The geopolitical situation is tense and complex, with undercurrents surging amidst sluggish trading in the European and American markets

On the trading day of December 26th, trading in Europe and America was sluggish due to the Christmas holiday, but there are still key information that investors need to pay attention to. The changes in the number of initial jobless claims in the United States are yet to be released. Previous data showed that the number of claims has entered a period of fluctuation, and there may be significant fluctuations in the future. The geopolitical situation is tense and complex, with the Gaza Strip being attacked by Israeli forces, resulting in the death of Palestinians; Israel is considering attacking Houthi militants in Yemen and is also discussing upgrading its strike plan with the United States, which will need to be implemented after Trump takes office. In terms of the conflict between Russia-Ukraine conflict, when Russia attacked Ukraine's energy facilities, Biden condemned and asked for arms reinforcements from Ukraine. On the financial market, the US dollar held firm on Tuesday, not far from the two-year high. Since September, it has risen by more than 7%. The interest rate gap has widened due to the US economic growth expectations and inflation and other factors, and the US Federal Reserve's cautious interest rate cut path has boosted the yield of US bonds. The yield of 10-year treasury bond bonds reached a seven month high, which has depressed the attractiveness of gold. If the yield of US dollars and US bonds is strong, the gold price trend will be worrying. In addition, the US financial market has resumed trading, while most European countries remain closed and trading may be restricted.

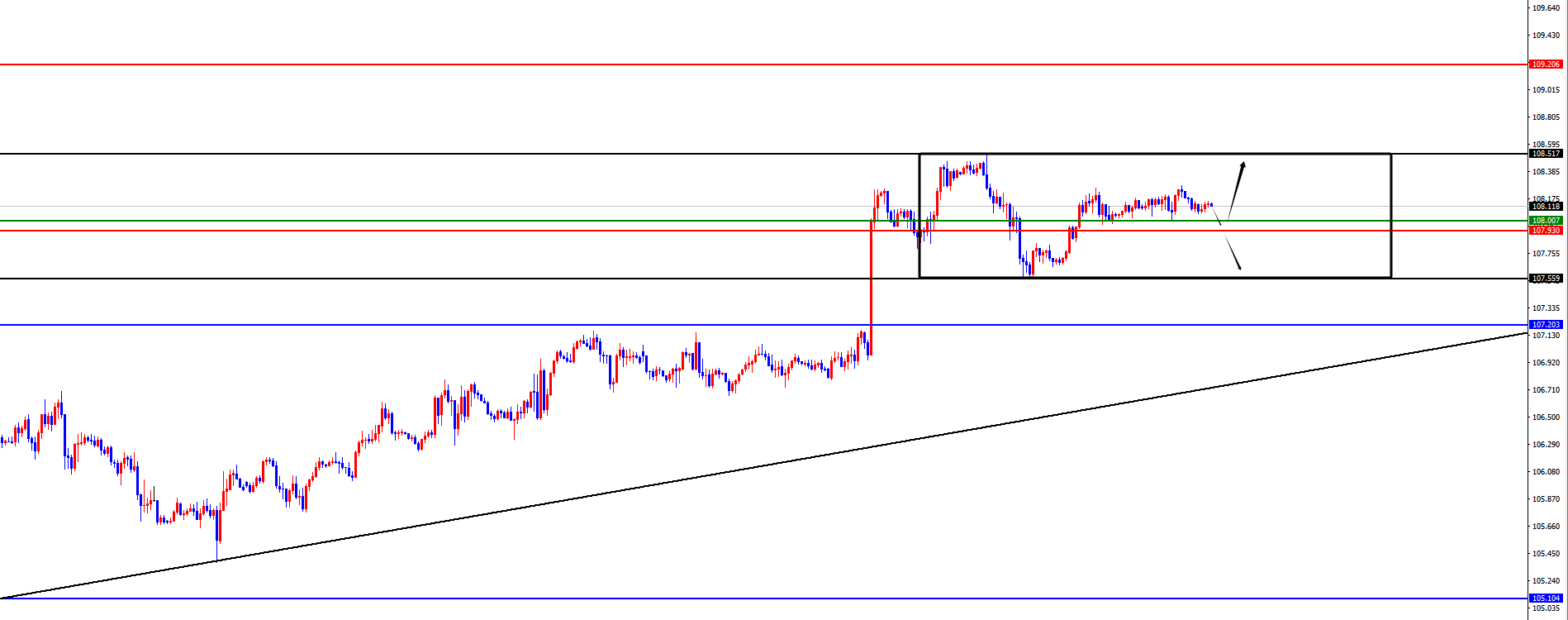

In terms of the US dollar index, the overall price of the US dollar index showed an upward trend on Tuesday. The highest price of the day rose to 108.276, the lowest was 108.014, and closed at 108.135. Looking back at the performance of the US dollar index on Tuesday, the price fluctuated and rose during the morning session, followed by a continuous range fluctuation on the same day, and ultimately closed with a strong bullish trend. From a weekly perspective, the area of 105.10 is the watershed between bullish and bearish on the central line, with prices above this position being bullish on the central line. At the same time, the 107.20 area on the daily line is the watershed of the band trend. From the current perspective, the price is above the support of the weekly and daily lines, so it is temporarily biased towards the bullish trend. In the short term, the price tends to oscillate in the range of 107.55-108.50, and the watershed of the oscillation range is in the 108 area. The price is biased towards the bullish trend above 108, and will only continue to correct after breaking below it. As today is still a holiday, the market trading is light, and we will layout after the end of the holiday in the future.

The US Composite Index oscillates within the range of 107.55-108.50, with 108 serving as the middle watershed

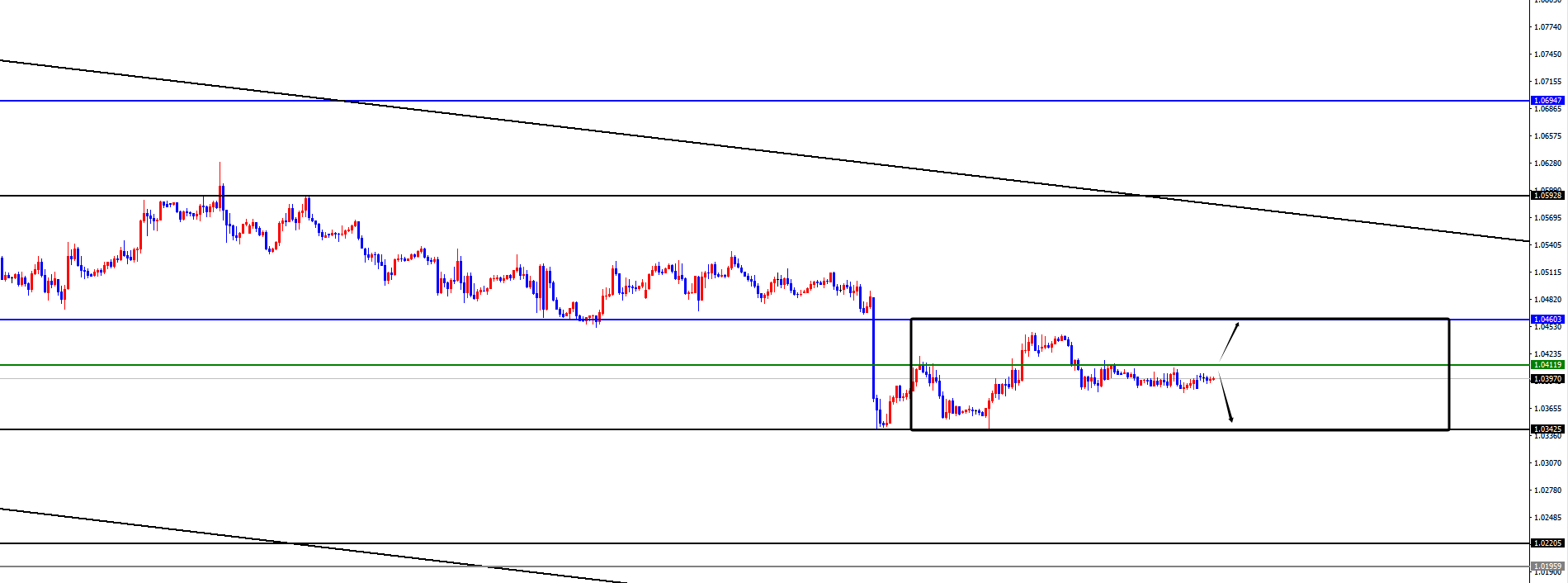

In terms of EURUSD, the overall price of EURUSD showed a fluctuating downward trend on Tuesday. The lowest price of the day fell to 1.0383, the highest rose to 1.0409, and closed at 1.0395. Looking back at the EURUSD market performance on Tuesday, the price was initially under pressure and fell during the morning session, then continued to suppress in the 4-hour resistance 1.0410 area, and finally closed with a bearish candlestick. At present, the overall resistance of EURUSD is below the weekly resistance of 1.0690 and the daily resistance of 1.0460, so both the medium-term and the band are bearish. In the short term, the price is at the high point on Tuesday in the four hour period. Due to the continuous fluctuation of the price in the range of 1.0340-1.0460 in recent days, it will be treated as a fluctuation before the price breaks the level, and will continue after the level is broken. The middle watershed is in the 1.0410 area, and it is still in the holiday period. We will focus more and move less until the holiday period truly ends before laying out.

EUR/USD fluctuates between 1.0342-1.0460, with a middle watershed of 1.0410

Tips:This page came from Internet, which is not standing for FXCUE opinions of this website.

Statement:Contact us if the content violates the law or your rights