Institutions say they will face an upward trend in bond yields by 2025, with a target for an average spot gold price of $2700

Economists from Western Pacific Bank say that gold is a prominent exception in the context of widespread commodity weakness this year, and it seems likely to perform strongly again in 2025. However, as central bank easing policies slow down, gold will have to face an increase in bond yields.

Pacific Bank economists Luci Ellis and Illiana Jain warned in their December January Market Outlook that in 2025, governments around the world will face an increase in bond yields due to expansionary fiscal policies, and there is a greater risk of interest rate cuts now.

They wrote, "The extent to which the central bank relaxes depends on demand conditions and how it will increase inflationary pressures once the current surge in pandemic related inflation subsides." "Fiscal policy is one important factor, and a series of actions and responses from many developed economies are driving policy in an expansionary direction, including: increasing defense spending to address geopolitical risks and the expectations of the incoming Trump administration for its allies; increasing health spending to address population aging; and increasing investment in energy infrastructure to tackle the challenges of climate change

Economists say that as the US federal deficit has reached 6% of GDP in the past few years, whoever wins the presidential election will have a deteriorating fiscal situation. They said, "On the margin, Trump's victory and the Republican Party's sweeping victory have increased the stimulus stance, and this combination will be beneficial for lowering taxes and reducing government spending. The response to loose fiscal policies, as well as a broader inclination towards investment rather than savings, has been and will continue to be reflected in yields

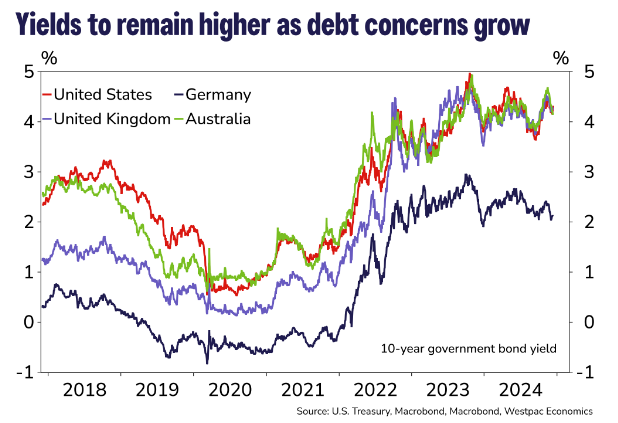

As debt concerns rise, bond yields will continue to rise. (10-year government bond yields, red line for the United States, black line for Germany, blue line for the United Kingdom, green line for Australia)

They added, "The bond yields of developed economies have significantly increased compared to before the pandemic, and we expect this to continue

When it comes to precious metals, Justin Smirk, a senior economist at Western Pacific Bank, pointed out that gold prices rose strongly by 30% in 2024 and entered a consolidation range of $2550 to $2750 per ounce after Trump's re-election as president. He said, "If we see the US CPI growing by 0.3% for the fourth consecutive month, it may consolidate the Federal Reserve's more cautious stance and potentially put some downward pressure on gold

Smirk wrote, "However, at the same time, we believe that with the rapid collapse of the Syrian government and the ongoing conflict in the Middle East, any downward trend in gold will ultimately be contained. As Asian central banks increase their gold reserves for the first time in seven months, we also see long-term structural buying in gold

He concluded, "Our mid-term goal for 2025 is around $2700 per ounce.

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights