The Bank of Japan will discuss raising interest rates this week, but believes that the urgency is limited

The Bank of Japan will discuss whether it is necessary to raise interest rates on Thursday (December 19), and officials' views suggest that the central bank tends to hold its ground as the market increasingly speculates that the bank will raise interest rates in January.

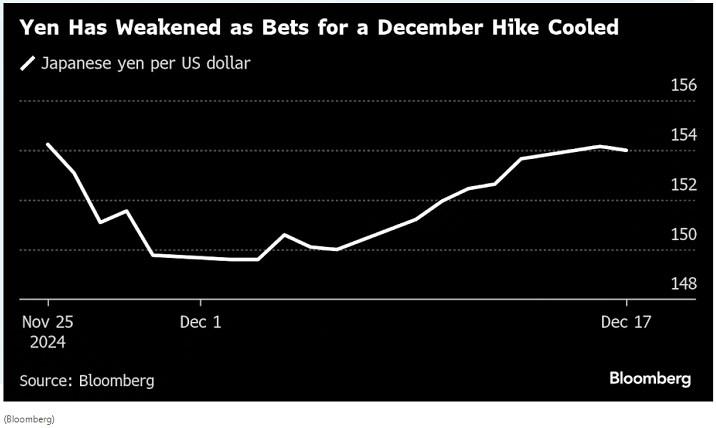

Image: As the December interest rate hike bet cools down, the Japanese yen weakens. (The white line refers to the USD/JPY exchange rate)

The latest overnight index swap rate reflects traders' views, and it is expected that the Board of Governors of the Bank of Japan, led by Kazuo Ueda, will keep the benchmark rate unchanged at 0.25% at the end of the two-day meeting. According to a Bloomberg survey this month, more than half of economists now expect a rate hike in January, and 44% of economists still believe a rate hike will occur this week.

Earlier this month, insiders said that Bank of Japan officials believe there is almost no cost waiting before raising borrowing costs. The decision of the central bank's board of directors is usually announced around noon, putting an end to weeks of intense speculation about whether the central bank will take action this week. Traders once believed that the likelihood of policy change was two-thirds.

Mari Iwashita, executive economist of Daiwa Securities, said: "The Bank of Japan is not in a hurry to raise interest rates." "Even though the economy and inflation are developing as expected, I do not feel that the Bank of Japan will take action this time."

However, many investors are well aware of the Bank of Japan's unexpected history, especially after the global market crash triggered by the July interest rate hike, and they remain vigilant about it. According to sources interviewed by Bloomberg, some Bank of Japan officials are not opposed to raising interest rates at this meeting, indicating a possible shift in voting behavior. In January 2007, three members of the board proposed a rate hike, laying the foundation for the next month's rate hike.

The Bank of Japan will make a decision a few hours after the expected interest rate cut by the Federal Reserve. Due to an increasing number of investors expecting that the Bank of Japan will not raise interest rates this month, the Japanese yen has weakened against the US dollar in the past two weeks. Nevertheless, the Bank of Japan may continue to hint at increasing borrowing costs in the future to avoid giving too much momentum to the yen's decline.

After the policy statement is released, the focus will shift to the usual Ueda press conference held in the afternoon. If interest rates remain unchanged, the key question will be how far the Bank of Japan is from raising interest rates again. Given Trump's January policy decision four days after taking office and the uncertainty in the future, Ueda may want to avoid confirming a third interest rate hike.

Bloomberg Economics said, "The economic background looks favorable for the Bank of Japan to normalize its policies. Wage and price data indicate that its 2% inflation target is becoming increasingly safe. We expect Ueda to hint at the possibility of taking action in January at his press conference

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights