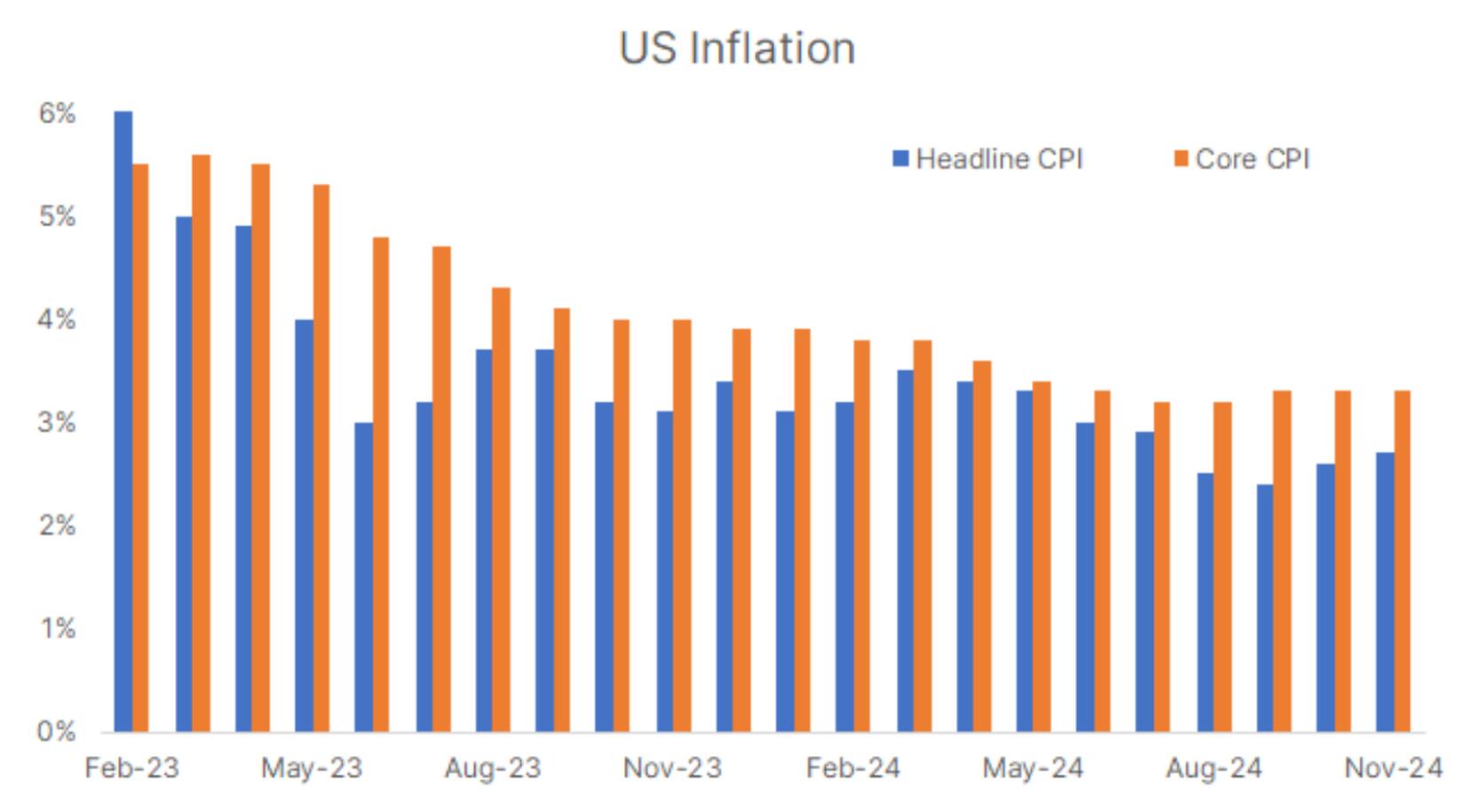

Housing inflation slows down: Although the overall rate of inflation has slowed down, the latest data shows that housing inflation has eased to some extent. As the main driving factor of inflation, the decline in housing costs has strengthened the rationality of interest rate cuts.

Although the Federal Reserve's interest rate cuts have been almost completely digested by the market, the market will focus on signals of a "hawkish interest rate cut," indicating that the Fed may be cautious about the pace of future rate cuts through a dot matrix or Powell's press conference while relaxing policy.

Will the Federal Reserve pause interest rate cuts in 2025?

There is increasing discussion in the market that the Federal Reserve may skip a rate cut and pause its easing cycle in January 2025. This may be due to the following reasons:

Stubborn inflation: Although housing inflation is slowing down, other inflation remains stubborn, making it difficult for the Federal Reserve to cut interest rates quickly.

Economic resilience: Recent economic data has shown unexpected resilience, which may prompt the Federal Reserve to adopt a more cautious pace of interest rate cuts.

Trump style inflation risk: The Trump administration may prioritize promoting trade tariff policies after taking office on January 20th, which could increase the risk of rising inflation and make the Federal Reserve more cautious about further interest rate cuts.

(Comparison chart of inflation trends in the United States)

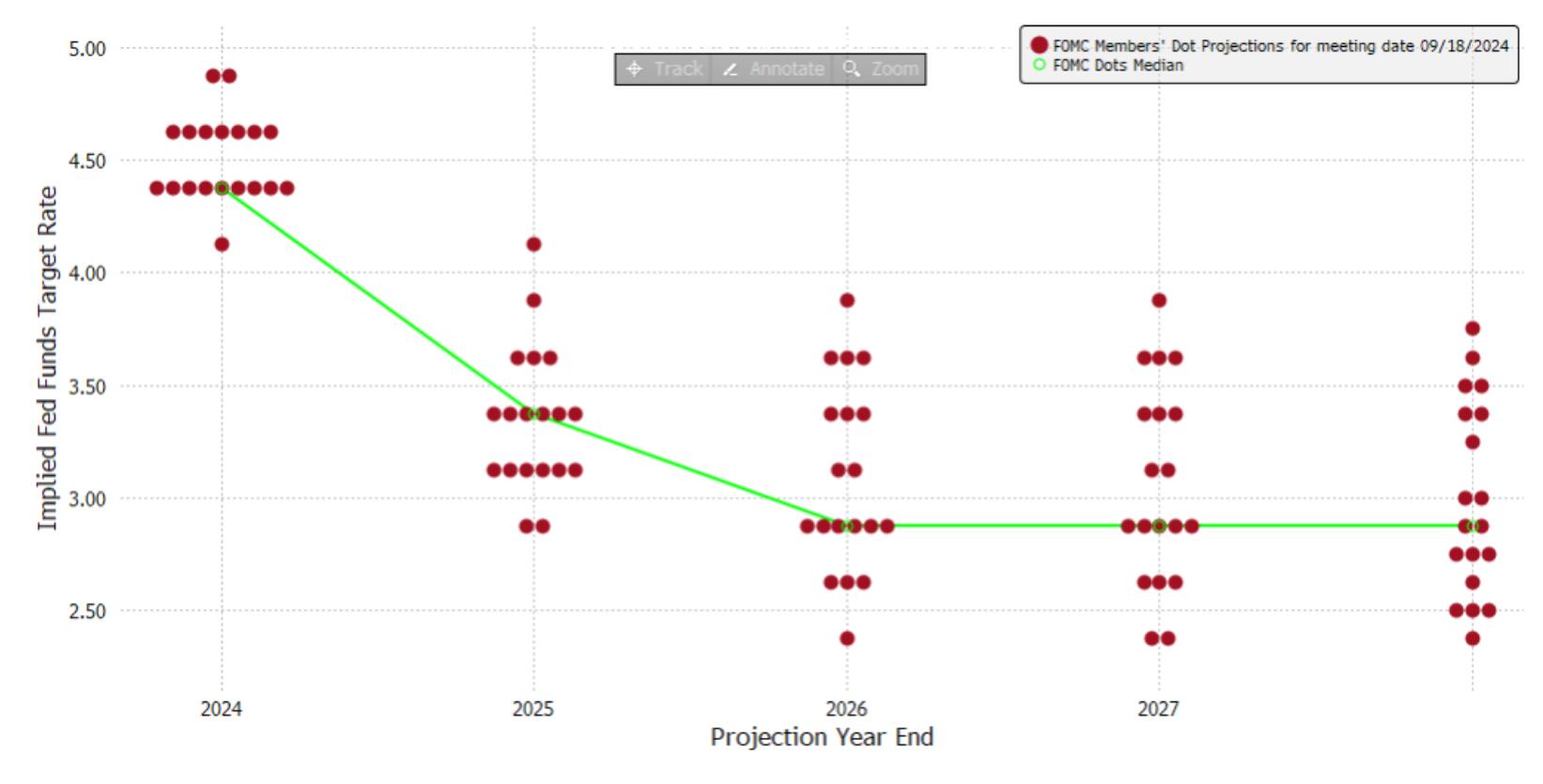

The dot plot will be the key to market sentiment as it reflects each FOMC member's expectations for interest rates. The dot plots for 2025, 2026, and 2027 will provide the Federal Reserve's assessment of the extent of future interest rate cuts.

Outlook for 2025: The previous grid chart showed that there may be 4 interest rate cuts (100 basis points) by 2025, but due to high inflation risks, this expectation may be lowered to 3 or even 2 interest rate cuts. The market generally expects interest rates to increase from 3.375% to 3.625% in 2025, which is the benchmark scenario for three interest rate cuts next year. If the interest rate is raised to 3.875% in 2025, it would mean only two interest rate cuts next year, which would pose a significant hawkish surprise to the market.

Long term interest rates: The expectation for interest rates in 2026 may be lowered to two rate cuts, indicating a slowdown in the normalization path. The market expects the interest rate at the end of 2026 to increase from the previously predicted 2.875% to 3.125%.

Terminal interest rate: The long-term 'neutral interest rate' may be raised from 2.875% in September to 3%, reflecting a higher structural interest rate environment.

Economic forecast update: The summary of economic forecasts may raise the core PCE inflation rate from 2.6% to 4.4% in 2024, while lowering the unemployment rate from 4.4% and raising the GDP growth forecast for 2024.

(Federal Reserve Rate Dot Matrix)

Market Impact and Investment Strategy (from Saxo Research Team)

Fixed income investment: If the dot plot suggests higher terminal interest rates or a decrease in the number of Fed interest rate cuts in 2025, the yield curve may show a bear flat trend, with short-term returns rising relative to long-term returns. Short term bonds may face downside risks due to rising yields.

Foreign exchange strategy: hawkish interest rate cuts may support demand for the US dollar. Although seasonal factors at the end of the year and excessive rise in US dollar positions may lead to short-term pullbacks, any pullback could be seen as a buying opportunity. The Trump administration's possible support for the US dollar policy may also provide support for the US dollar in 2025. At the same time, if the yield of the US 10-year treasury bond bond rises significantly, JPY may be under pressure, while the tariff threat may put pressure on EUR and AUD.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights