Gold prices and EURUSD experience short-term fluctuations, as the market awaits guidance from the Federal Reserve's interest rate decision

The complex economic situation in the United States is influenced by multiple factors that affect the Federal Reserve's policies. The retail sales growth in November exceeded expectations, with strong domestic demand and a rebound in inflation. The Federal Reserve has opened its policy meeting, and the market expects a 25 basis point rate cut on Wednesday. The probability of a rate cut this week is 95%, but only about 16% in January. Barclays expects a pause after this reduction and may reduce it three times next year. Its benchmark forecast is a 25 basis point reduction in March and June, and it also expects inflation to rise in the second half of next year due to the impact of Trump's policies, with two more reductions around mid-2026. Trump's policies have made the work of the Federal Reserve complex, and his tax cuts and other measures may prompt the Fed to adjust its forecasts for economic growth and interest rate cuts. Most analysts expect three interest rate cuts next year, while some believe two may be possible. The US dollar rose on Monday, and US bond yields rose, increasing the opportunity cost of gold and suppressing gold prices. The interweaving of US economic data, inflation, and Trump policies requires the Federal Reserve to comprehensively consider and balance multiple objectives. Its policy direction is full of variables and affects the domestic and international economy, which deserves in-depth attention and research.

In terms of the US dollar index, the overall price of the US dollar index showed a fluctuating state on Tuesday. The highest price of the day rose to 107.06, the lowest was 106.668, and closed at 106.921. Looking back at the price performance of the US dollar index on Tuesday, after the morning opening, the price first continued to decline and then rose again. From the high point of the rise, it did not break through the high point of the previous day. During the US trading period, it continued to fluctuate. Currently, the US dollar index tends to fluctuate at a high level. From the weekly level, we need to pay attention to the support in the 104.50 area temporarily, and from the daily level, we need to pay attention to the 106.40 area temporarily. The watershed of the daily line determines the key trend of the band. At the same time, the daily line is currently inclined towards the 108.10-105.40 large range of oscillation, and there is further adjustment in the price in the short term. Therefore, we will temporarily focus on the 107.00-107.10 range to see pressure, and from the bottom, we will pay attention to the support in the.

Short selling in the 107.00-10 range of the US Composite Index, defending against $5 and targeting 106.40

[Gold]

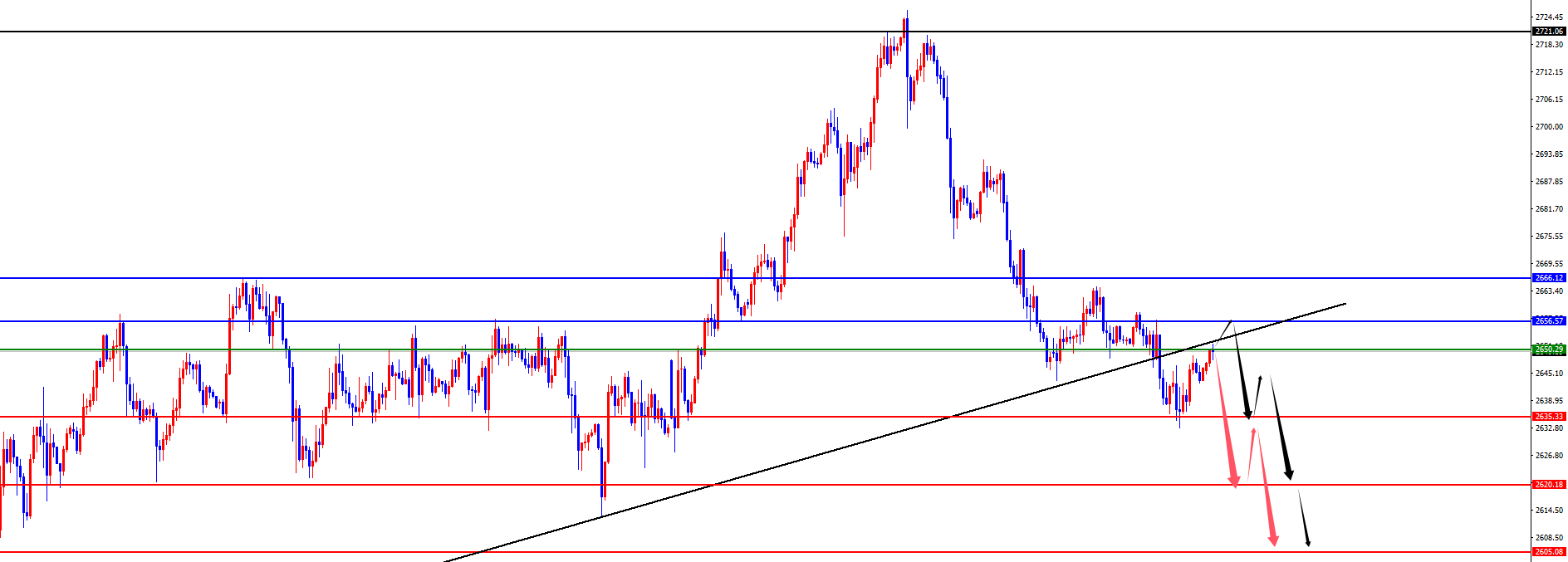

In terms of gold, the overall price of gold showed a downward trend on Tuesday, with the highest price rising to 2658.54 and the lowest falling to 2632.95, closing at 2646.27. Looking back at the details of the gold market performance on Tuesday, the price first slightly corrected upwards during the morning session, and then fell again under pressure. During the European session, it broke through the previous upward trend line as scheduled, supporting the 2648 level. After the US session, the price mainly fluctuated, and finally ended with a bearish candlestick on the daily chart. At present, the upper weekly resistance is in the range of 2666-2667, the daily resistance is in the range of 2655-2656, and the 4-hour resistance is in the range of 2650-2651. Overall, multiple resistance forces are suppressing the upper level. At the same time, the price has once again fallen back into the trend line resistance area. Radical traders sell short in the range of 2650-2651, while conservative traders can wait for the daily and weekly resistance areas to see pressure. Pay attention to the 2635-2620-2605 area below.

Radical: Short selling in the gold 2650-51 range, defending $10, targeting 2632-2620-2605

Conservative: Looking at the resistance range of the daily and weekly gold lines and the pressure again

In terms of EUR/USD, the overall price of EURUSD showed a downward trend on Tuesday. The lowest price of the day fell to 1.0478, the highest rose to 1.0533, and closed at 1.0490. Looking back at the performance of the EURUSD market on Tuesday, during the morning session, the price continued to rise in the early morning of the previous day, and then fell under pressure from the daily resistance. From the falling position, it happened to touch the area where we emphasized a more volatile layout. Later, the evening mainly fluctuated, and the daily line still ended in a big bearish trend. At present, the EURUSD price is still in a volatile range, and the subsequent price will only open up space after breaking through the volatile range. The key is the daily resistance of 1.0520 above, and the gain or loss in the 1.0450 area below.

EURUSD 1.0460-70 is mostly in the range, with a defense of 40 points and a target of 1.0520-1.0560-1.0600

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights