The Federal Reserve cuts interest rates by 25 points, causing the US dollar index to rise and putting pressure on Europe and the United States

The Federal Reserve predicts two 25 basis point interest rate cuts next year when inflation rises, which is related to its wait-and-see attitude towards Trump's inauguration. This news has impacted the financial market, causing a decline in gold prices due to the difficulty in digesting expectations of interest rate cuts and the weakening of its attractiveness caused by high interest rate expectations. Powell's statement had a significant impact, emphasizing that the progress in reducing inflation would determine a rate cut, leading to a decline in the stock market and a correction in market expectations for future rate cuts. At the same time, there has been progress in the ceasefire agreement between Hamas and Israel, which will allow humanitarian aid and other aid to enter Gaza. Although control of the Gaza Strip is still pending, this is suppressing the demand for safe haven gold. Currently, traders are focusing on this week's US GDP and inflation data as they will affect monetary policy expectations, and with the upcoming interest rate decisions from the Bank of Japan and the Bank of England, investors need to integrate multiple information to seize opportunities and respond to challenges in the complex and ever-changing global financial market.

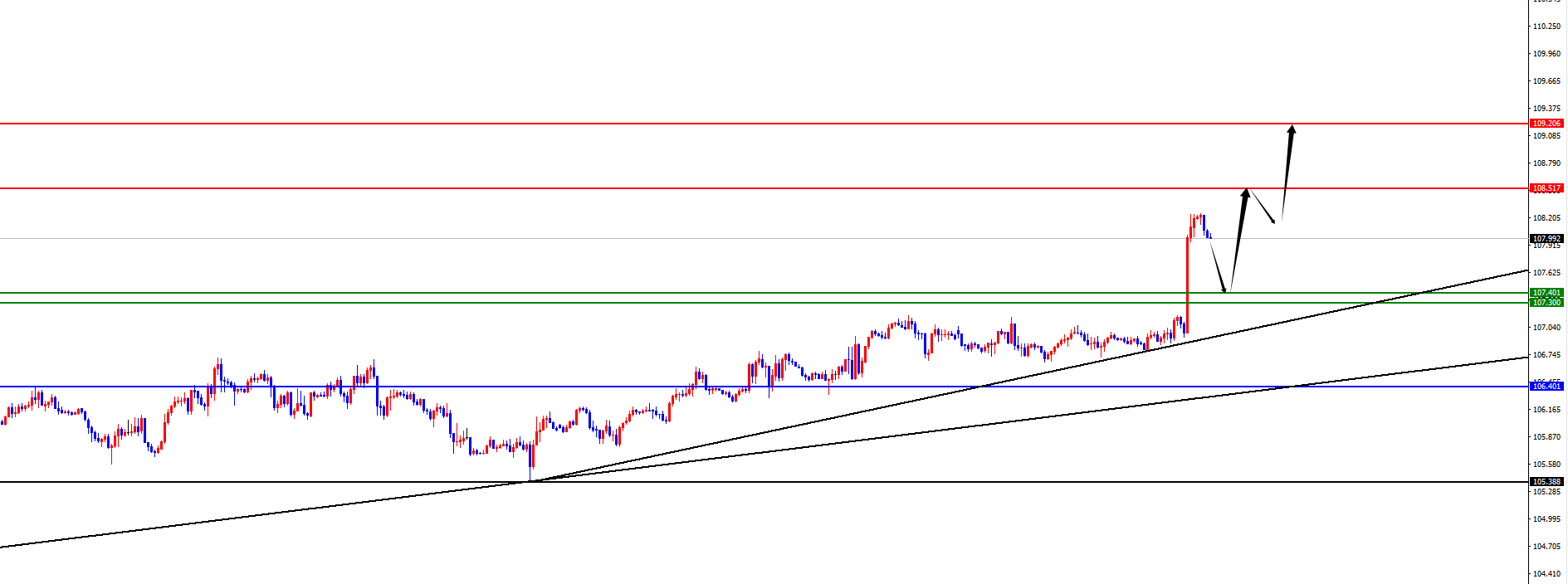

The US Dollar Index

In terms of the US dollar index, the overall price of the US dollar index showed an upward trend on Wednesday. The highest price of the day rose to 108.248, the lowest was 106.788, and closed at 108.204. Looking back at the price performance of the US dollar index on Wednesday, after the morning opening, the price maintained a four hour key position oscillation. Before the European session, the price made a strong upward trend, and then continued to fluctuate during the European session. After the US session, the price reached a new intraday high, indicating that the overall price was still bullish. The price did not return to the daily line support and rose directly. Overnight, it surged again due to the influence of news. At present, the price of the US Composite Index still shows a bullish trend, with daily support at the 106.70 level. If the price is above this level, it will continue to be bullish in the band. In the short term, we will temporarily focus on the support range of 107.30-40 for the four hours, and above it, we will focus on the 108.50-109.20 area.

Buy long in the 107.20-30 range of the US Composite Index, defend for $5, target 108-108.50-109.20

In terms of EURUSD, the overall price of EURUSD showed a downward trend on Wednesday. The lowest price of the day fell to 1.0343, the highest rose to 1.0512, and closed at 1.0351. Looking back at the performance of the European and American markets on Wednesday, there was an upward correction during the morning session, followed by further pressure on prices within the daily and four hour resistance ranges. As time passed, prices continued to suppress, and after the US session, prices fell again under pressure. At the same time, the overnight period also accelerated, and the daily chart ultimately ended in a bearish trend. At present, the EURUSD price is approaching its recent low point, so it is cautious to pursue orders at this position. At the same time, the price is still in a downward channel, so it is temporarily bearish. The resistance in the 1.0450-60 range above is currently being monitored, and the pressure will be monitored once the price is in place. The area below is being monitored in the 1.0330-1.0230 range.

EUR/USD 1.0450-60 range empty, defend 40 points, target 1.0330-1.0230

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights